Circle CEO addresses USDC liquidity concerns, welcomes PayPal move into stablecoins

Jeremy Allaire, Circle CEO, confirmed that USD Coin (USDC) saw more redemptions than issuance over the past month, according to an Aug. 7 tweet.

Allaire stated that Circle issued $5 billion worth of USDC over the past month, with redemptions surpassing issuances by $1.6 billion, totaling $6.6 billion. He said the high redemptions were a testament to the firm’s liquidity despite recent community concerns about its books and reserves.

Allaire explained that the stablecoin issuer’s global banking and liquidity network was expanding. He added:

“We’re working with exceptional and high-quality banks in major regions around the world, to bring local settlement rails and globally distributed mint/burn to USDC.”

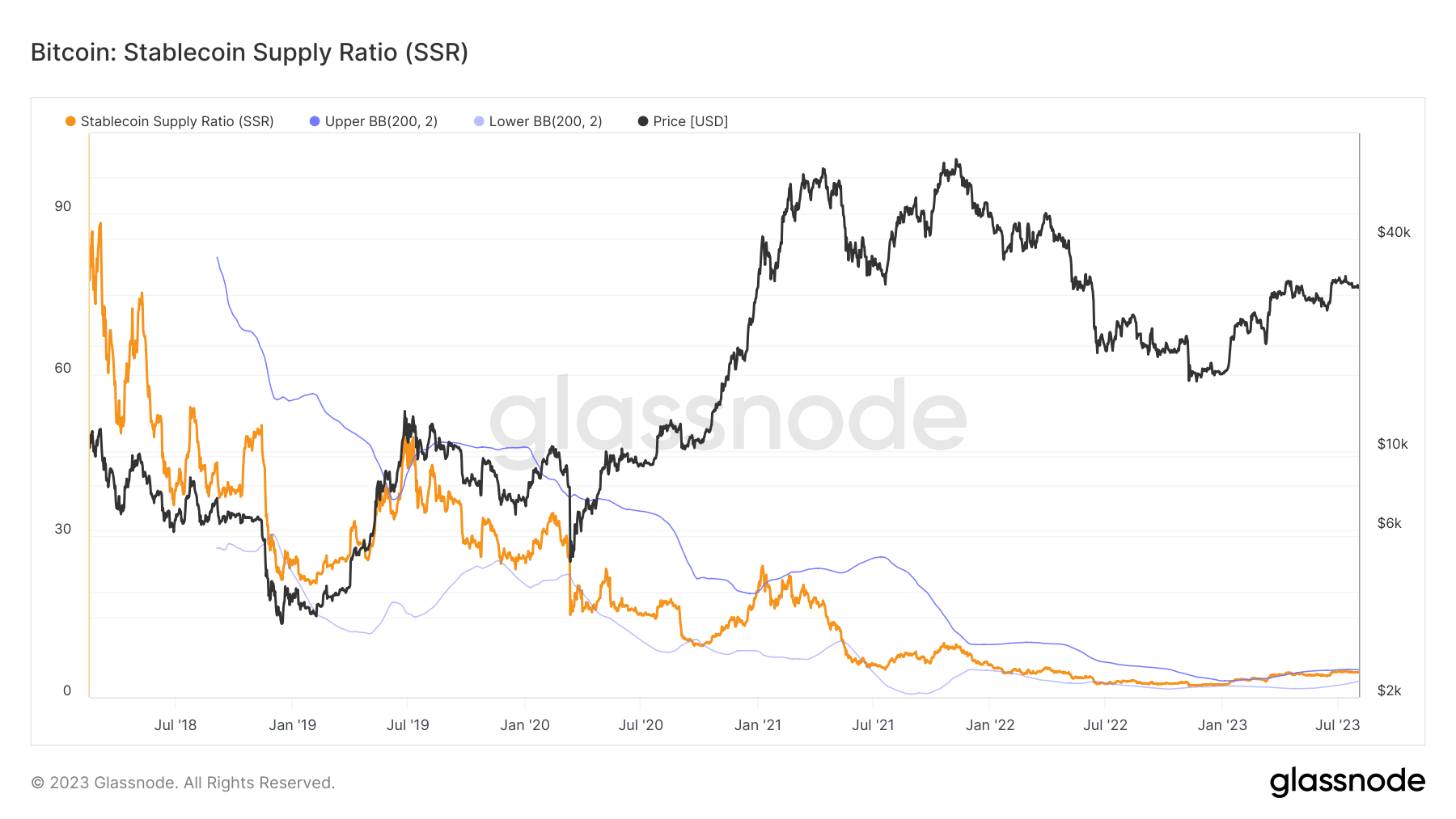

USDC has faced increased scrutiny over its reserves and liquidity after it was revealed that it was exposed to the failed Silicon Valley Bank (SVB) in March. Since then, the stablecoin has seen its market dominance drop to 21%, with its supply falling to around $26 billion, according to CryptoSlate’s data.

70% of USDC adoption is abroad

Despite its declining market share, Allaire noted that 70% of USDC adoption was from abroad, dousing insinuations that the company was “all about the U.S.”

According to Allaire, the stablecoin’s adoption was coming majorly from emerging and developing markets across Asia, Latin America, and Africa.

Circle has yet to respond to CryptoSlate’s request for additional comment on its adoption across these markets.

Welcomes PayPal foray into stablecoins

The Circle CEO also hailed PayPal’s entrance into the stablecoin as evidence of what could happen if more regulations were introduced. He said:

“This is what happens when we start to get regulatory clarity, and with the Payment Stablecoin Act, this can open up a free and competitive market for dollar stablecoin issuers with strong supervision, allowing the US to compete with digital dollars that are uniformly safe, transparent, liquid and supervised to Fed-standards.”

Allaire further pointed out that the arrival of stablecoin laws across different jurisdictions would allow customers to know who they are dealing with, adding that firms that can survive scrutiny by central banks and prudential regulators will thrive.