Ether restaking’s biggest risk is lack of understanding around asset looping — Haven1

The emerging Ether restaking protocols promising investors double-digit passive returns have caused significant economic sustainability and security concerns.

However, the biggest risk around Ether (ETH) restaking is not the technical complexity but the lack of investor understanding according to Jeff Owens, the co-founder, and CEO of Haven1.

Speaking with Cointelegraph, Owens said that investors need to understand the risks of asset looping in restaking protocols:

“I hope people start to learn that the more you loop your assets the more risk you’re at. That means that all it takes is one of those layers to pull out or not to contribute the rewards and you can have that waterfall effect that comes down with it.”

Asset looping for restaking involves traders deploying the same capital into multiple protocols. This is because liquid staking offers investors a copy of the underlying Ether token, which can be further deployed in other decentralized finance (DeFi) protocols.

Haven1 is an EVM-compatible layer-1 blockchain that recently launched its own liquid staking token, hsETH.

Related: Marathon’s BTC mining is heating an entire town in Finland

Restaking is a “robust financial tool,” but investors need to understand the number of loops

Liquid staking became a leading protocol category for crypto investors because it enables more capital efficiency. Regular staking protocols won't allow the re-deployment of staked assets.

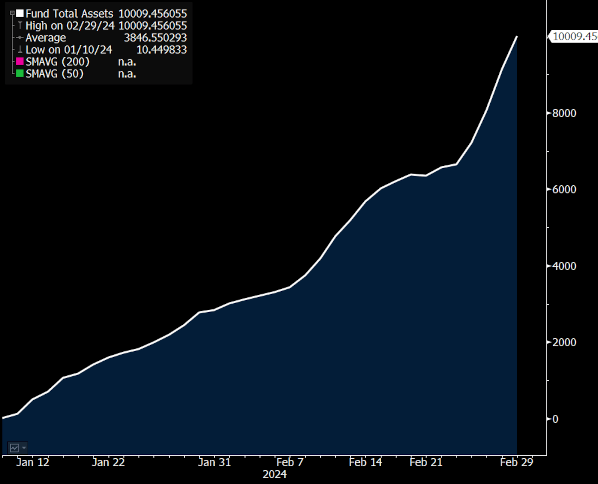

Liquid staking is the largest protocol category, with a combined total value locked (TVL) of over $51.1 billion. In comparison, the lending market is only worth $32 billion in cumulative TVL, according to DefiLlama.

While Ether restaking is a “robust financial tool,” investors still need to understand the number of loops they are adding to their assets, according to Owens. He said:

“There’s always this concern that people are given these very robust financial tools within crypto and don't necessarily understand the implications, the number of loops that they’re adding, and the implications to their underlying asset. So for us, the ethos of Haven1 ultimately is to avoid a lot of those [risks].”

Related: Centralized crypto exchanges are key for mass adoption, despite FTX collapse — X10 CEO

How is hsETH offering a 25% APY yield?

Haven1’s recently launched restaking portal is offering investors a yield of up to 25.24% annual percentage rate (APR) on top of the current 3.24% Ether restaking APR.

The launch of the offering caused some concerns since it was considerably higher than the 20% yield offered by Anchor Protocol on Terra’s UST before the algorithmic stablecoin issuer Terra collapsed in May 2022.

However, investors should not be concerned about another Terra-like meltdown, since hsETH’s 25% yield is a “pre-mainnet incentive mechanism” from Haven1, which will adjust over time based on supply and demand.

“The APR is not meant to be sustainable for Haven1 and it’s purely an incentive mechanism to bring the community in early on in the testnet. The actual mechanism of this is just Ethereum liquid staking.”

As an additional safety mechanism for its emerging restaking ecosystem, Haven1 created a reserve fund comprised of 10% of all application fees earned through the network, Owens explained:

Magazine: Ethereum’s recent pullback could be a gift: Dynamo DeFi, X Hall of Flame