The rise and potential of BGB: A comprehensive analysis

As the cryptocurrency market witnesses a vibrant surge, buoyed by Bitcoin’s rally to $68k, a wave of optimism sweeps through the digital asset space. This renewed enthusiasm is not just confined to the world’s leading cryptocurrency but has also ignited a bullish momentum across a spectrum of altcoins and exchange-native tokens. One token that stands out for its remarkable performance is Bitget’s native token, BGB. Achieving an impressive new all-time high of $1.15 at the time of writing, BGB encapsulates the market’s growing confidence and the potential for sustained growth.

As investors and enthusiasts focus on the dynamic shifts within the market, BGB’s journey offers a compelling narrative of resilience, innovation, and the promise of a bullish horizon.

This analysis delves into the achievements of BGB, its benefits in a bull market, and a comparative outlook with other exchange tokens, underpinning the token’s potential for future appreciation.

Achievements and Price Analysis of BGB

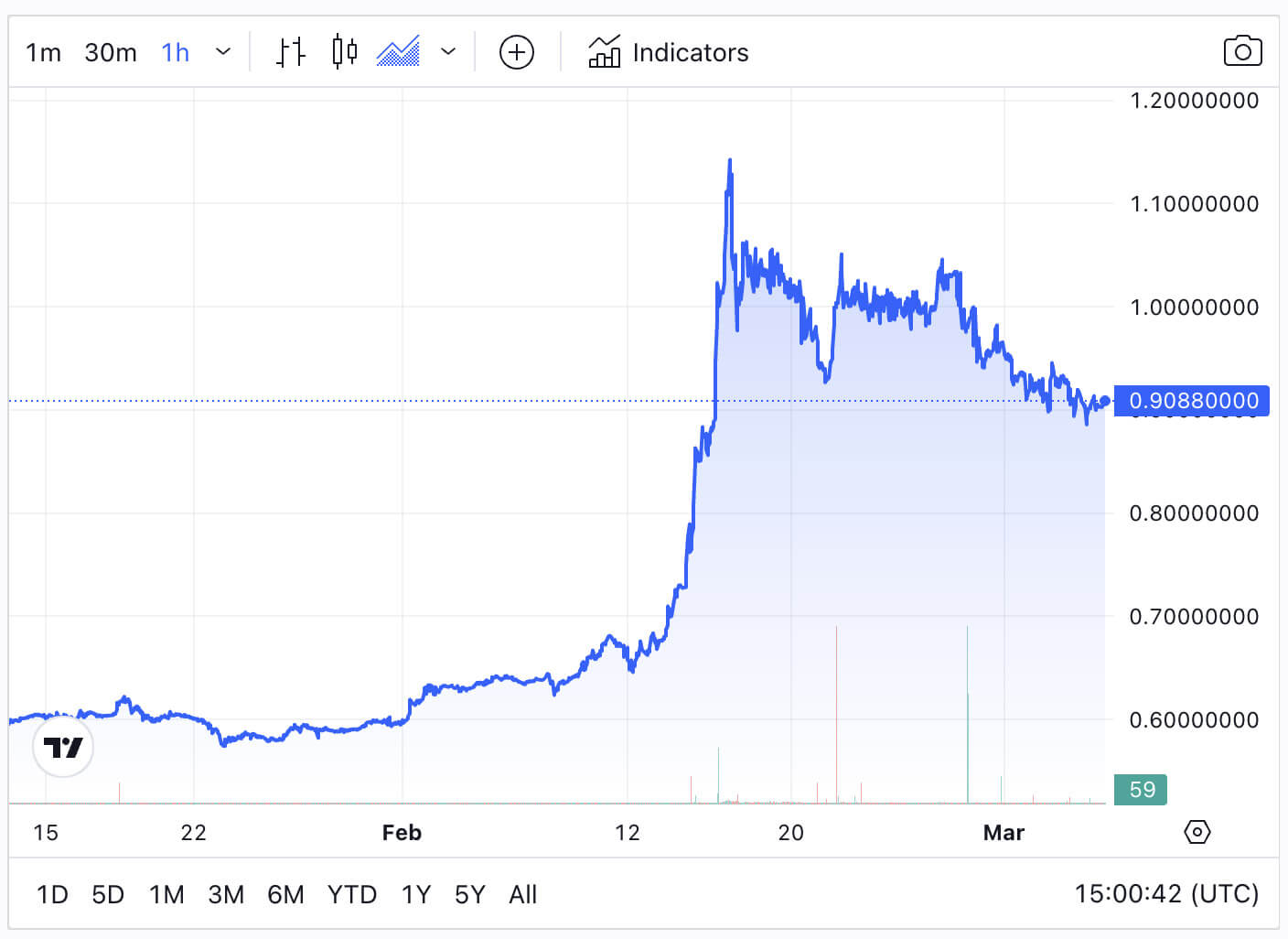

Over the past four months, BGB has demonstrated remarkable resilience and growth, appreciating from $0.4 to a peak of $1.15, marking a significant increase in value. This steady ascent from $0.39 to $1.15, devoid of volatile spikes, underscores a consistent investor confidence and sturdy foundational support from Bitget’s operational successes. As 2024 unfolds, Bitget pledges to further align the token’s trajectory with the platform’s growth, promising enhanced benefits for BGB holders.

Advantages of Holding BGB in a Bull Market

In a bull market, BGB holders are positioned to leverage unique advantages, particularly in staking and transactional efficiencies. Staking BGB yields an annual return of 2%, coupled with daily free withdrawal limits that mitigate the high transaction fees commonly experienced during such market phases. Using BGB to stake, users effectively transform their Bitget accounts into central wallets for Web3 interactions, ensuring security and cost savings on transfers.

Moreover, Bitget’s innovative launchpad projects, such as T2T2 and TonUp, offer BGB holders exclusive access to promising digital assets, amplifying the wealth effect during bullish market conditions. This strategic engagement in launchpad events indicates Bitget’s commitment to maximizing holder value through dynamic market mechanisms.

Comparative Analysis with Other Native Exchange Tokens

A pivotal aspect of BGB’s value proposition is its comparative undervaluation against counterparts like OKX’s native token, OKB. Despite Bitget’s daily trading volume for contracts reaching an impressive $9 billion—approximately 70% of OKX’s volume—BGB’s market capitalization stands at a modest $1.1 billion compared to OKB’s $15 billion.

This discrepancy highlights a significant growth potential for BGB, especially considering the cyclic nature of exchange businesses and the prospective bull market in 2024.

BGB’s Future Performance

Looking ahead, the symbiosis between BGB’s value and Bitget’s operational success is poised to drive further appreciation. With Bitget’s trading volume already showing a 60% increase over OKX, and BGB’s market capitalization presenting a compelling case for undervaluation, the token may be well-positioned for a significant breakout.

This bullish outlook is a testament to Bitget’s robust platform and innovative offerings and highlights the strategic importance of BGB within the broader cryptocurrency market. As such, BGB emerges not just as a token of transactional utility, but as a cornerstone in Bitget’s vision for a more interconnected and value-driven digital asset ecosystem.

Conclusion

The analysis of BGB’s performance, benefits, and comparative valuation underscores a compelling narrative of growth and potential within the competitive landscape of exchange tokens. With strategic initiatives to enhance holder value and leverage market conditions, BGB is poised for significant appreciation. As the digital asset market continues to evolve, BGB stands out as a token with deep intrinsic value, driven by Bitget’s continued success and the broader adoption of cryptocurrencies.

Disclaimer: This is a sponsored article brought to you by Bitget.