cyptouser10 months ago309

A recent keynote address by American entrepreneur and early Bitcoin adopter Erik Voorhees has ignite...

Coinbase raises USDC interest rate to 5%

cyptouser11 months ago324

Coinbase is now offering up to a 5% interest rate on any USDC held on the exchange, up from the 4% i...

Coinbase, Circle, Aave, and more partner to launch Tokenized Asset Coalition

cyptouser11 months ago291

The new group, called the Tokenized Asset Coalition, aims to have real-world assets represented and...

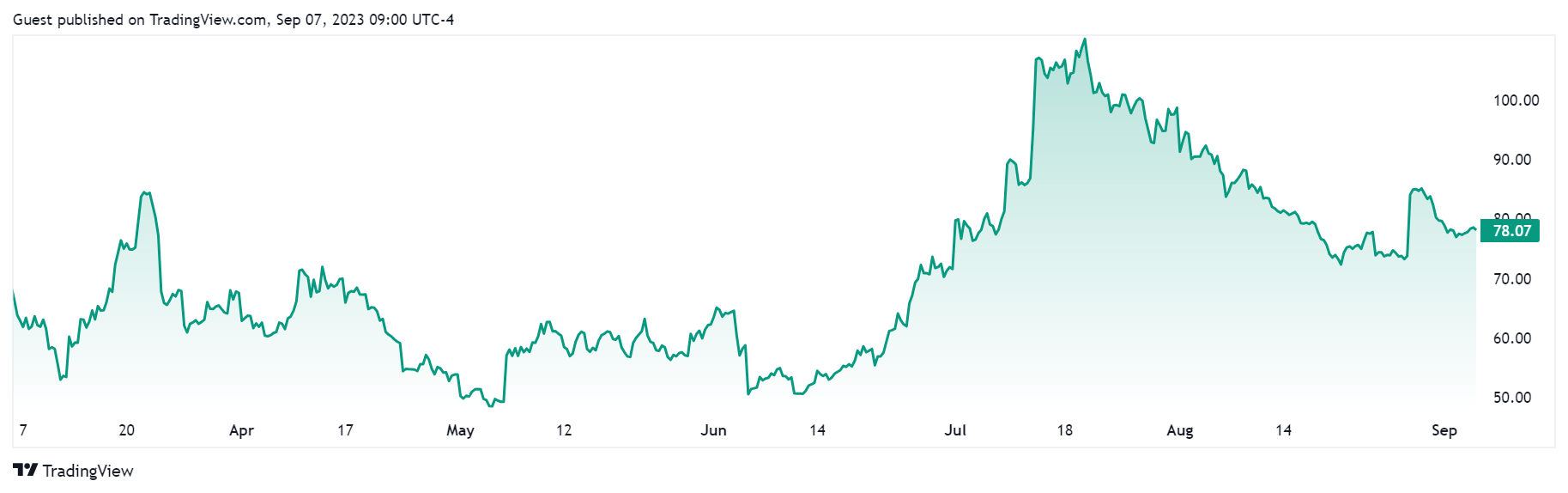

Coinbase insiders dump over $30M stocks amid SEC lawsuit, but share value defies odds

cyptouser11 months ago290

Coinbase top executives have sold more than $30 million worth of the company shares since the U.S. S...

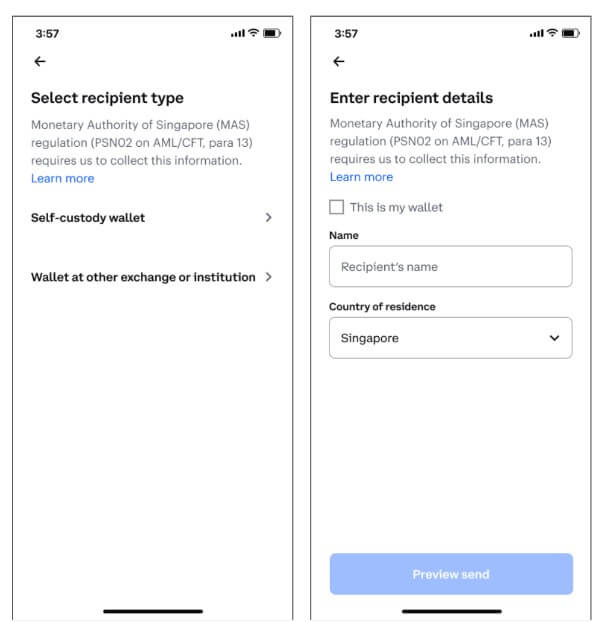

Coinbase Singapore now requires counterparty’s personal information to process transactions

cyptouser11 months ago347

Coinbase Singapore users must provide additional counterparty information when initiating cryptocurr...

