Why are top Bitcoin traders bullish despite BTC price dip to $64.3K?

On June 18, Bitcoin's (BTC) price tumbled 5.6% over the course of the day to $64,300, reaching its lowest level in over a month.

The six-day downtrend coincided with macroeconomic data pointing to a slowdown in the U.S. economy, particularly in retail sales and employment. Meanwhile, the U.S. Federal Reserve has kept interest rates at their highest level in two decades. However, the resilience in the derivatives markets points to a potential BTC price recovery ahead.

U.S. recession risk, high interest rates hamper BTC price

U.S. retail sales increased a modest 0.1% from the previous month, below the economists' consensus of 0.3%, according to Yahoo Finance.

Paul Ashworth, chief North America economist at Capital Economics, noted that this data points to a “lackluster” second-quarter gross domestic product. However, Matthew Luzzetti, chief U.S. economist at Deutsche Bank, believes that consumption is returning to a “more normal pace for the economy.”

Federal Reserve Bank of New York President John Williams described the U.S. economy and labor market as strong and expects “inflation to keep coming down in the second half of this year.” Williams said the Fed’s current policy is weighing on the economy but argued that the central bank “needs more data” before considering an interest rate cut.

A high-interest rate environment favors fixed-income investments and is detrimental to Bitcoin. The fact that the S&P 500 index rose to an all-time high on June 18, even if driven by a handful of tech companies, also negatively impacts investor interest in Bitcoin.

This scenario is even more concerning when combined with the fact that U.S. spot Bitcoin exchange-traded funds (ETFs) experienced a $562 million outflow in three days, according to Farside Investors' data.

Investors can gauge market sentiment by measuring the top traders’ long-to-short ratio. By consolidating positions across perpetual and quarterly futures contracts, a clearer insight can be gained into whether professional traders are leaning toward a bullish or bearish stance.

The long-to-short ratio for Binance’s top traders increased from 1.32 on June 13 to 1.52, indicating strong demand for leveraged long positions despite Bitcoin’s failure to sustain the $68,000 support level. At OKX, the indicator rose to 1.78 from 1.65 on June 13, suggesting that whales and market makers added net longs while Bitcoin’s price fell below $67,000.

Bitcoin whales and miners remain cautiously optimistic

To determine whether traders were caught off guard and currently hold short positions underwater, analysts should examine the balance between call (buy) and put (sell) options. Growing demand for put options typically indicates traders are focusing on neutral-to-bearish price strategies.

Data from Bitcoin options at Deribit reveals that the demand for put options has declined since June 14, favoring call instruments by more than two times. This suggests that Bitcoin whales and market makers did not anticipate a price downturn and remained optimistic during the dip.

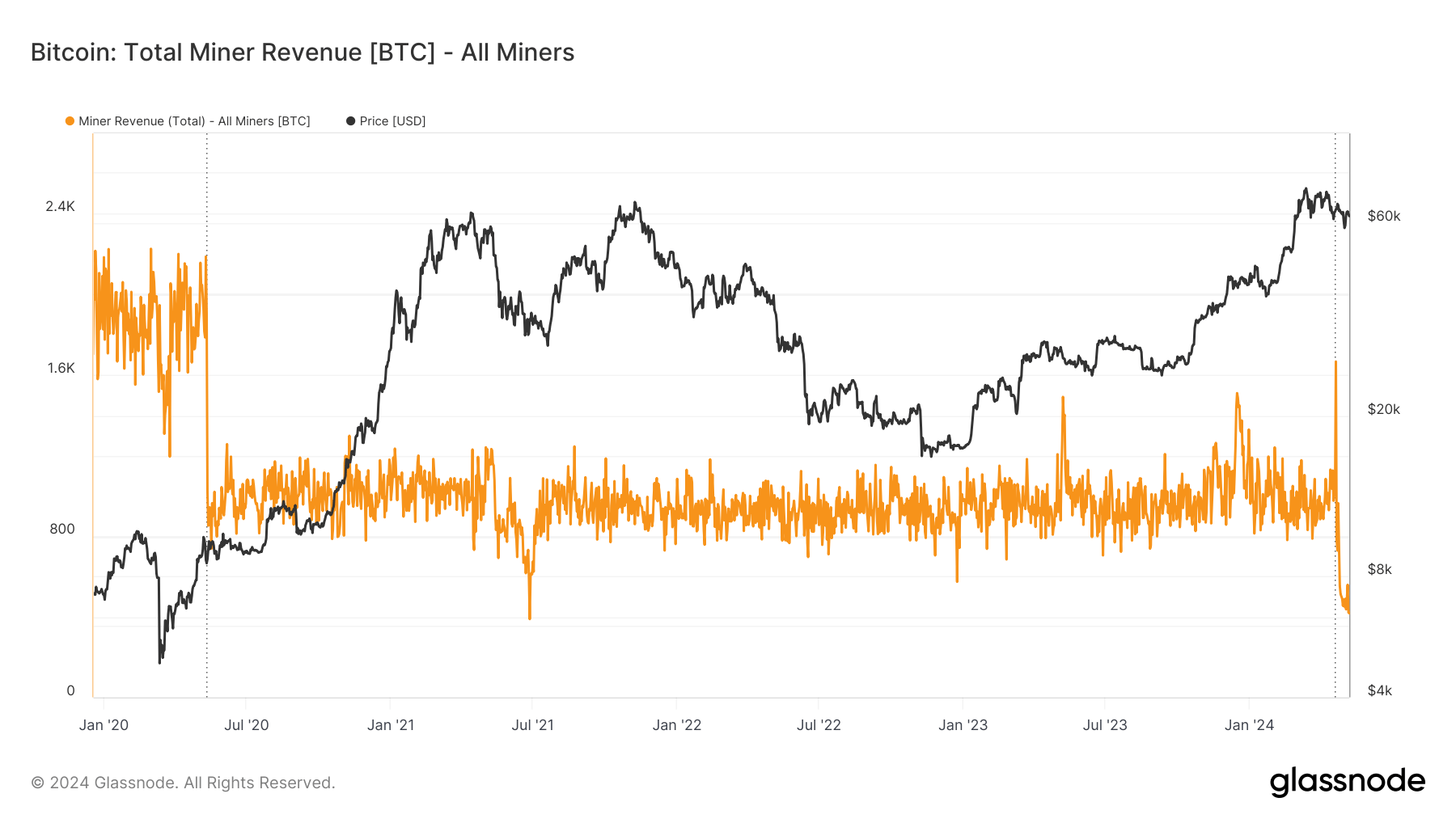

Apart from ETFs and derivatives traders, Bitcoin miners generate an average of BTC 3,150 every week. Miners can potentially offload over $203 million on the market weekly, so monitoring their outflow is crucial to understand traders' sentiment.

Related: Bitcoin price ‘clusters’ hint at more downside: Is BTC about to lose $64K support?

Glassnode’s Miner Outflows Multiple has remained below 0.8 since June 14, indicating reduced sell pressure. This trend contrasts with the period between May 30 and June 13, when the indicator often neared or surpassed 1.0, meaning miners sold more than the average of the previous 365 days.

Given that Bitcoin derivatives traders held a bullish stance during the dip to $64,300 on June 18, while the spot ETF presented strong outflows, there is no reason to expect additional BTC price pressure, considering that the current macroeconomic setup suggests the Fed will likely to cut rates by year-end.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.