Euro Area increases interest rates to a high of 4.25%

Quick Take

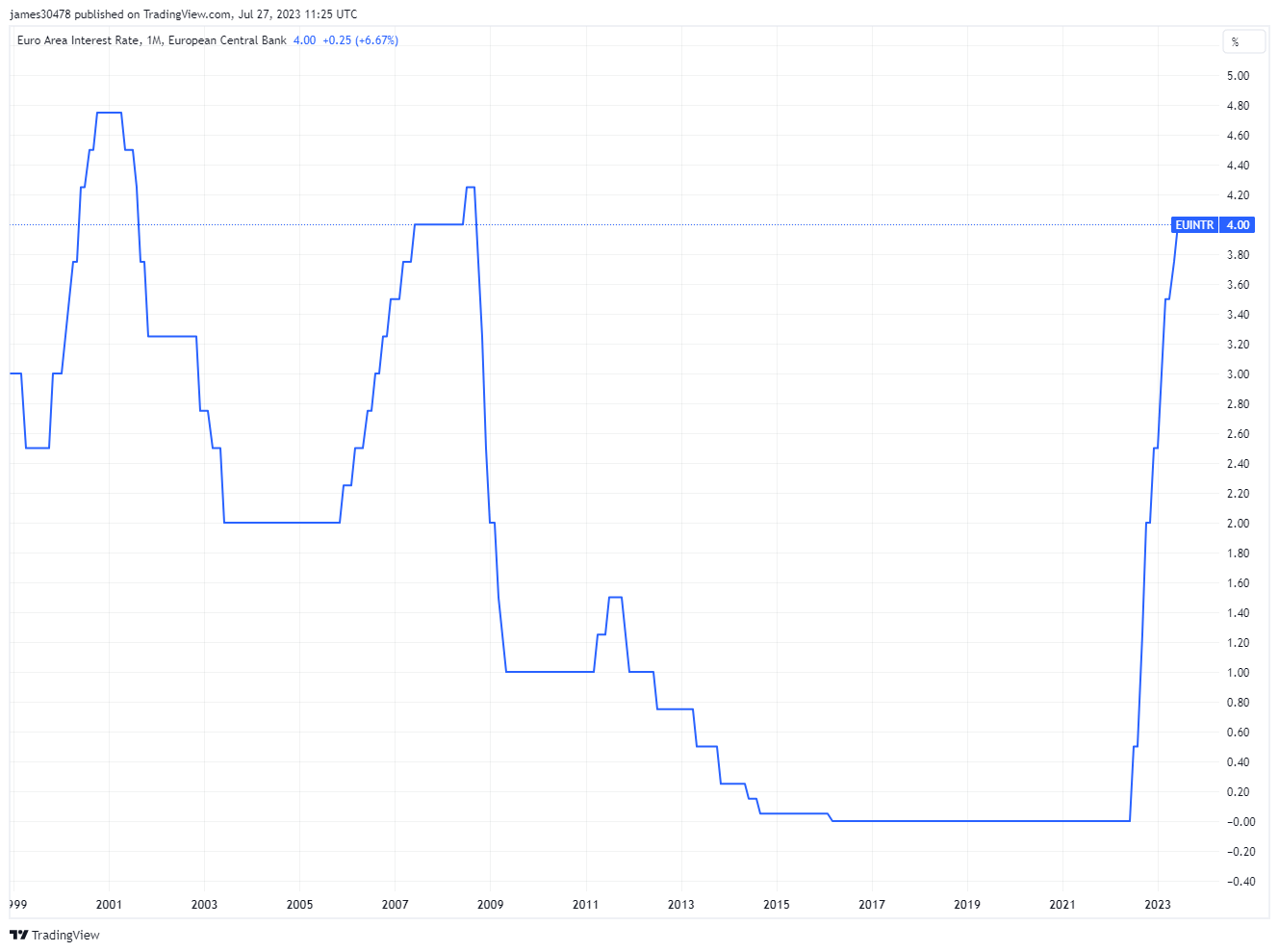

The Euro Area has taken an assertive step towards controlling inflation, augmenting its rates by an additional 25 basis points (bps). This progression propels the current rate hiking cycle to an impressive 4.25%. Marking a notable surge, this level represents the highest rate observed since 2008.

Moreover, this significant interest rate adjustment follows nearly a decade of negative interest rates, underlining the magnitude of this financial policy change.

On the inflation front, the Euro Area is experiencing an annual inflation rate of 5.5%. Although this figure might seem high, it’s important to bear in mind the preceding era of negative interest rates that have shaped the financial climate for nearly ten years.