BloFin believes spot Ethereum ETFs will drive short-term surge in ETH prices

The exchange, citing various data points such as options skewness, portfolio adjustments, and whale holdings, noted that the ETFs’ launch would likely boost Ethereum’s short-term price.

BloFin analysts said:

“The relative strength of BTC has lasted for several months, but investors are changing their views: they seem to believe that the performance of ETH will strengthen for some time with the listing of the spot ETH ETFs.”

Last month, the US Securities and Exchange Commission (SEC) approved key filings for spot ETH ETFs, surprising many market participants. Since then, the ETH ETF applicants have been engaging with the regulator’s staff, and there are rumors that these financial instruments could start trading as early as the first week of July.

Bullish ETH expectations

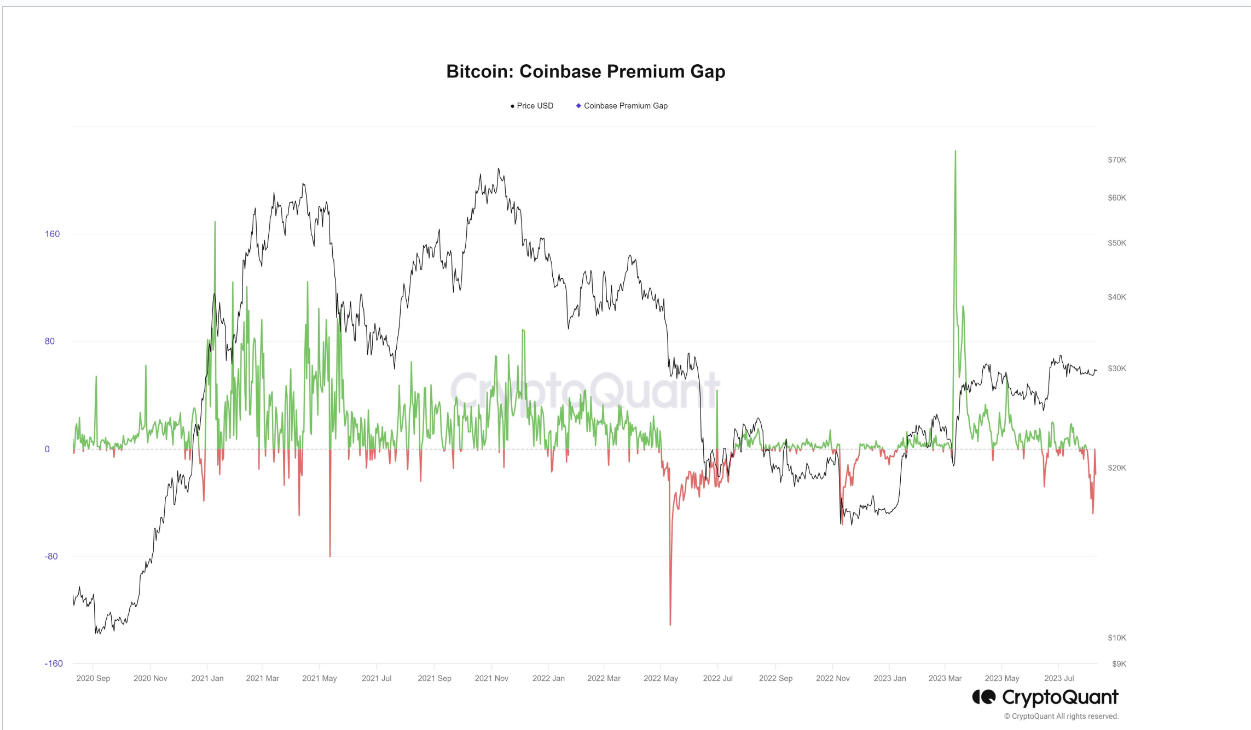

BloFin observed that Bitcoin’s skewness data had been more bullish than Ethereum’s for the majority of this year. However, the trend has reversed in recent weeks, with investors’ short-term expectations for Bitcoin now “neutral” and “slightly bearish,” while expectations for Ethereum are more bullish.

Although investors remain bullish on Bitcoin’s medium and long-term performance, their optimism for Ethereum has surpassed that of the top crypto in the shorter time frames.

The analysts explained that one of the reasons driving this change is the potential for higher returns. According to the note:

“Assets with relatively low market cap and relatively high volatility have a better potential for returns during the interest rate cut cycle.”

BloFin also anticipates that the “asset allocation period” following the approval of spot Ethereum ETFs will positively impact ETH’s price, similar to Bitcoin’s experience in February and March.

Additionally, the latest forward exchange rate term structure of ETH/BTC suggests that investors believe ETH will outperform BTC in the coming months, pushing the exchange rate higher in the short term.

According to the analysts:

“The Risk Premium difference between ETH and BTC has also converged to within 25[basis points], and investors are looking forward to the potential new wealth effect brought by ETH after the listing of spot ETH ETFs.”

BloFin highlighted that on-chain data further supports its bullish outlook. According to the firm, ETH whales have stopped selling their holdings, while BTC whales continue to reduce theirs.

The firm noted that this might be due to miners regularly selling BTC for cash, but it could also indicate investors readjusting their portfolios.