cyptouser1 years ago309

Stablecoins are making significant waves in the payments sphere, primarily as a vehicle for non-spec...

Circle and Coinbase to dissolve Centre; USDC will remain fully available

cyptouser1 years ago314

Coinbase and Circle said in a blog post on Aug. 21 that Centre — the consortium originally...

Kraken introduces support for PayPal’s stablecoin, PYUSD

cyptouser1 years ago319

Kraken announced on Aug. 18 that it had added support for PayPal’s stablecoin, also k...

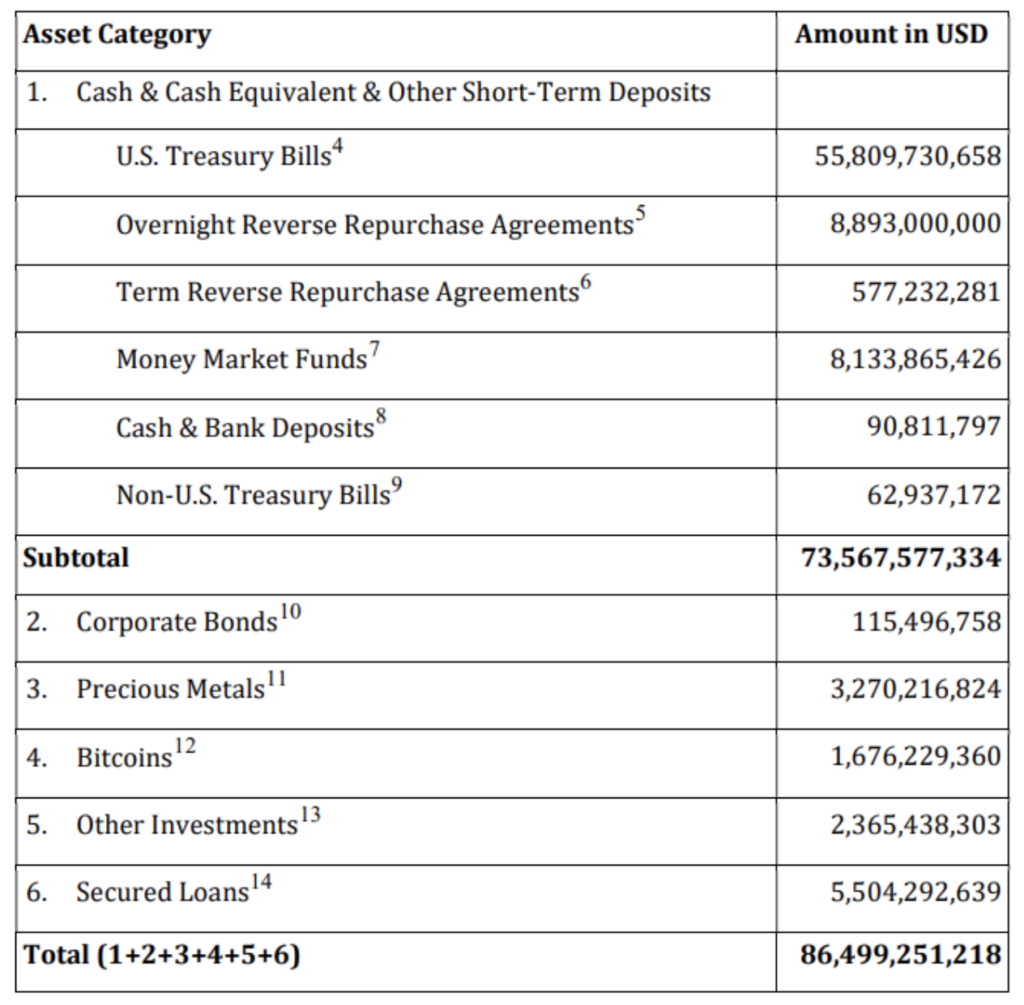

Is Tether’s profitability a risky bet on treasury profits?

cyptouser1 years ago389

Tether, the issuer of the world’s largest stablecoin, USDT, is breaking all records in 2023. In its&...

Circle says competition from PayPal and others is ‘great to have’, reports $1B in cash

cyptouser1 years ago296

Circle’s top executive spoke favorably of competition from PayPal’s stablecoin while emphasizing his...

Rep. Maxine Waters criticizes PayPal’s stablecoin, demands regulation on par with financial institut

cyptouser1 years ago357

Democratic U.S. Congresswoman and House Financial Services Committee Ranking Member Maxine Wate...

Federal Reserve will require state banks to get written ‘non-objection’ from central bank before eng

cyptouser1 years ago357

The U.S. Federal Reserve has issued new guidelines for state member banks regarding activi...

Tether ‘welcomes’ PayPal’s PYUSD stablecoin to the market, says CTO Paolo Ardoino

cyptouser1 years ago573

Paolo Ardoino, CTO of Tether (USDT), said in an Aug. 8 statement shared with CryptoSlate t...

Circle CEO addresses USDC liquidity concerns, welcomes PayPal move into stablecoins

cyptouser1 years ago412

Jeremy Allaire, Circle CEO, confirmed that USD Coin (USDC) saw more redemptions than issuance over t...

House Financial Services Committee chair renews call for stablecoin legislation after PayPal’s PYUSD

cyptouser1 years ago357

Representative Patrick McHenry, (R-NC), chair of the U.S. House Financial Services Commit...