DeFi Bubble bursts for Friend.tech as key metrics tumble by over 90%

After a blistering start to life that saw it generate much hype and interest from the cryptocurrency community, top metrics of the decentralized social media platform Friend.tech have significantly dropped within the past week.

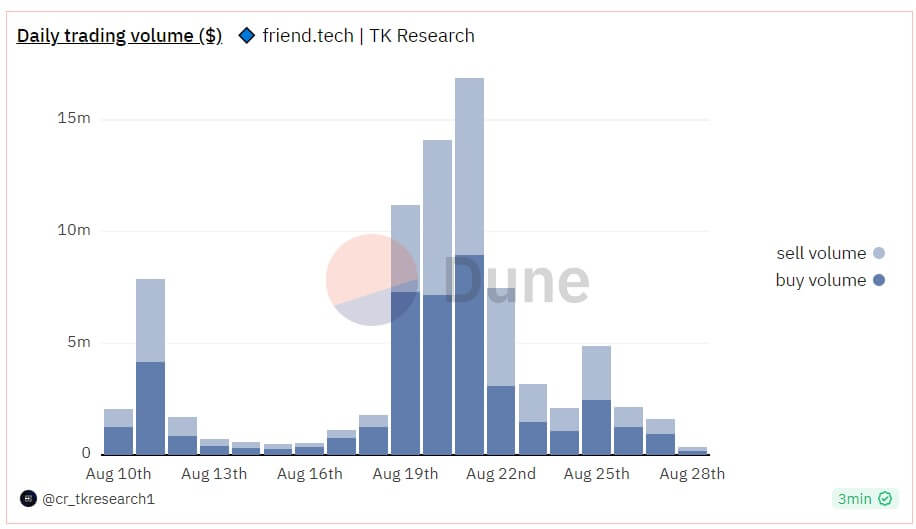

Trading volume is down 94%

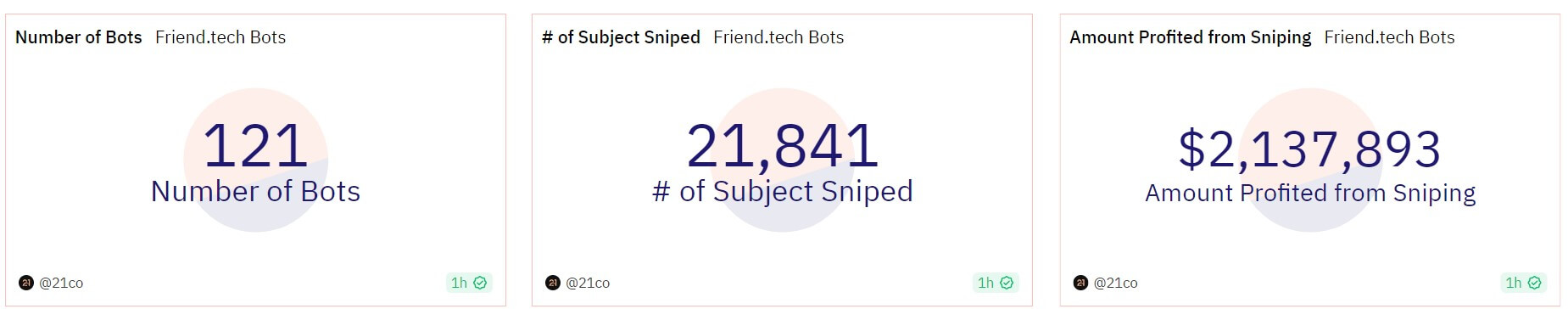

CryptoSlate, using Dune Analytics data compiled by TK Research, saw that trading volume on the platform declined to $1.6 million on Aug. 27, representing a 95% decline from its $16.87 million peak recorded on Aug. 21. Additionally, the number of transactions on the platform has also fallen by more than 90%, to 51,000 by Aug. 27 during the same period.

