Market sentiment sways as Tether sees largest redemption since FTX collapse amid PYUSD launch

Tether, the issuer of USDT, has recently experienced one of its largest redemptions since the FTX collapse in Nov. 2022, according to Paolo Ardoino, Tether’s CTO.

A total of approximately 325 million USDT was redeemed, marking a significant event in the stablecoin’s history.

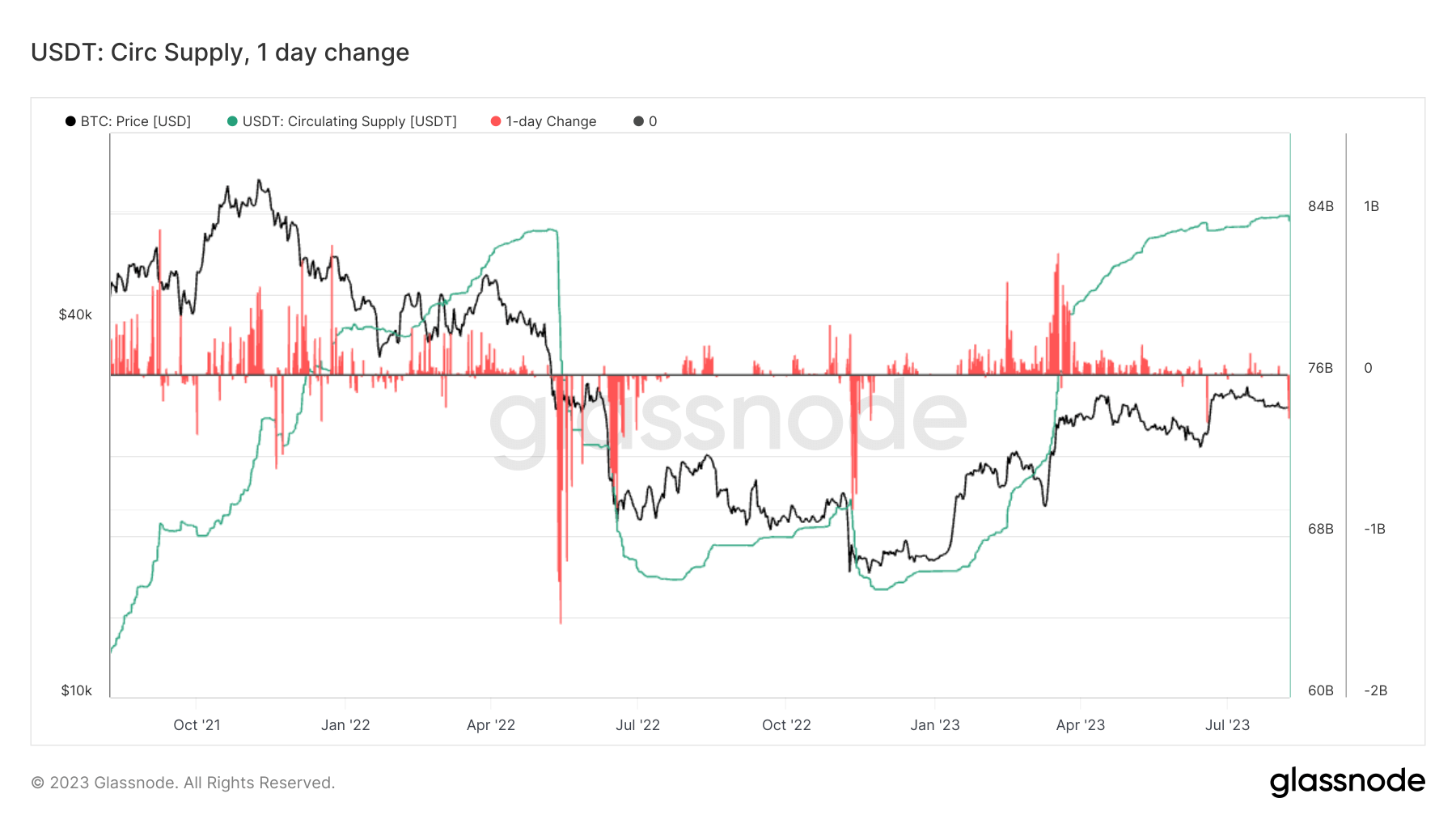

This comes as the circulating supply of USDT is near record highs of around 83 billion, indicating the resilience and demand for this particular stablecoin.

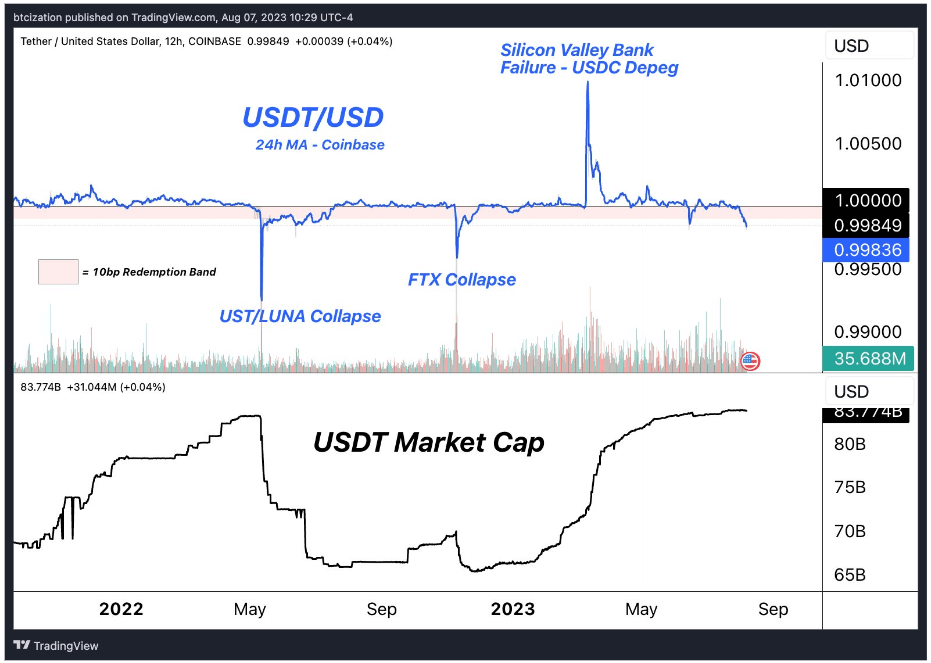

An intriguing note is the USDT/USD redemption rate, which, according to Dylan LeClair, has fallen below the 10bp mark over the past 24 hours. This is the lowest rate seen since the FTX collapse and may suggest a change in market behavior or sentiment towards the stablecoin.

This data provides a snapshot of Tether’s activity and the ongoing influence of past market events, like the FTX collapse, on present occurrences. Further tracking of these redemption rates and circulating supply trends could offer valuable insight into the broader market dynamics and the stablecoin’s role within it.

PayPal launched its own stablecoin PYUSD on Aug. 7, which currently has a market cap of just $26 million, suggesting USDT redemptions are not directly linked to the increased competition.