cyptouser1 years ago308

In an unprecedented twist, the correlation between the 10-year Treasury yield and gold, two key fina...

Pantera predicts 322% Bitcoin price surge to $148k after halving in 2024

cyptouser1 years ago308

Bitcoin has experienced its longest stretch of negative year-over-year returns in its history,...

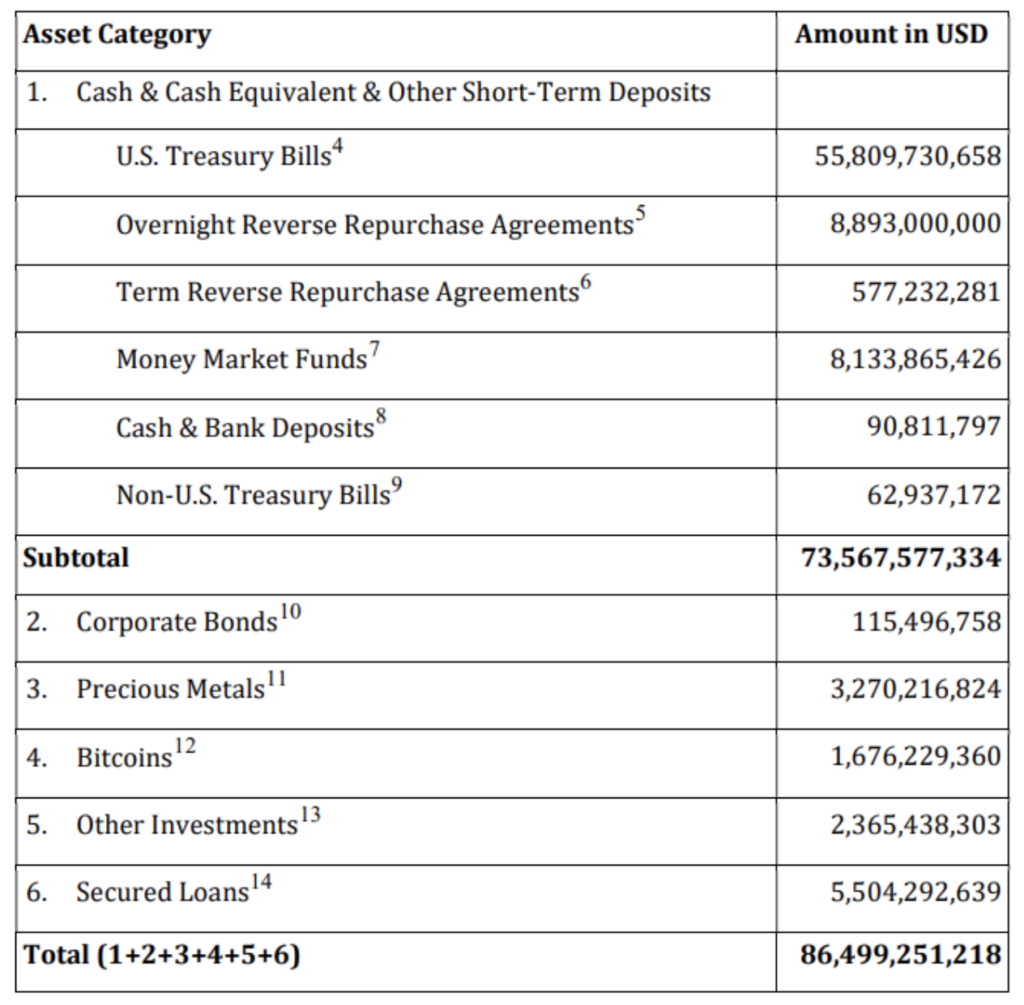

Is Tether’s profitability a risky bet on treasury profits?

cyptouser1 years ago343

Tether, the issuer of the world’s largest stablecoin, USDT, is breaking all records in 2023. In its&...

