Is Tether’s profitability a risky bet on treasury profits?

Tether, the issuer of the world’s largest stablecoin, USDT, is breaking all records in 2023. In its Q1 assurance report, Tether gained an all-time high reserve surplus of $2.44 billion, and a net profit of $1.48 billion

This raised many eyebrows because the world’s largest asset manager, BlackRock, had only $1.2 billion net income in the same period.

Not only does dollar tokenization pay off but it pays off drastically. This is evidenced by profit efficiency per employee, as BlackRock’s profits are secured by 16,500 – 19,800 personnel vs. Tether’s modest 60 – 155 employee count.

Tether’s latest Q2 assurance report from its accounting firm BDO tells the same story. Its stablecoin reserves increased by $850 million, reaching $3.3 billion. Taken at face value, these reports show that Tether cracked the money-making formula while providing critical USDT stability in extreme market conditions.

How? Tether seemingly discovered a money printer in US treasuries. But is there a risk in Tether’s evolving business model? One that could topple the entire crypto market given Tether’s enormous $83.7 billion market cap weight?

Let’s explore.

Tether: Combining Saylor’s Strategy While Leveraging US Debt

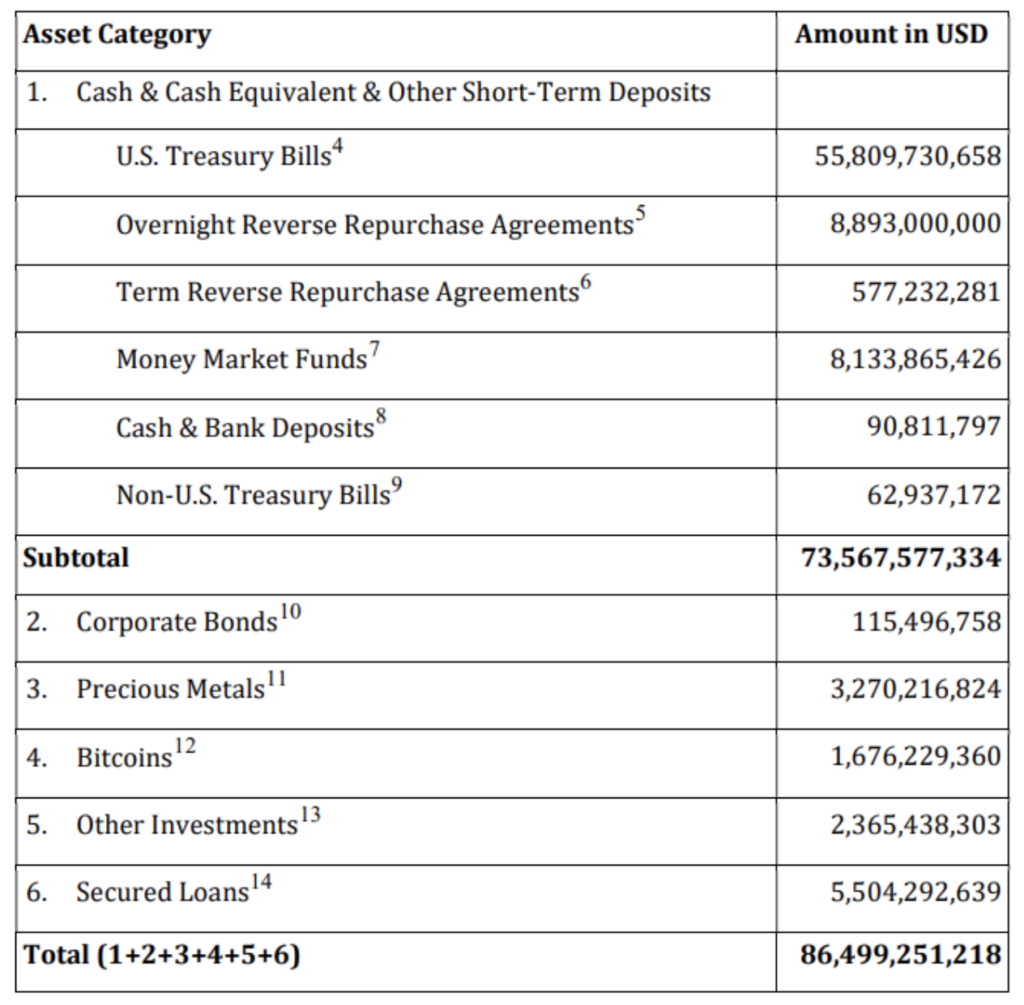

Both Q1 and Q2 reports show Tether’s increased reliance on US treasuries. The latest Q2 attestation accounted for Tether Holdings Limited owning at least $86.5 billion in consolidated assets.

Out of that, $83.2 billion is in liabilities, revolving around Tether’s core product – USDT – stablecoin issuance pegged to the USD and backed by cash and cash equivalents. USDT is mostly backed by US government debt, as 64.5% of Tether’s total assets are in US Treasury Bills, at $55.8 billion.

Tether’s entire gambit focuses on higher liquidity of short-term assets. This comes as no surprise, as it’s the crux of most day-trading strategies and is even openly taught by the leading courses for day trading.

As short-dated US debt, typically yielding above 5% after the Fed’s latest hiking cycle, Tether generates profits by simply accruing that one-month Treasury interest. Likewise, Tether effectively loans money over a short period for the same yield-generating reason.

More precisely, it does this via overnight reverse repurchase agreements (ON RRPs) at $8.89 billion and money market funds at $8.1 billion. Through these short-term investment vehicles, Tether eliminated reliance on lower interest rates offered by bank deposits.

