Bitcoin futures show renewed confidence amidst price surge

Earlier this week, Bitcoin broke above the $27,000 barrier on the news about Grayscale’s court victory against the SEC.

The decision marks a pivotal win for Grayscale and carries profound ramifications for upcoming spot Bitcoin ETF applications. As highlighted by CryptoSlate earlier, the court’s verdict on this case might influence the outcome of several spot Bitcoin ETF applications submitted earlier in the year.

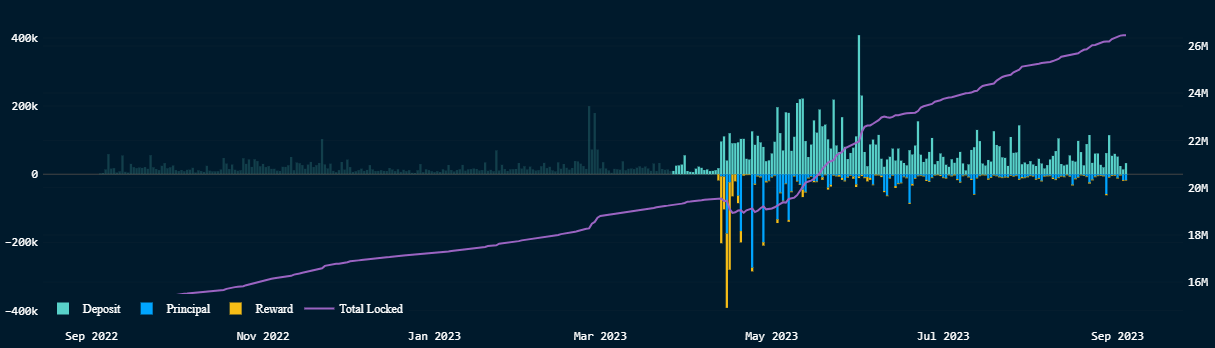

Grayscale’s victory also seems to have bolstered the confidence of Bitcoin traders. This renewed confidence is seen in the futures market, where on-chain indicators have shown a notable uptick in leverage.

