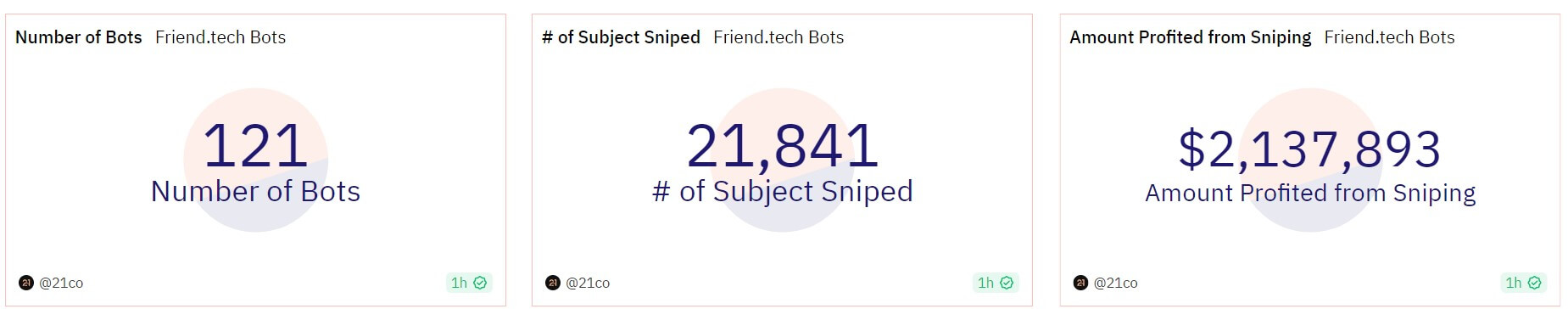

Friend Tech (FT), the web3 social token platform that saw a resurgence in user activity recently, has seen an increase in “sniper bots,” which have been causing significant shifts in share prices.

According to a detailed analysis performed by X user @unexployed_ of Castle Capital, these bots, beyond their normally expected functionality, are deploying a technique of ‘sniping’ to gain control over high-value profile shares.

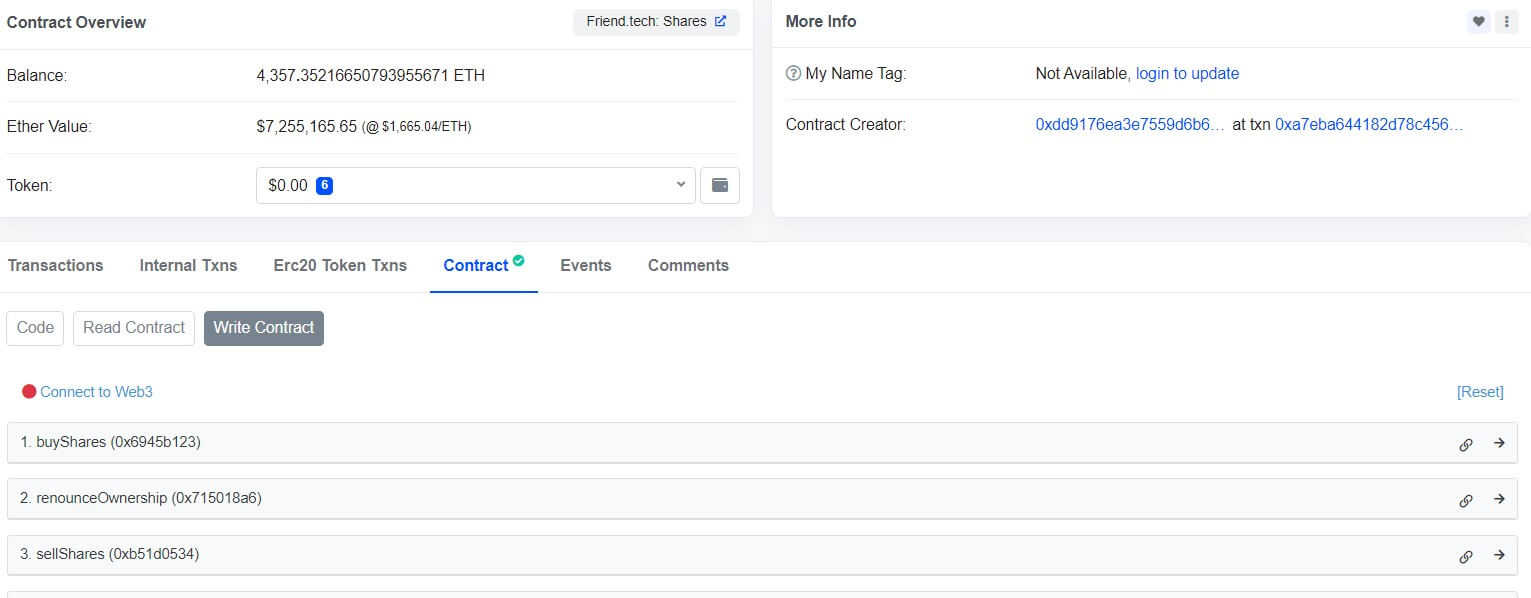

In the case of DappRadar’s recent registration on FT, Unexployed revealed that the share prices started at an unusually high point of 0.26 ETH. This was not triggered by a registered account but seemingly by a sniping address interacting directly with the smart contracts, demonstrating the influence of these bots on the market.

