Bank of Japan alters yield curve control program, impacting global bond markets

BOJ’s New Policy Direction

The Bank of Japan (BOJ) announced a significant policy change today, July 28, which is already influencing the global financial markets.

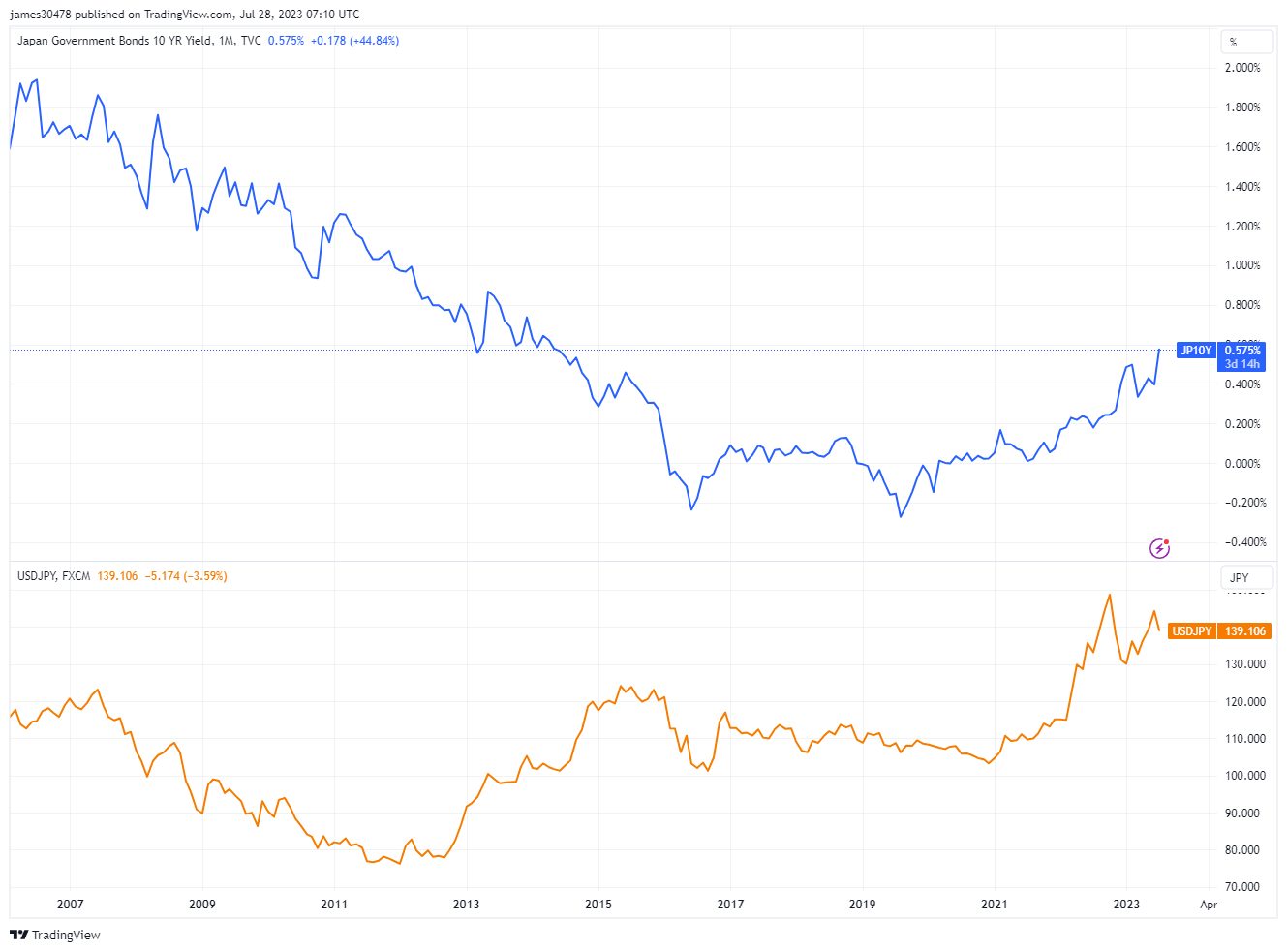

The BOJ has adjusted its yield curve control program, formerly designed to cap the 10-year government bond yield at 0.5%. Analyst Mohamed A. El-Erian commented that the BOJ considered its “0.5% ceiling on yield movements as a reference point rather than a rigid limit”.

In tandem, the BOJ has sustained its policy on short-term interest rates, which have been in negative territory since 2016.

As part of the policy changes, the BOJ is offering to purchase 10-year Japanese government bonds at a rate of 1% on each business day.

Global Implications and US Treasuries

A CryptoSlate market report from June underscores the significant international implications of these changes. Japan is the largest holder of US treasuries, and an increase in Japanese rates could lead to reduced demand for US treasuries. Consequently, US yields could rise.

Indeed, early market responses suggest that this move is already transpiring. The 10-year US treasury yield has breached the 4% threshold, indicating a remarkable shift in the bond market.

Impact on the Domestic Currency

Compounding these global ramifications, the domestic currency situation in Japan is also evolving. Currently, the Japanese Yen is trading at almost 140 against the US dollar. This represents a serious concern for Japan, as a weaker Yen could increase the cost of imports and exacerbate inflation which is already at 35-year highs, thereby putting additional pressure on the economy during a period of significant financial policy changes.

The BOJ’s next moves will be crucial in managing these complex dynamics, with global and domestic observers keenly monitoring the situation.