Bitcoin, Solana community calls out Coinbase CEO on crypto payment vision

The vision for a future where crypto payments are instant, accessible, and global has ignited a spirited debate among industry leaders on the path toward achieving this goal.

As reported by Brian Armstrong, CEO of Coinbase, the crypto industry, including Coinbase, focuses on integrating layer 2 solutions, better on-ramps, and simpler user experiences to bring the cost of an average payment under one cent and the confirmation time under one second.

Armstrong asserted, “Payments are like water, they flow to the path of least resistance,” hinting at the competition among various blockchains to become the most attractive option for these transactions.

Coinbase announced its own Ethereum L2 in February, which uses ETH as its native gas token as a “modular, rollup agnostic Superchain powered by Optimism.”

Crypto leaders unite

However, Armstrong seemingly hit some nerves of the Crypto Twitter community, as he also commented,

“The next step for crypto is to make payments instant and free globally.

This will take lots of work from all of us, Coinbase included, getting layer 2’s integrated, better on-ramps, simpler UX/onboarding, etc.

A magic threshold would be getting the average payment under 1 cent and confirmed in under 1 second. I think we’d see orders of magnitude more payments move to crypto if we can achieve that.”

Block CEO Jack Dorsey advocated for Bitcoin and its layer-2 solution, Lightning Network, as a potential solution. He questioned Armstrong’s apparent omission of Bitcoin in his vision for the future of crypto payments.

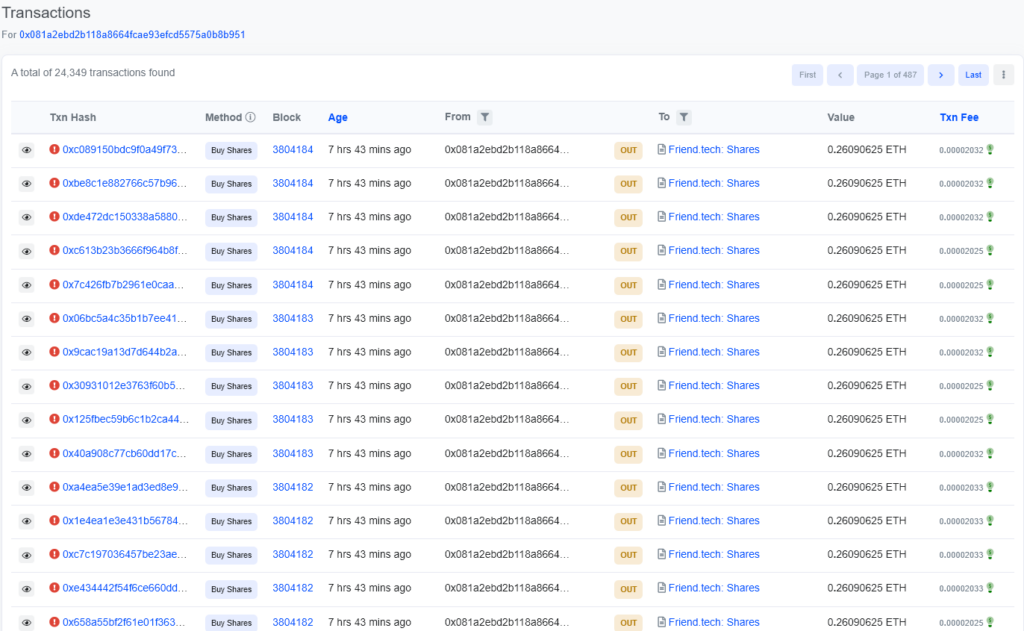

However, disagreement with Dorsey’s perspective came from Anatoly Yakovenko, the founder of Solana Labs. He claimed that USDC on Solana is “cheaper and faster than Bitcoin and Lightning,” arguing that it’s the currency people globally want to use, with a median user confirmation time of just 1.3 seconds.

Other notable figures in the crypto space joined the conversation as Ava Labs Founder Emin Gün Sirer echoed Yakovenko’s sentiment, stating that instant global payments are also already possible with Avalanche with a “sub-second finality, lower fee” structure, and optimizations to make these payments more “composable and dynamic.”

In contrast, Michael Saylor, CEO of MicroStrategy, sided with Dorsey’s perspective, advocating for integrating Bitcoin’s Lightning Network. At the same time, Mike Dudas, Co-Founder of The Block, pointed out that Armstrong’s Coinbase runs the largest validator on Solana, where fast, affordable transactions are already possible, subtly indicating a potential conflict of interest.

The conversation, which continued within Armstrong’s thread, reveals an industry still grappling with the best path for advancing the global adoption of crypto payments. The bridge between technology and adoption remains unbuilt as the network effect of Ethereum seemingly stands in the way of the technological advancements on other chains.

Meanwhile, the competing claims of pivotal founders in the space present a landscape of dynamic and evolving options, striving to hit the sweet spot of speed, cost-effectiveness, and global acceptance for digital assets.