WisdomTree first to get nod from FCA on spot Bitcoin ETP ahead of multi-product UK launch

Alexis Marinof, WisdomTree’s Head of Europe, emphasized the importance of this regulatory approval in providing UK-based professional investors with easier access to digital assets. Marinof noted that FCA approval could potentially increase institutional adoption, removing previous regulatory barriers that limited exposure to Bitcoin and other cryptocurrencies.

WisdomTree’s current offerings, listed on major European exchanges such as Deutsche Börse Xetra, the Swiss Stock Exchange SIX, and Euronext, include eight physically backed crypto ETPs that provide spot price exposure to individual coins and diversified crypto baskets.

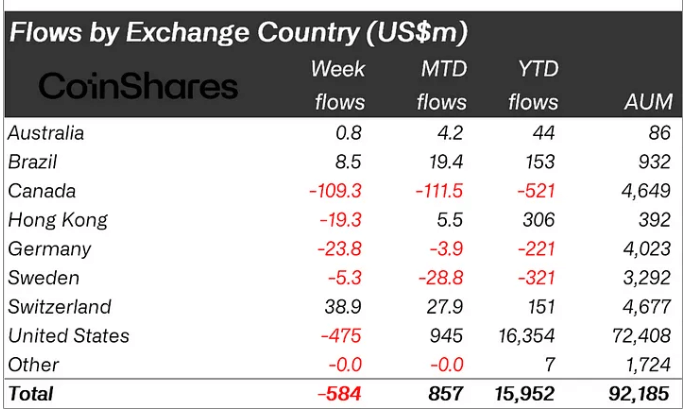

Other issuers, including ETC Group and CoinShares, are also preparing to list their crypto ETPs on the LSE, complying with the FCA’s regulatory requirements. Given recent guidance from the FCA, it is essentially a box-checking exercise for established ETP issuers at this stage.

WisdomTree’s initiative, combined with potential interest from other major European crypto players like VanEck, signals a growing momentum towards regulated and institutional-grade crypto investment products in the UK market. However, for now, retail investors are being left out and thus deemed incapable of handling Bitcoin purchases via ETPs.