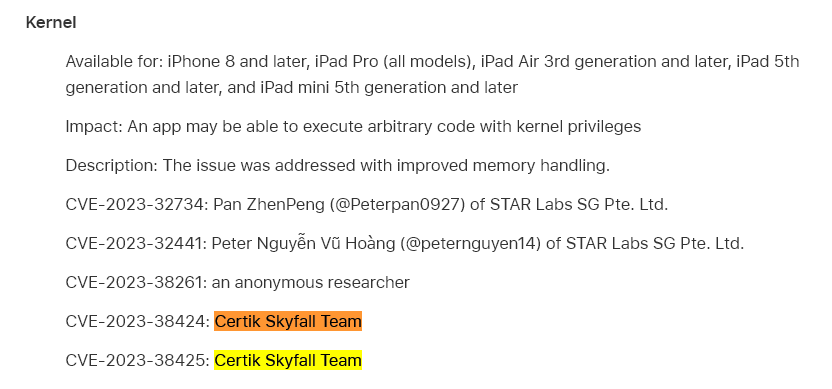

CertiK’s crypto security reviews uncover critical vulnerability in Apple iOS

cyptouser1 years ago348

The blockchain cybersecurity firm, CertiK, has reportedly been instrumental in uncovering critical s...

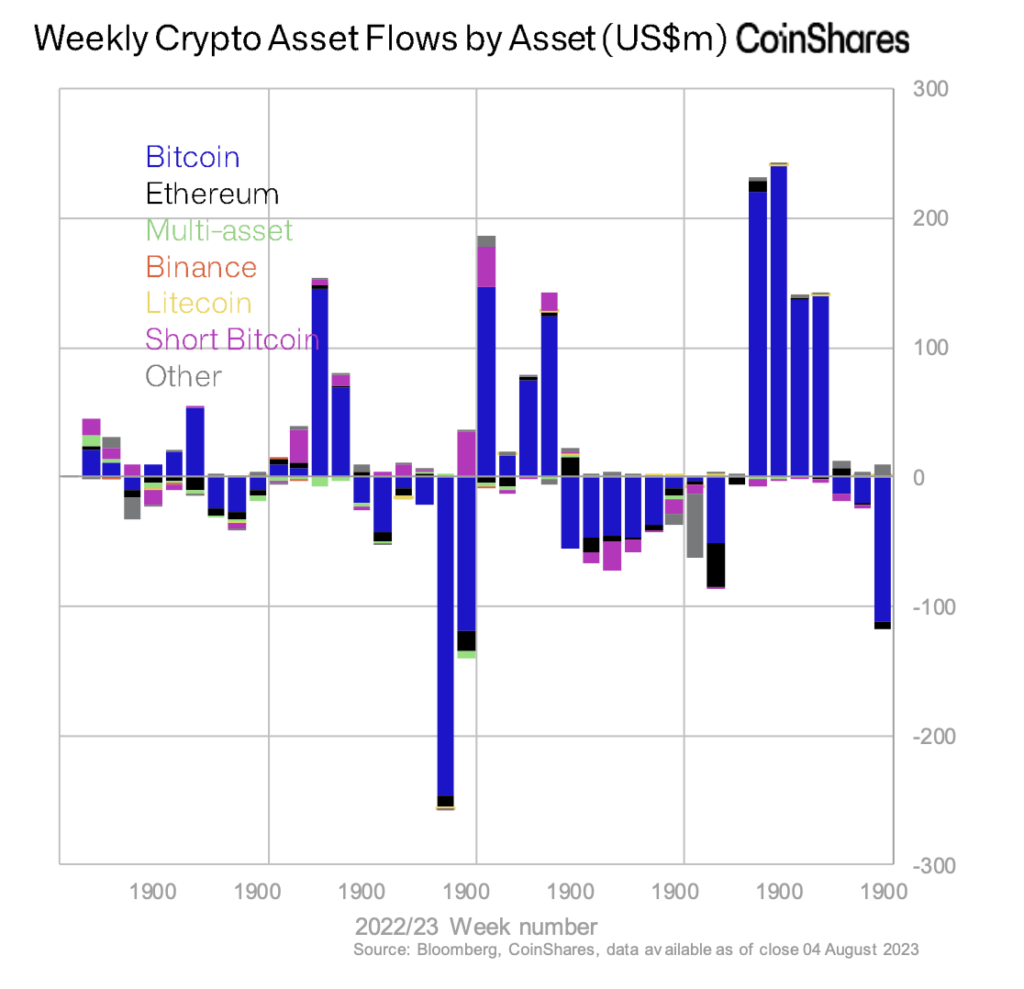

Largest Bitcoin ETP outflow since March as profit taking continues

cyptouser1 years ago631

The exchange-traded digital asset market has seen considerable outflows this week, marking a total o...

Bitcoin sees the second-highest number of new Inscriptions per day

cyptouser1 years ago371

Bitcoin, the world's most popular cryptocurrency, has been making headlines again. This time, it...

