Coinbase-backed Base restores block production after more than 40 minutes outage

Coinbase-backed layer2 network Base suffered a temporary outage that led to a stalled block production on Sept. 5.

The blockchain network, however, has “identified and remediated” the issue and assured users that their funds were safe.

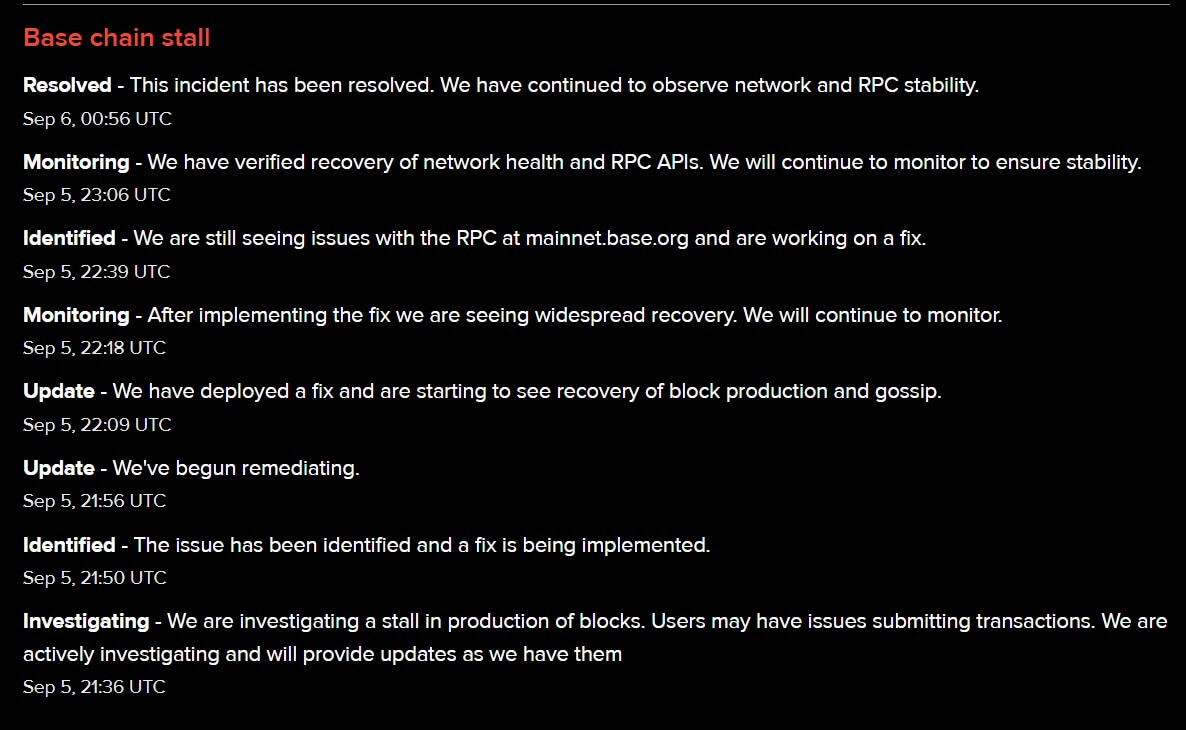

According to its status page, Base’s stalled block production led to users having problems submitting new transactions on the network. The issues were identified around 9:36 pm UTC, and a fix was developed 14 minutes later.

Nonetheless, the layer2 network encountered a persistent problem with delayed remote procedure calls (RPCs), causing a delay in issuing a conclusive report until the early hours of today, Sept. 6.

The outage marked Base’s first significant issue since its public launch on Aug. 9. Several crypto community members quickly pointed out that this was one of the issues of using an Ethereum layer2 network.