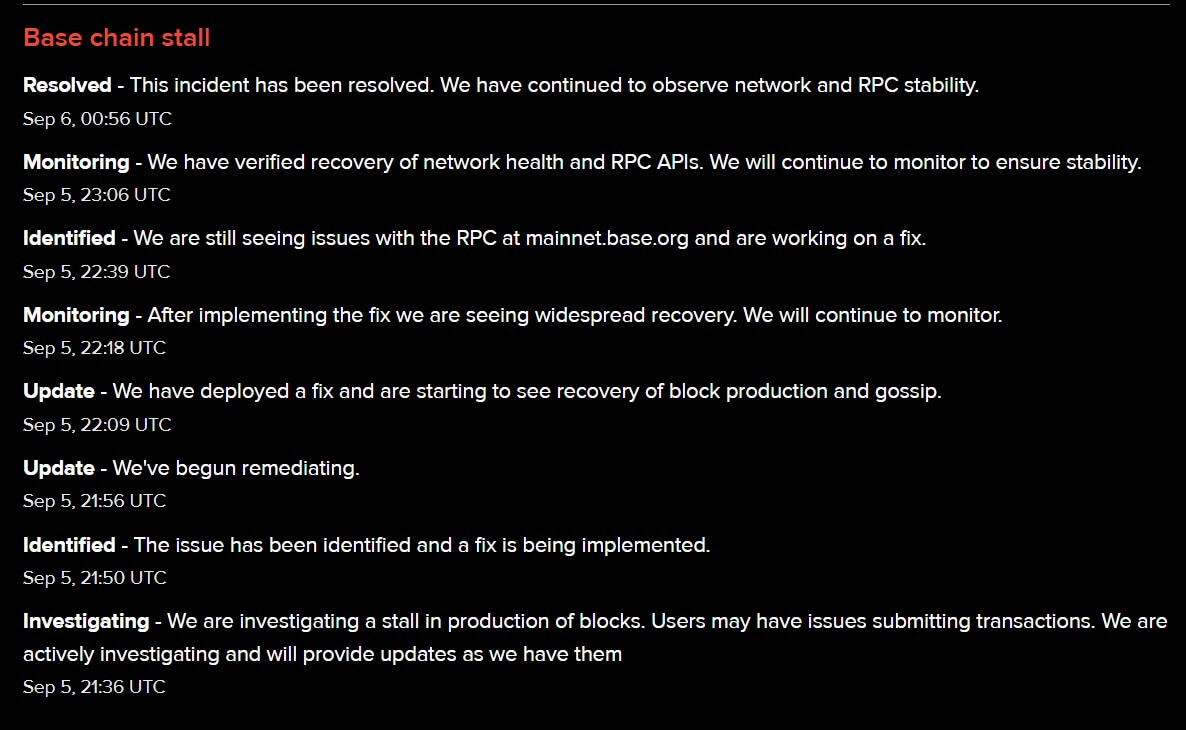

Coinbase-backed Base restores block production after more than 40 minutes outage

cyptouser11 months ago276

Coinbase-backed layer2 network Base suffered a temporary outage that led to a stalled block producti...

Coinbase launches institutional lending service

cyptouser11 months ago303

Coinbase is in the process of creating an institutional lending service, according to regulator...

Coinbase raises bond buyback limit to $180M amid a surge in investor interest

cyptouser11 months ago319

Coinbase increased its bond buyback limit to $180 million and extended its deadline to Sept. 18, acc...

Synapse token, TVL slide following major liquidity provider sell-off

cyptouser11 months ago306

Synapse Labs, the main contributor to the cross-chain bridge Synapse (SYN), confirmed that an unname...

Women hold just 6% of crypto CEO roles highlighting gap in leadership

cyptouser11 months ago295

A new report reveals women are vastly underrepresented in leadership positions across the...