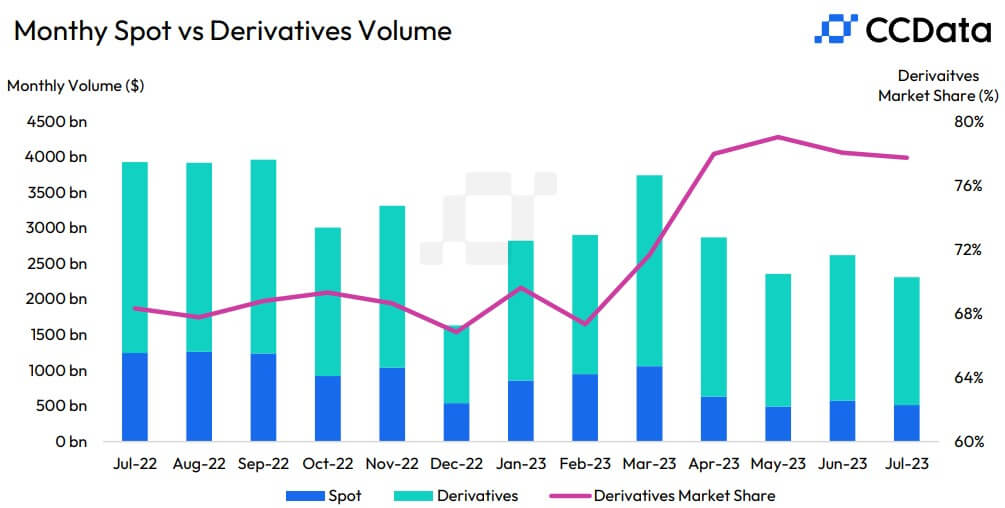

Centralized exchange trading volumes hit yearly low, though South Korean exchanges resist trend

cyptouser1 years ago315

Crypto trading on centralized exchanges declined by 12% to $2.36 trillion. This is the lowest volume...

Social media bots suspected in possible FTX crypto price manipulation, reveals report

cyptouser1 years ago286

A new report by the Network Contagion Research Institute (NCRI) suggests that social media...

Countdown to Litecoin halving today, is ‘digital silver’ ready to break out?

cyptouser1 years ago498

The highly anticipated Litecoin (LTC) halving will occur later today, Aug. 2, marking the third even...

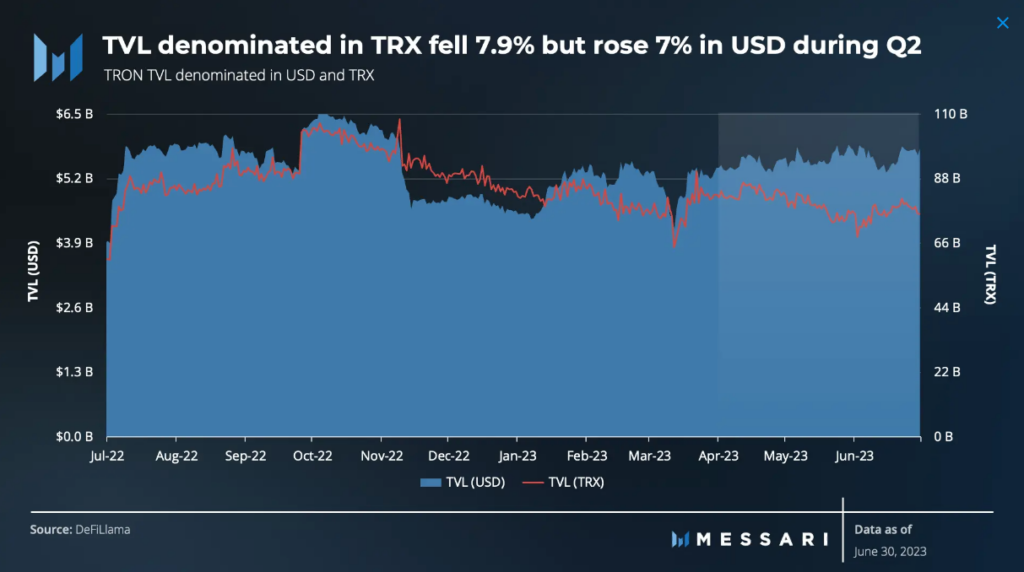

TRON ecosystem grows amid increasing DeFi activity

cyptouser1 years ago321

The TRON (TRX) network exhibited considerable growth in Q2 in daily active accounts, new accounts, a...