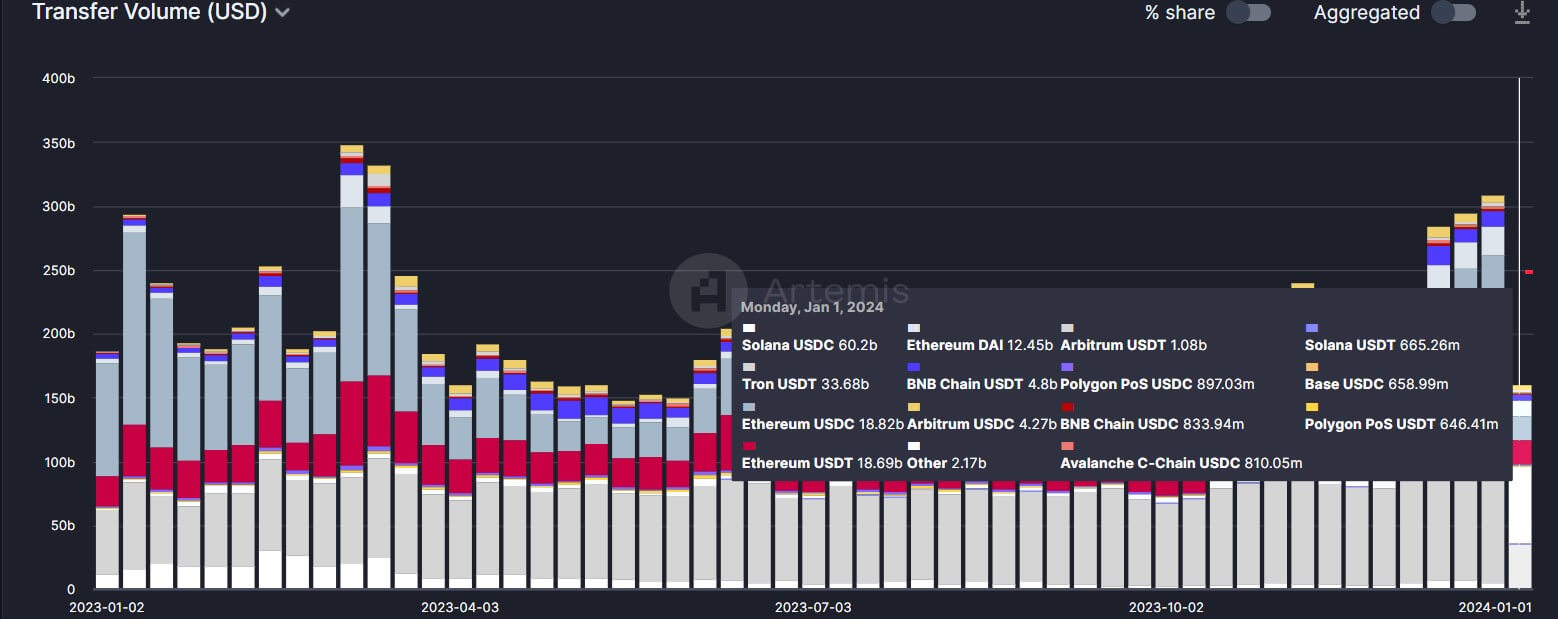

Record-breaking Solana USDC volume signals growing stablecoin dominance

Solana-based USD Coin (USDC) transaction volume surpassed that of USDT on the Tron blockchain, according to data from blockchain intelligence platform Artemis.

Data from the platform shows that Solana USDC transfer volume reached more than $60 billion on Jan. 1, while that of Tron USDT was around $34 billion.

This continues a trend observed in December when Solana USDC’s monthly transfer volume was nearly that of Tron’s USDT. Per Artemis data, Solana USDC saw $24.58 billion in volume, while Tron’s USDT was $6.54 billion.

USDT and USDC are the top two largest stablecoins by market capitalization. These stablecoins account for nearly 90% of the industry supply and trading volume.

Circle’s CEO, Jeremy Allaire, expressed excitement at the milestone, noting that it was only the beginning of the year. Circle is USDC’s issuer.

“Incredible! What’s even more incredible is that it’s only Jan 2nd, imagine where we’ll be a year from now,” Allaire said.

CyptoRanking had previously identified that Solana-based USDC contributed a significant portion of trading activities on decentralized exchanges. At the time, Allaire stated that 90% of all stablecoin transaction volume on Solana was USDC.

Solana’s thriving ecosystem

Solana’s blockchain ecosystem is enjoying a resurgence that has helped it regain a pole position within the crypto industry.

The blockchain ecosystem has experienced significant growth despite its past connections with Sam Bankman-Fried, the embattled FTX founder. This development has led to an influx of new users and crucial partnerships with major global financial entities such as Visa and Shopify.

Furthermore, Solana’s DeFi sector has witnessed remarkable expansion, resulting in an unprecedented surge for its blockchain-based tokens like Helium’s HNT.

Data from CyptoRanking shows Solana’s native SOL token closed last year as one of the top-performing assets, up more than 850% to a peak of $120. However, it has retraced to $98 as of press time.