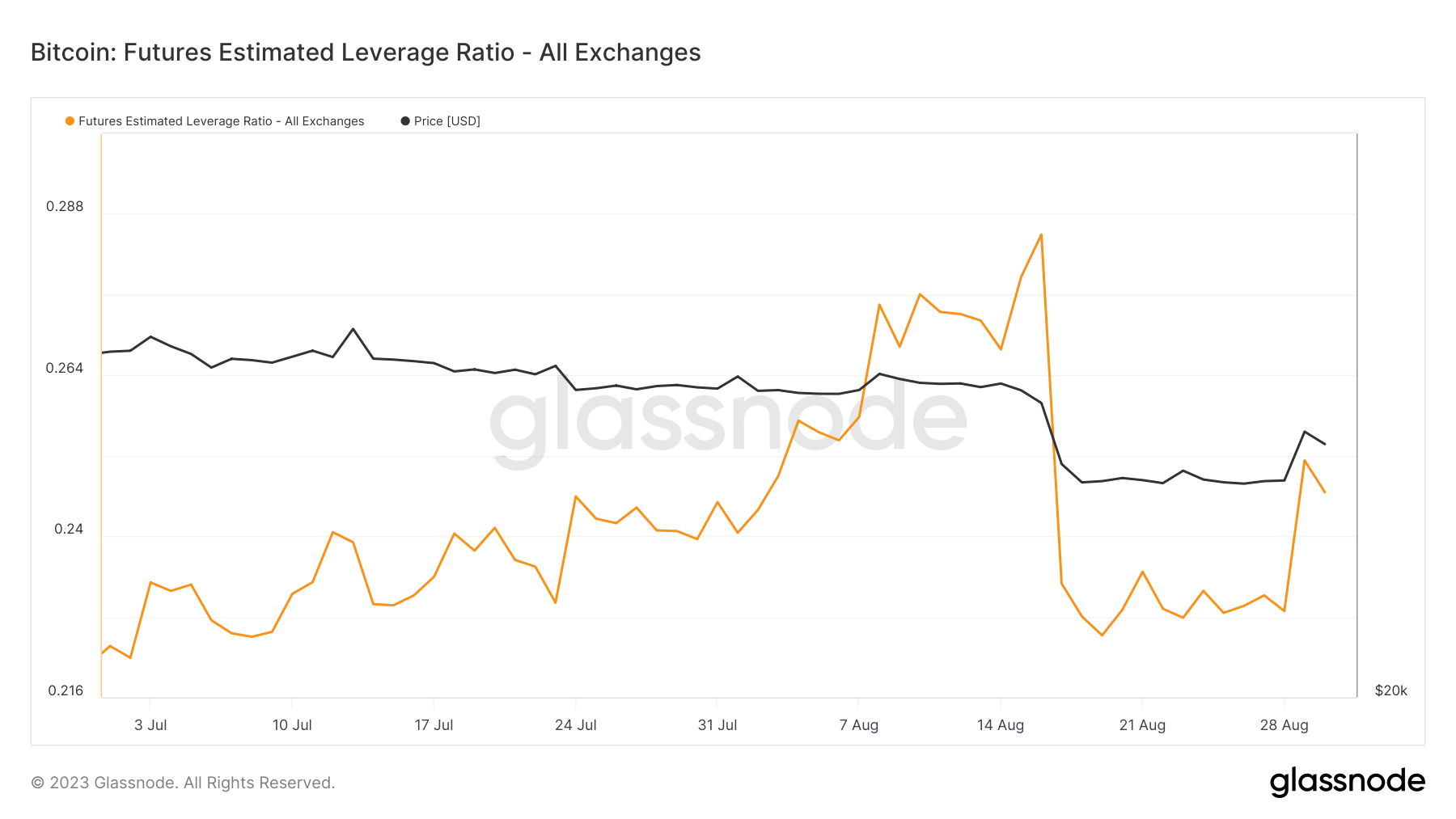

The Estimated Leverage Ratio (ELR) is a crucial metric that offers insights into the level of risk traders are willing to assume. It represents the ratio of the open interest in Bitcoin futures contracts to the Bitcoin balance of the corresponding exchange. A rising ELR suggests that traders leverage their positions more, indicating an increased appetite for risk.

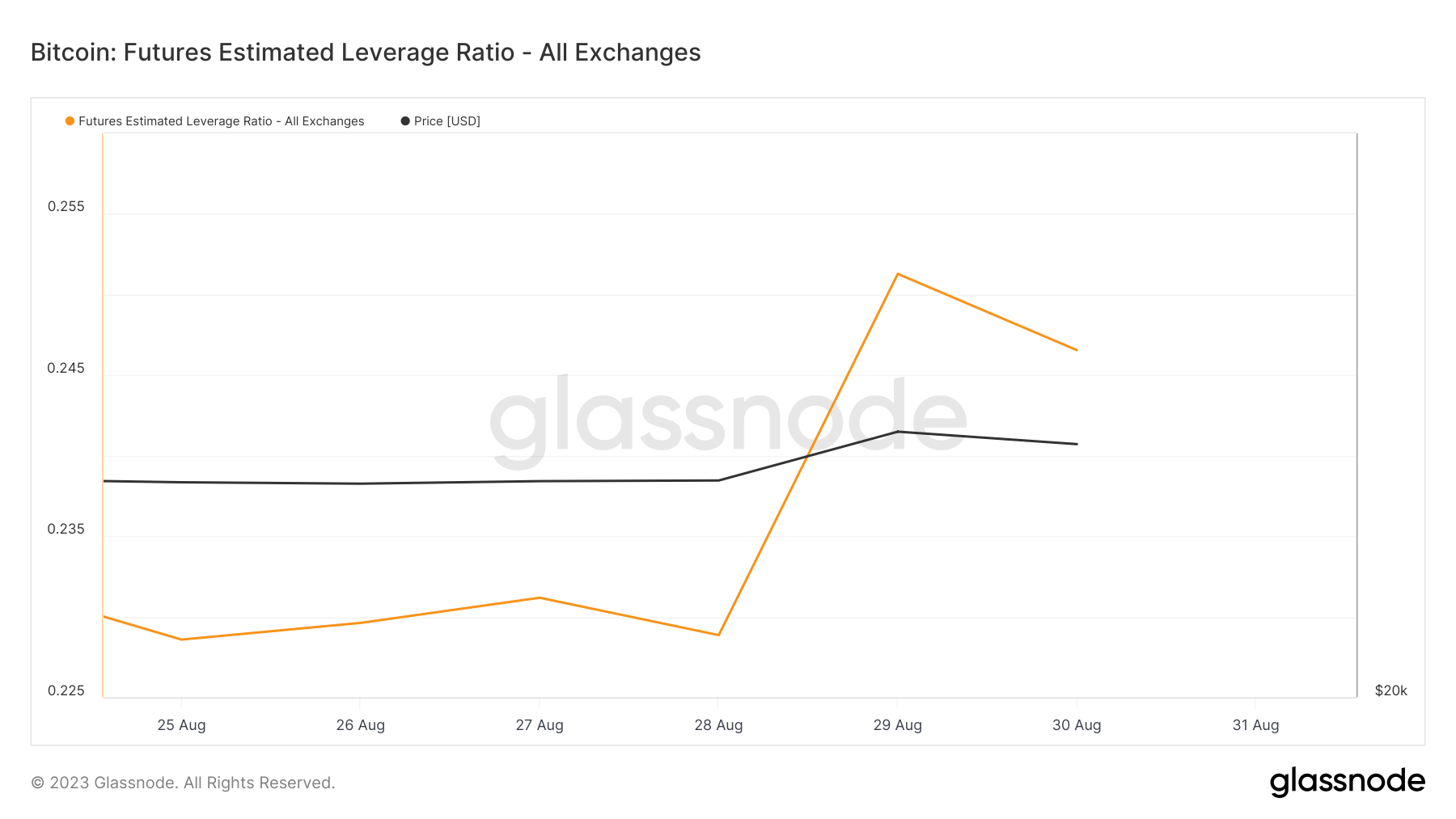

The Estimated Leverage Ratio (ELR) experienced a jump from 0.22 to 0.25 on Aug. 30, following Bitcoin’s jump from $26,100 to $27,700.

