cyptouser1 years ago426

Former FTX co-CEO Ryan Salame is expected to plead guilty to the criminal charges against...

Coinbase insiders dump over $30M stocks amid SEC lawsuit, but share value defies odds

cyptouser1 years ago319

Coinbase top executives have sold more than $30 million worth of the company shares since the U.S. S...

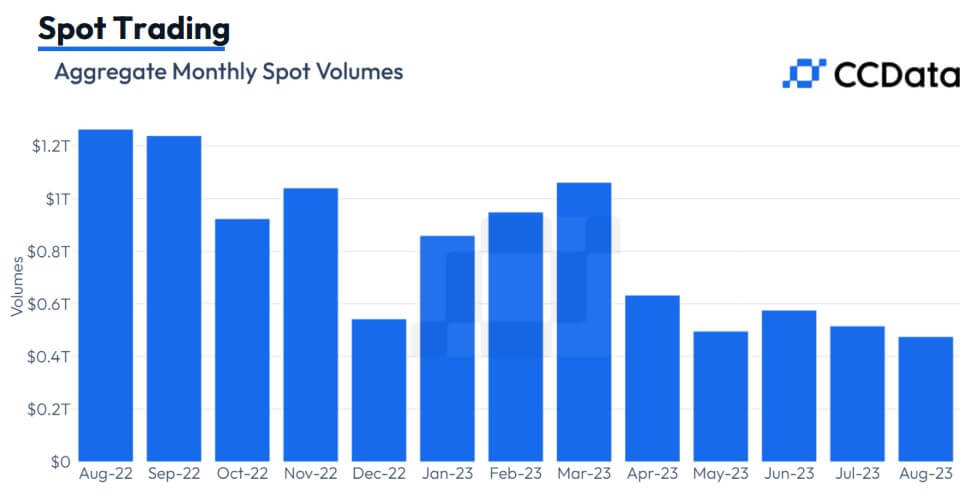

Crypto trading sinks to 2019 levels as Binance sees market dip and Huobi volumes surge

cyptouser1 years ago307

Spot and derivatives trading activities on centralized cryptocurrency exchanges declined for the sec...

FTX reorganizing on-chain assets by bridging tokens, consolidating holdings

cyptouser1 years ago449

Bankrupt crypto exchange FTX revealed in a tweet on Sept. 6 that it is in the process of m...

Adaptation and Growth: Bitfinex’s Resilience in the Crypto Revolution

cyptouser1 years ago318

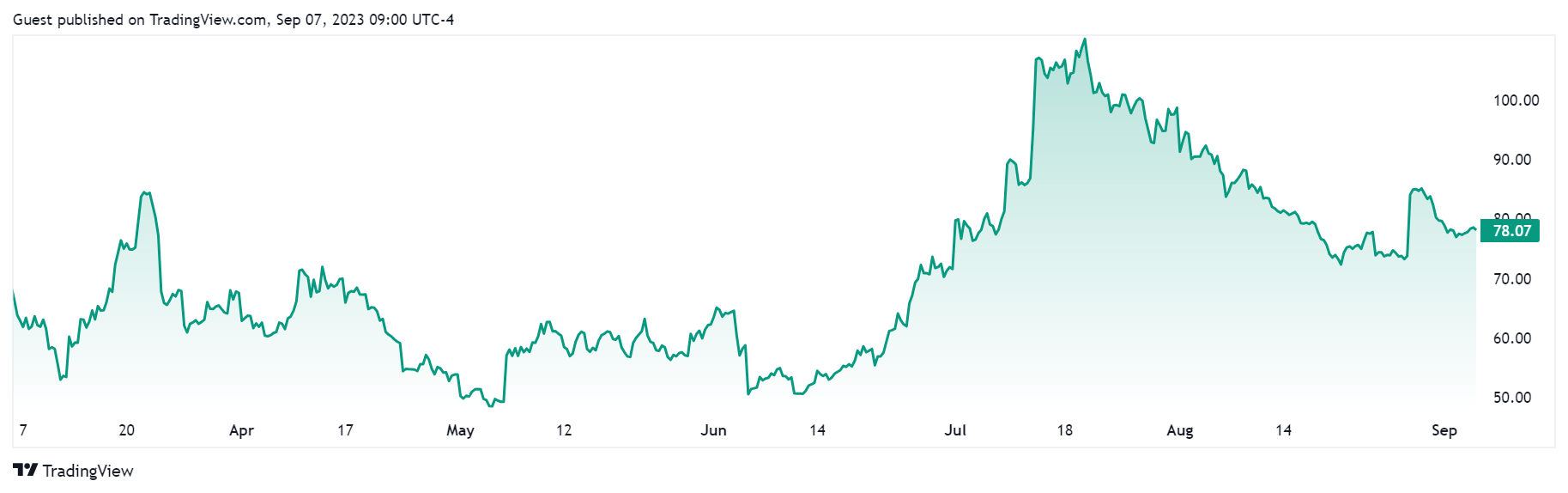

Bitfinex initially emerged in 2012 as a harbinger of change, fueling the evolution of digital tradin...

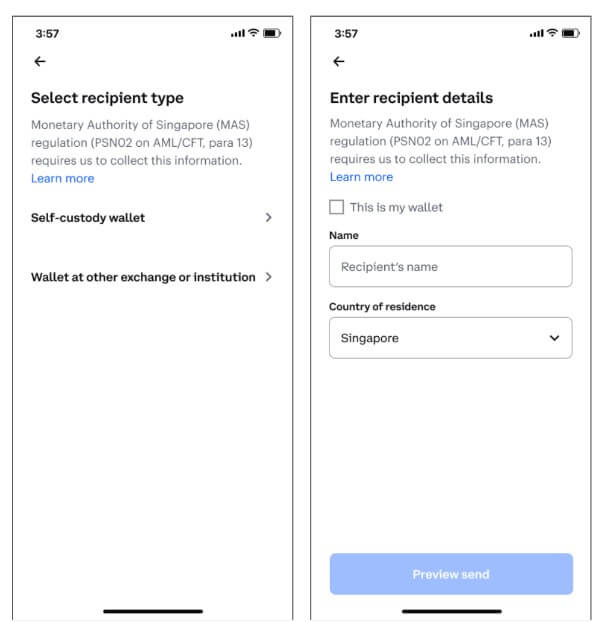

Coinbase Singapore now requires counterparty’s personal information to process transactions

cyptouser1 years ago373

Coinbase Singapore users must provide additional counterparty information when initiating cryptocurr...

Coinbase launches institutional lending service

cyptouser1 years ago330

Coinbase is in the process of creating an institutional lending service, according to regulator...

Coinbase raises bond buyback limit to $180M amid a surge in investor interest

cyptouser1 years ago342

Coinbase increased its bond buyback limit to $180 million and extended its deadline to Sept. 18, acc...

Regulated exchanges hesitate on crypto exposure despite growing demand – report

cyptouser1 years ago303

According to a report published Sept. 5 by the World Federation of Exchanges, regulated st...

Binance records mild outflow as another top executive leaves

cyptouser1 years ago364

Binance confirmed to CryptoSlate in a Sept. 4 email that its head of product, Mayur Kamat,...