cyptouser10 months ago516

The U.S. Securities and Exchange Commission (SEC) acknowledged on Sept. 18 that multiple k...

Class action case against Bitfinex gets dismissed, marking another legal win

cyptouser11 months ago294

Crypto exchange Bitfinex has secured another significant legal victory, as a class action lawsuit ag...

Binance drops support for Sandbox NFT staking, will soon end support for all Polygon NFTs

cyptouser11 months ago327

Leading crypto exchange Binance said that it will end support for features related to non-...

Coinbase, Circle, Aave, and more partner to launch Tokenized Asset Coalition

cyptouser11 months ago291

The new group, called the Tokenized Asset Coalition, aims to have real-world assets represented and...

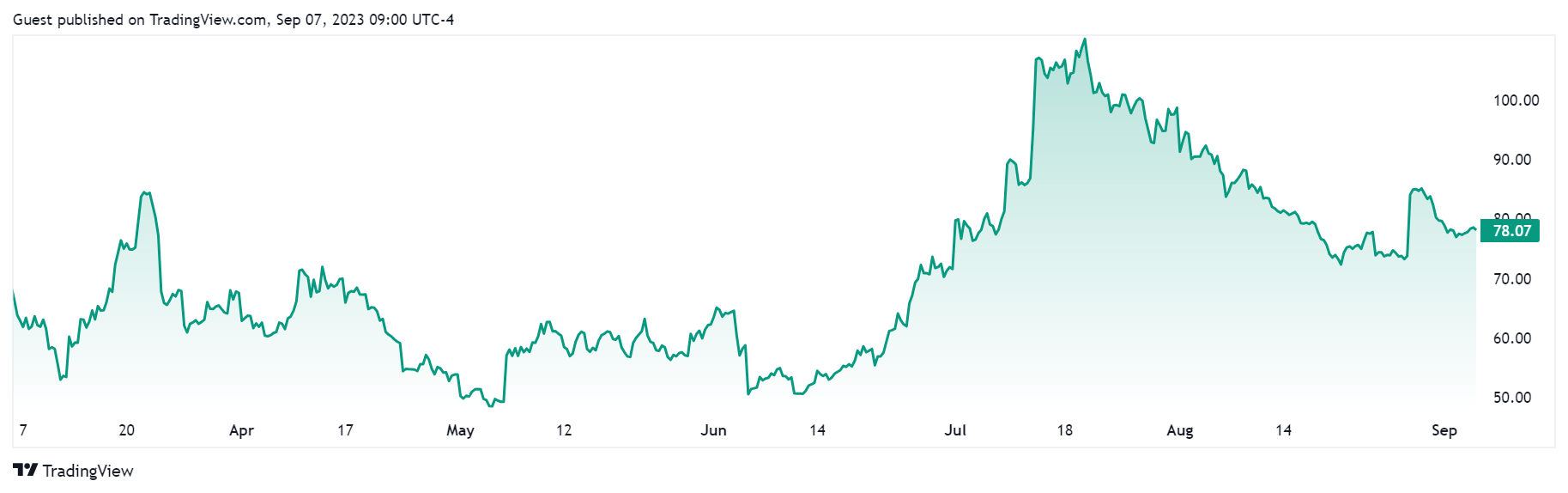

Coinbase insiders dump over $30M stocks amid SEC lawsuit, but share value defies odds

cyptouser11 months ago291

Coinbase top executives have sold more than $30 million worth of the company shares since the U.S. S...

Adaptation and Growth: Bitfinex’s Resilience in the Crypto Revolution

cyptouser11 months ago296

Bitfinex initially emerged in 2012 as a harbinger of change, fueling the evolution of digital tradin...

Coinbase launches institutional lending service

cyptouser11 months ago303

Coinbase is in the process of creating an institutional lending service, according to regulator...

Crypto betting platform Stake silent on reported $41M fund drain

cyptouser11 months ago323

Several blockchain security firms, including Peckshield, have reported the suspicious movements...

Binance-backed BUSD circulating supply drops to less than $3B

cyptouser11 months ago343

The circulating supply of Binance USD (BUSD) has fallen to $2.8 billion, marking its lowest point si...

Ripple files motion to block SEC appeal attempt

cyptouser11 months ago312

Ripple has filed a motion requesting the court to deny the SEC’s certification request for...