On one hand, the rise in ELR underscores that traders are increasingly bullish. For every Bitcoin stored in an exchange, there’s a corresponding uptick in the futures contracts being traded. This trend suggests that traders, carried by positive market sentiment, are willing to assume greater risks in anticipation of favorable returns.

However, a broader perspective reveals another narrative. The current ELR mirrors the levels observed at the beginning of August. In mid-August, the market witnessed a significant dip in the ELR, plummeting from 0.28 to 0.22. This decline happened in tandem with Bitcoin’s price drop, which slid from $29,000 to $27,000.

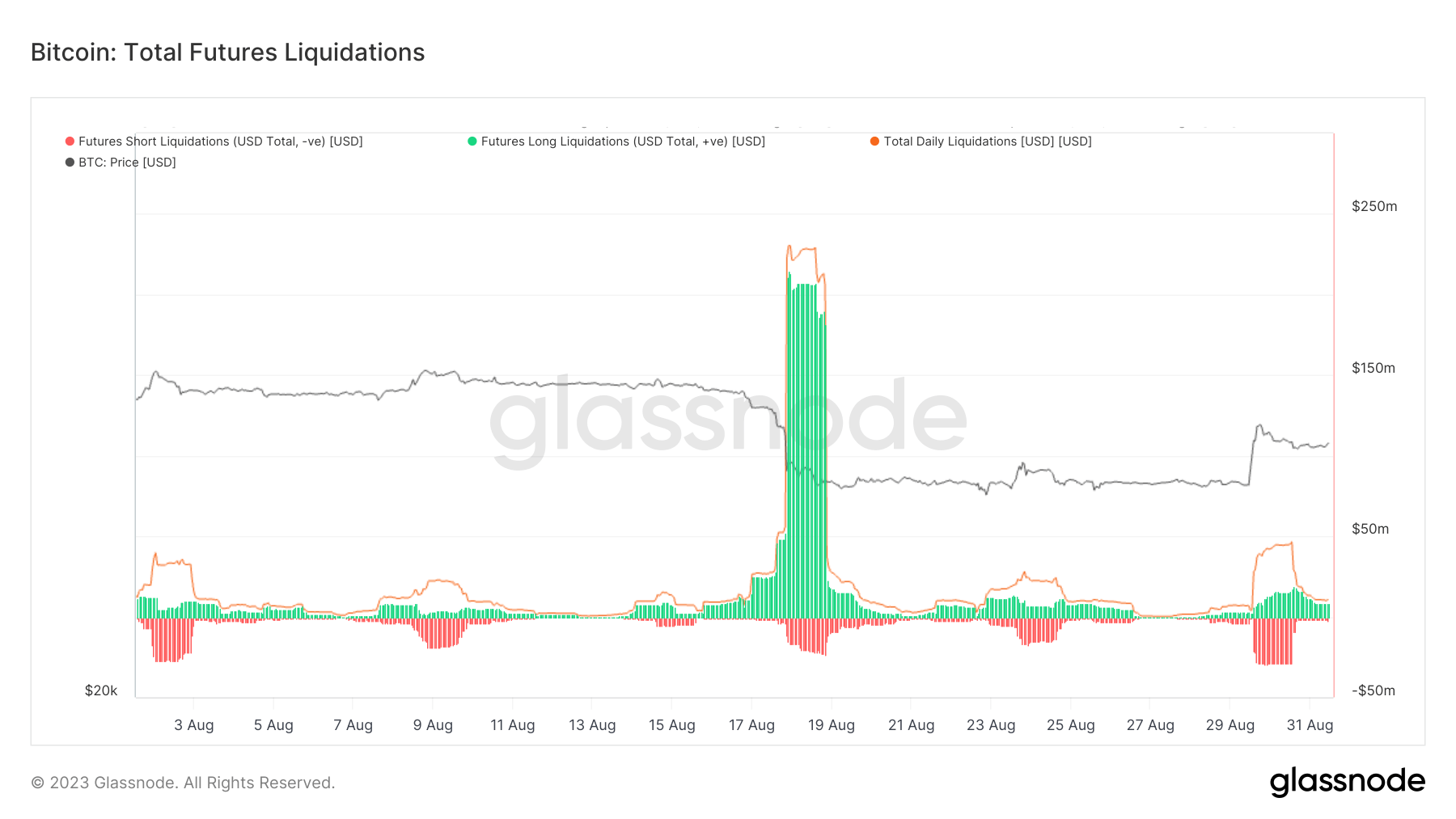

However, the current ELR levels hint at a market risk profile reminiscent of early August. This means the market remains vulnerable to sharp price oscillations, much like the ones observed earlier in the month. It’s essential to remember that BiBitcoin’sescent below $28,000 in mid-August triggered a cascade of liquidations. These forced closures of leveraged positions introduced additional volatility to an already tumultuous market.

While Bitcoin’s recent price surge and the corresponding rise in ELR indicate a bullish sentiment among traders, the market should remain cautious. The market’s current risk profile, mirroring early August, could still experience significant volatility.