FTX faces backlash after proposed estimation of customers' Bitcoin at $16k

Bankrupt FTX seeks court approval to estimate its customers’ digital asset claims in U.S. dollars, according to a Dec. 27 court filing.

The exchange clarified that the action was essential to prevent any hindrance in the bankruptcy proceeding, adding that:

“The liquidation of every individual Claim in respect of a Digital Asset is impractical and unnecessary and would unduly delay these Chapter 11 Cases.”

As such, the defunct crypto platform proposed estimating Bitcoin’s value at $16,871, Ethereum’s price at $1,258, and Solana’s SOL at $16. The firm also estimated Avalanche’s AVAX at $14.19, stablecoins USDT, TUSD, and BUSD a few cents less than their usual $1 peg.

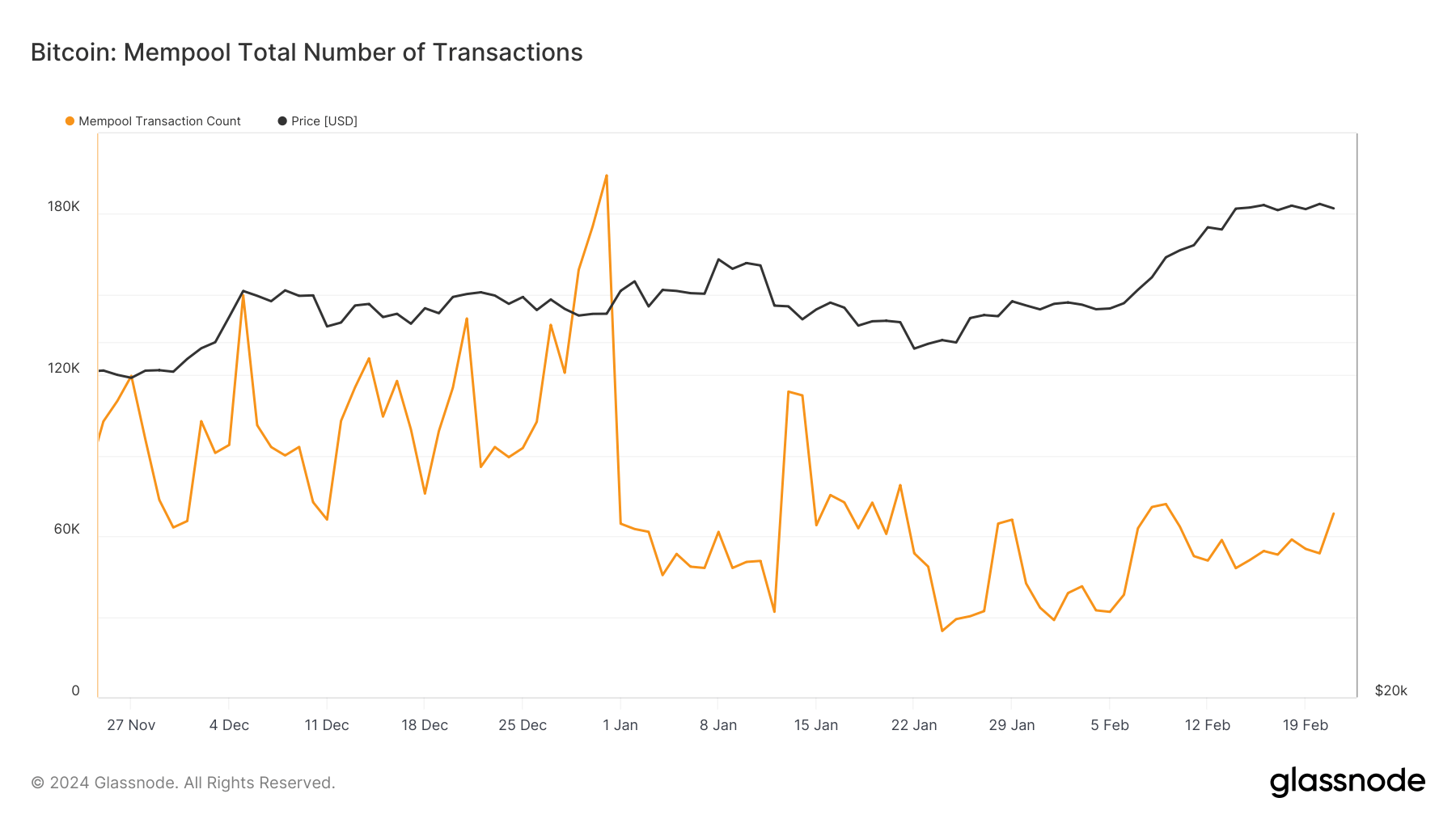

The value of many of these digital assets, bar the stablecoins, has rapidly increased amid the significant market rise of the past year. For context, BTC is trading above $40,000 presently, while ETH’s value has also exceeded $2,200. SOL is also trading at more than $100 as of press time.

However, FTX argued that its valuations represent a “fair and reasonable” value of these digital assets as of the petition date—Nov. 11, 2022.

FTX creditors want to ‘fight’ motion

Meanwhile, the motion has attracted criticism from FTX creditors, who describe it as another theft and urge people to object to the plan.

Sunil Kavuri, one of the most prominent creditors of the bankrupt firm, noted the motion grossly undervalues the value of the digital assets and urges customers to “fight.”

“Alameda research claims prices are up by 40%. Alameda, FTX VCs, claim buyers of unsecured non-customer claims are getting this extra value. FTX creditors must fight,” he added.

The FTX 2.0 Coalition, a group of FTX creditors, advised customers who want to object to the motion to write a letter to the judge in charge of the bankruptcy case.

“Anyone can send a signed letter addressed to the Delaware bankruptcy court. No lawyer needed,” the group said.

Simon Dixon, the CEO of BnkToTheFuture, chimed in that FTX customers “should fight this hard.”

Customers who disagree with the motion have until Jan. 11 to object to the plan.