Tether’s lean operating structure allows the company to pour that excess yield into other ventures, like Bitcoin. Michael Saylor of MicroStrategy honed this approach – utilizing debt to gain exposure to a scarce asset.

Presently holding $1.67 billion in BTC, Tether is going further from monthly BTC allocations. In late May, the company announced investments in Uruguay’s Bitcoin mining operations, taking advantage of the country’s impressive 94% utilization of renewables for its electricity needs.

At the same time, Tether spread its wings into the payment processing arena via CityPay.io in Georgia.

As a partner of Binance Pay, investing in CityPay revealed another Tether gambit. Make stablecoins usable for daily needs without the need for redemption. This aligns with a recent risk Tether is undertaking – reduced cash reserves.

Tether’s Risk: Evaporating Cash Reserves

The dollar’s credibility relies on the US’s standing in the world. Tether’s credibility relies on its USDT stability. And that stability depends on Tether’s capacity to redeem large USDT amounts for dollars in short periods.

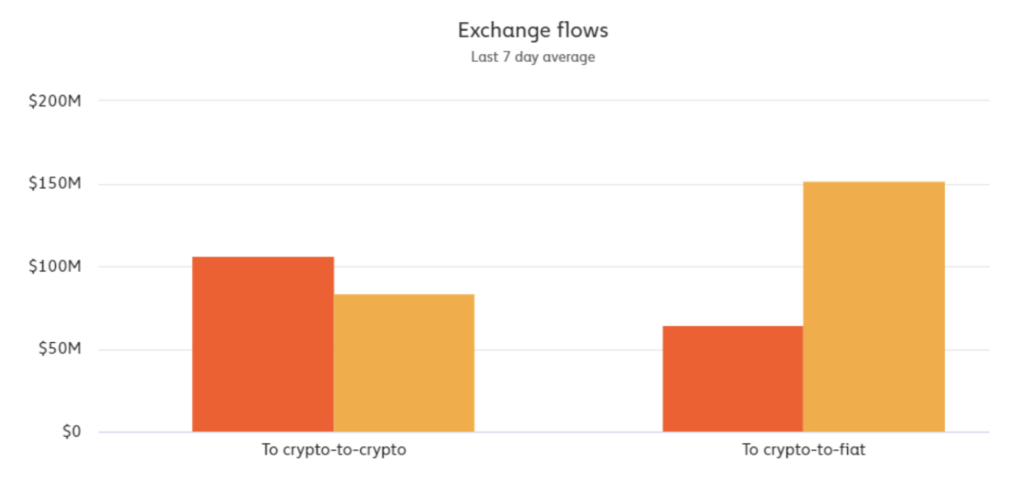

In other words, Tether’s entire business model could collapse if that credibility is questioned, resulting in non-redeemable outflows. Chainalysis data shows $151.9 million in 7-day average USDT crypto-to-fiat exchange flows in a stagnating crypto market.

At this low cash-out pressure, Tether’s job to maintain the USDT peg is easy. However, instead of bolstering its cash reserve for future market conditions, Tether has been reducing it. At the end of 2022, Tether held $5.3 billion in cash & bank deposits.

Tether’s latest Q2 2023 attestation report (not a true audit) shows a 98.3% decrease in cash reserves, at $90.8 million. While Tether’s holdings of Treasuries, ON RRPs, and money market funds are liquid, this drastic reduction doesn’t instill the confidence the market needs from a stablecoin company.

Equally concerning, the Fed’s hiking cycle birthed Tether’s current business model. Given that federal interest payments approach the $1 trillion milestone, what happens if the Fed needs to cut rates?

Can Tether Rely on the Strength of Faith?

In a debt-based monetary model, equating US Treasuries with cash is easy. After all, they are both backed by the “full faith and credit” of the US government. Nonetheless, the US is facing tough challenges ahead, per nonpartisan Congressional Budget Office (CBO) forecasts:

Rising budget deficit, at 5.8% of GDP in 2023, is projected to climb to 10% by 2053.

Rising debt, at 98% of GDP in 2023, is projected to climb to 107% in 2029 and 181% by 2053.

Decreased revenue dropped to 18.4% of GDP in 2023, projected to reach 19.1% by 2053.

In addition to these mutually reinforcing headwinds, government spending shows little signs of easing up, projected to go up from the present 24.2% of GDP to 29.1% by 2053.

In other words, Tether’s dedication to US Treasuries as a safe-haven asset, which is highly liquid, may not be as sound in the future.

You can’t blame Tether for this. It’s simply a result of the interconnected nature of macrofinance, where, just as most investing podcasts will explain, the Fed’s interest rate and money management policies dictate the market’s direction. Tether has just taken advantage of an obvious opportunity amid the Fed’s attempt to cool the US economy.

How Can Tether Boost USDT Confidence?

It is inherently risky for Tether to view itself as an ordinary company, one that seeks ever-increasing profits typical for hungry investors. With that mindset, pitfalls await. And even minor pitfalls could dearly cost Tether and the wider crypto market.

As the dollar revolves around trust, Tether’s core business model mirrors it. In turn, if an erosion of faith in the US economy decreases the liquidity of US Treasuries, this would also transfer to Tether’s USDT redemption capacity.

Focusing on its core mission – USDT issuance and redemption – Tether should instead deploy excess reserves into cash. After all, this is the base layer of money. Focusing on its purpose, Tether should strive to have as few hops away from the base layer as possible.

In a way, by going too much outside of those bounds, Tether would repeat the mistakes of the US government in its economy management.