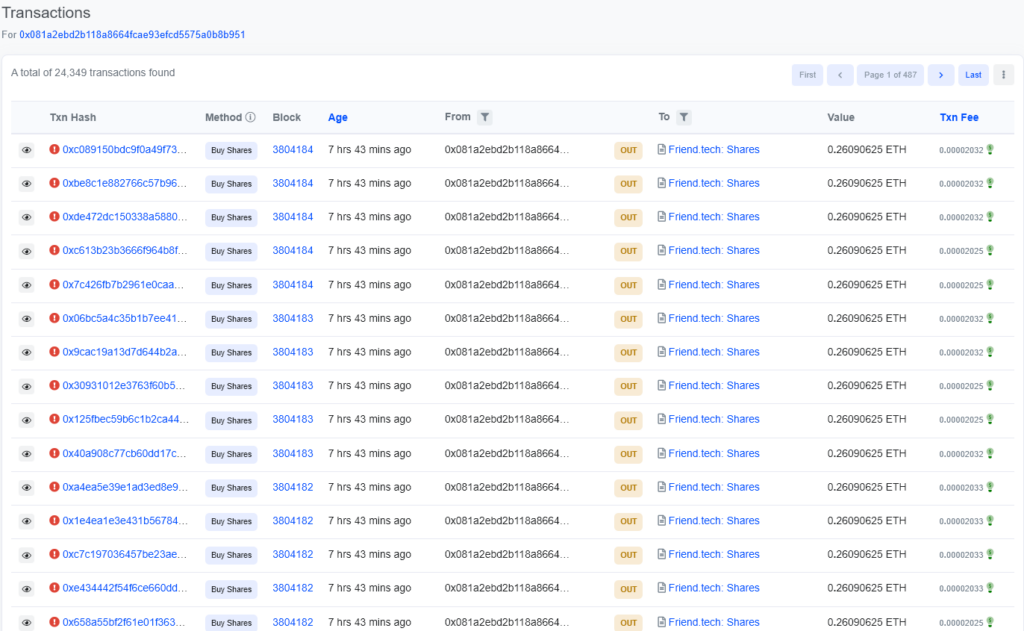

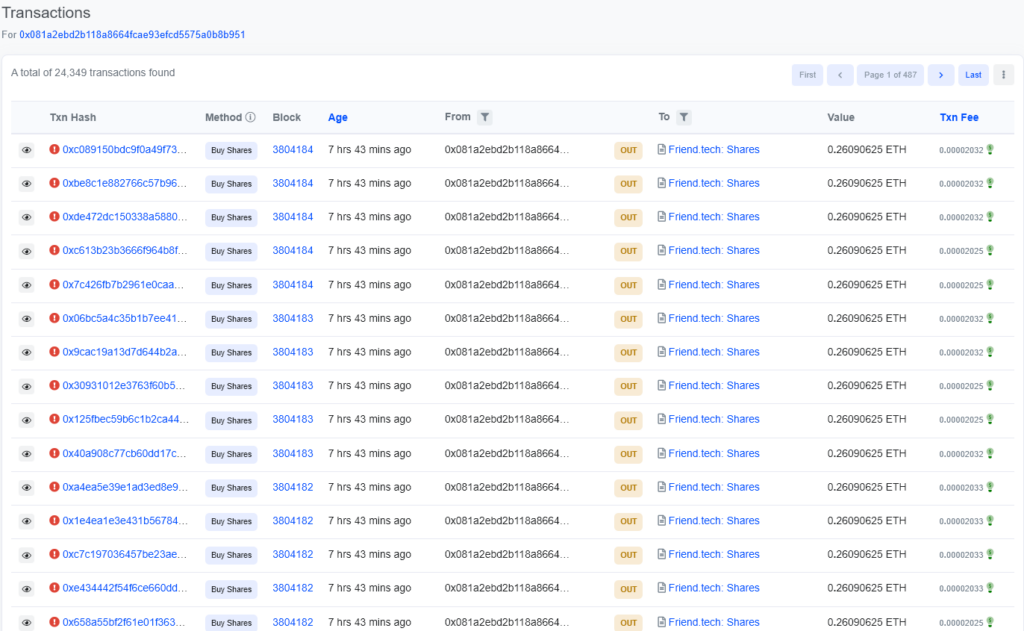

Digging deeper into basescan.org, Unexployed was able to trace the chronological order of buyers and sellers. Within the first four blocks, there were already 65 shares on the market. And DappRadar was not alone. Other entities, such as Moonshilla and Rektdiomedes, also faced a similar situation where snipers gained immediate control over their FT supply.

The primary sniper, identified as 0x081…951, executed over 20,000 transactions to acquire the shares. The first 46 transactions failed with the error “Fail with error ‘Insufficient payment” and were reverted, according to Basescan.

A CryptoSlate analysis of the transactions revealed that the account attempted to purchase the shares before the owner of the account had purchased the first share (a requirement of FT.) The transaction log states Fail with the error, “Only the shares’; subject can buy the first share”