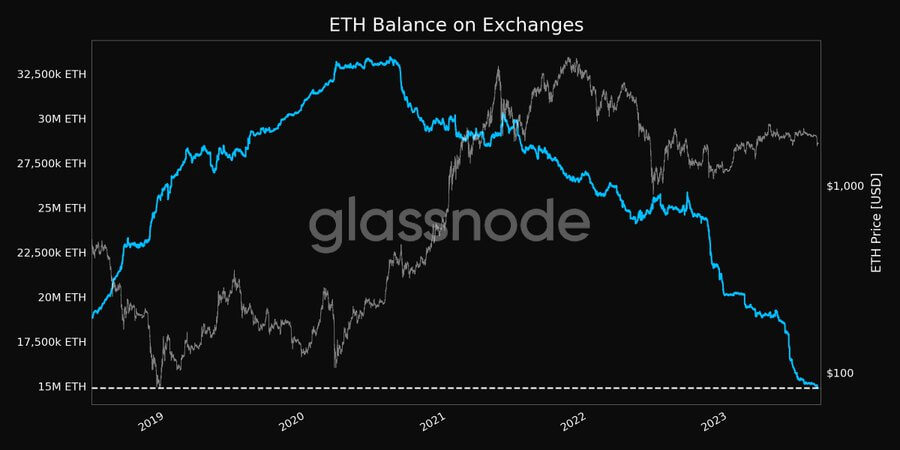

According to Matt Willemsen, the head of research at crypto firm Collective Shift, Base’s issue underlined why Ethereum’s mainnet “is more battle-tested and involves fewer trust assumptions.”

Base’s early success

In a relatively brief period, Base has surged into the top 10 rankings on DeFiLlama’s Total Value Locked (TVL) charts, surpassing notable blockchain networks like Cardano, Solana, and even Bitcoin. The network’s TVL stands at $406.04 million as of press time.

Furthermore, its daily transaction volume briefly eclipsed that of fellow layer-2 networks such as Optimism and Arbitrum, underscoring its remarkable adoption and advancement.

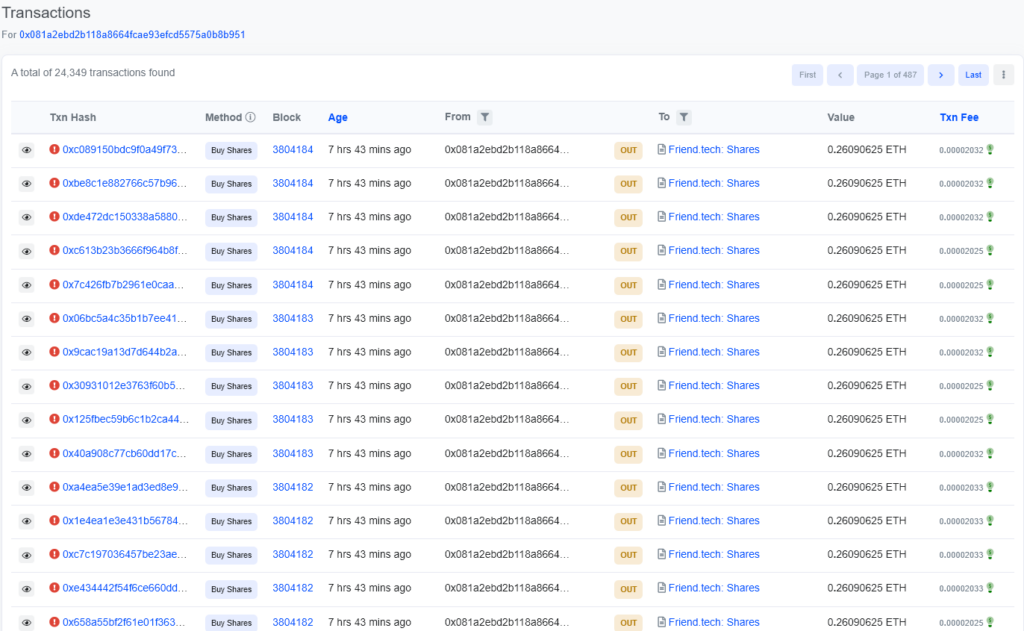

Additionally, Base has become the launchpad for intriguing crypto ventures like Friend.tech, a decentralized social web application, and has also scored the integration of notable crypto decentralized exchanges like 1inch. However, it has also faced challenges, with malicious projects like BALD causing financial losses on the network.