AI tokens surge 9% amid OpenAI leadership saga

Artificial Intelligence (AI) tokens’ value pumped over the weekend amid increased attention brought to the industry by the leadership crisis at OpenAI, the leading generative AI company.

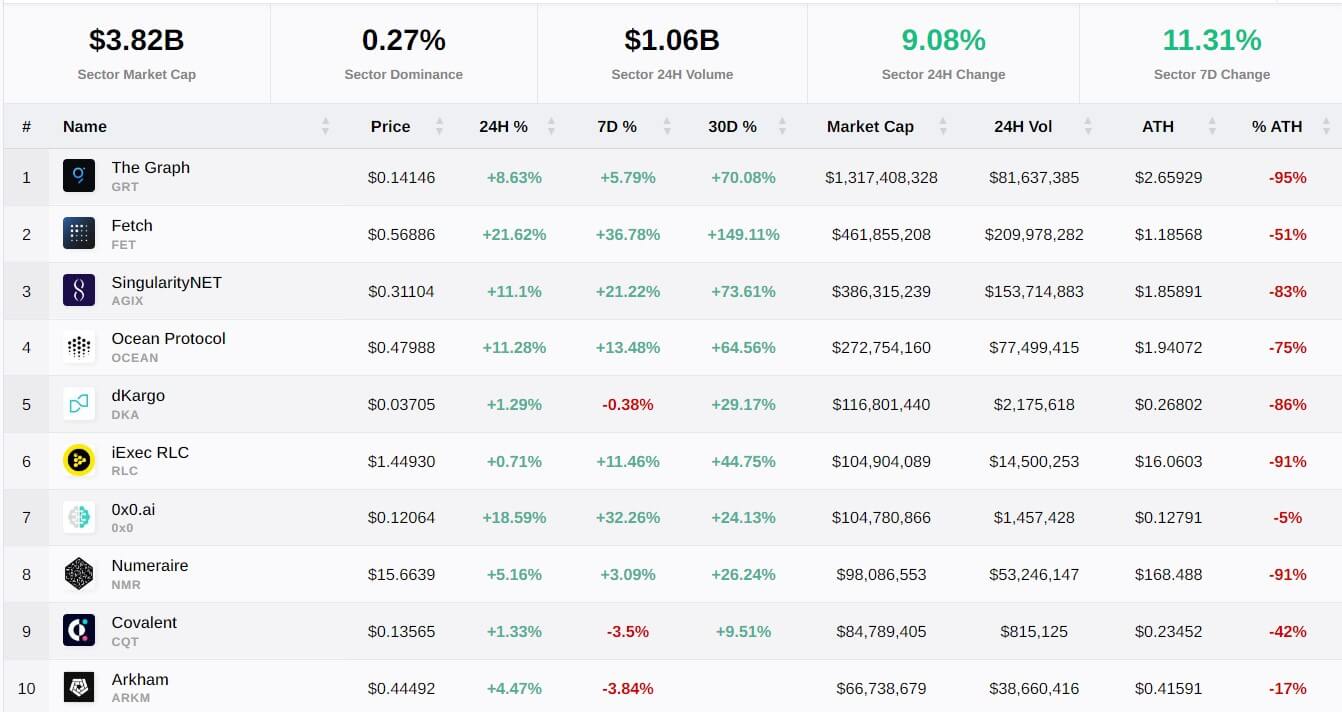

Data from CryptoSlate shows that digital assets in the sector grew by more than 9% over the last day and by over 11% during the past week. Additionally, tokens in the sector saw their trading volume exceed $1 billion during the last 24 hours.

An evaluation of the top ten AI coins by market capitalization, including The Graph, Fetch, SingularityNET, Ocean Protocol, dKargo, and others, showed that most of these tokens recorded double-digit gains during the reporting period, continuing a run where they all posted an average return of more than 45% during the past 30 days.

This run is reminiscent of the euphoria these tokens had generated earlier in the year on the back of the launch of OpenAI’s generative AI chatbot, ChatGPT. The AI captured the imaginations of people across the globe with its novel technology, resulting in its digital traffic accounting for more than 60% of all AI tools during the past year.

Its success also spurred the development of several rival companies like Anthropic and the entrance of major technological companies like Meta, Google, and Microsoft into the scene.

However, the AI narrative soon subsided as the market evolved as major traditional financial institutions, including BlackRock and Fidelity, applied for a spot Bitcoin exchange-traded fund (ETF) with the U.S. Securities and Exchange Commission (SEC).

Why AI tokens are pumping

Crypto traders’ interest in the sector was rekindled over the weekend as OpenAI battled its leadership issues.

Andrei Grachev, the co-founder and managing partner of crypto market maker Digital Wave Finance (DWF), said the “Sam Altman case is pushing people’s interest to AI tokens.”

On Nov. 17, OpenAI’s board decided to replace founder Sam Altman as CEO. This action sparked considerable criticism from key stakeholders and staff of the organization.

However, the power dynamics seem to have settled with the board naming former Twitch CEO Emmett Shear as the new CEO while Altman transitions to a role at Microsoft.