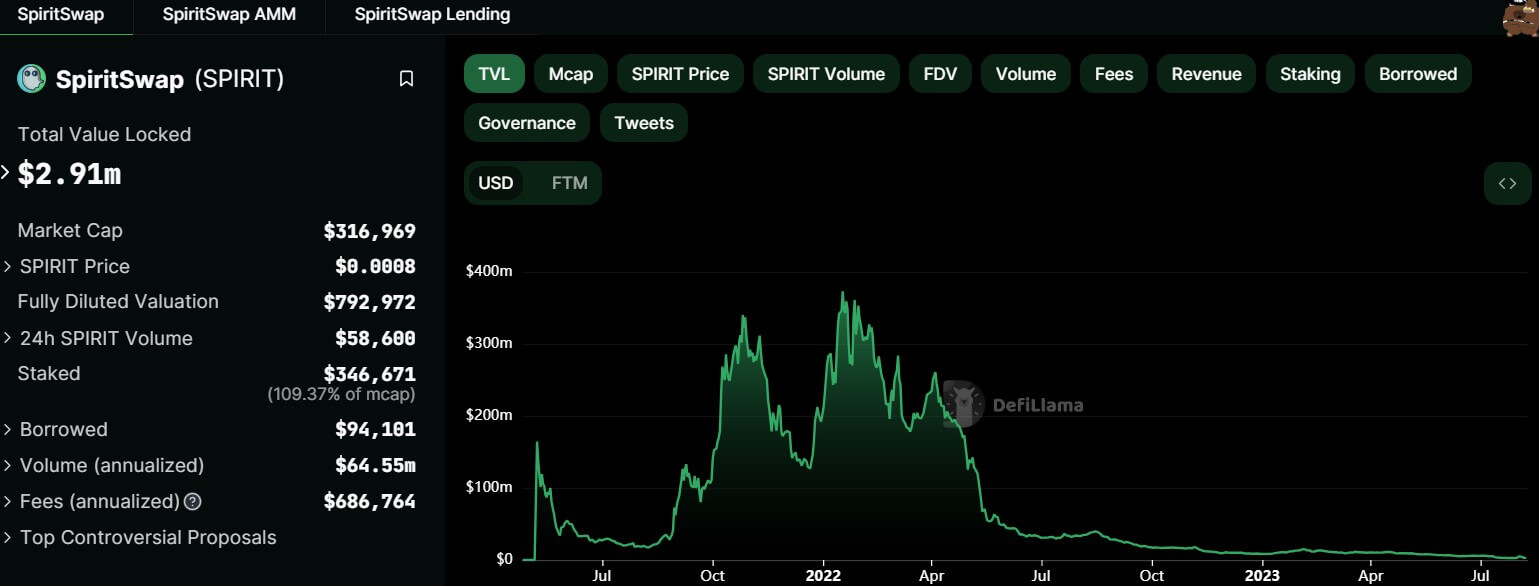

The fallen transaction volume has also significantly impacted the application’s revenue on the network. CryptoSlate previously reported that Friend.tech was one of the crypto industry’s top 5 fee generators, raking in as much as $843,761 on Aug. 21. However, that figure has dropped to $80,558 as of press time, according to DeFillama data.

Ghost of BitClout?

The recent challenges faced by Friend.tech have resurfaced memories of BitClout, a blockchain-based social media platform that experienced a surge in popularity but ultimately struggled to maintain its momentum.

Notably, Alex Valaitis, a former BitClout employee, said the hype surrounding Friend.tech was unsustainable due to its perceived lack of innovation and what he claimed was a heavy reliance on Bitclout’s concept, suggesting that 90% of its ideas were borrowed from Bitclout.

Valaitis elaborated on several reasons he believed would contribute to Friend. tech’s eventual downfall, sharing these insights during the height of the decentralized social media application trend.

Short-lived crypto projects

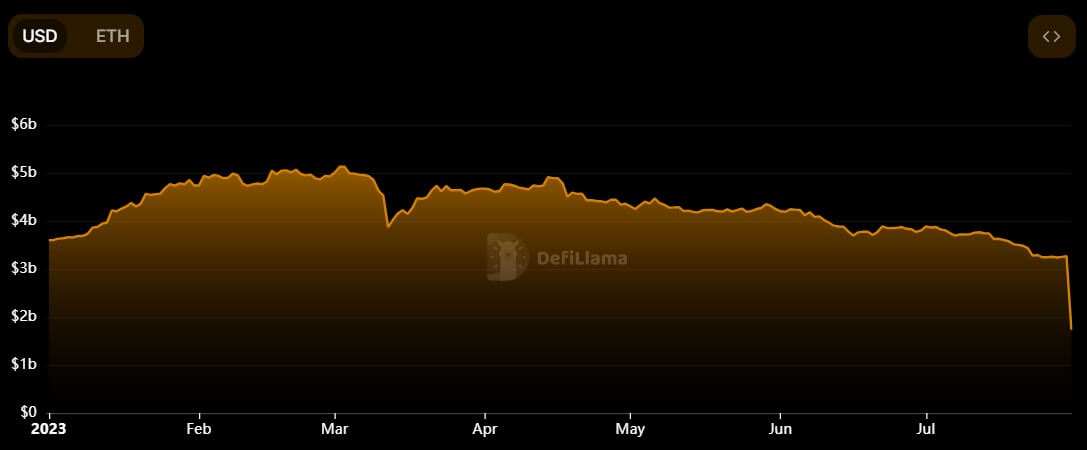

Friend. tech’s recent decline underscores the fleeting nature of many trending crypto projects in recent months. Several of these projects have experienced weeks, sometimes even months, in the limelight during the year before ultimately crashing without signs of revival.

One notable example is BALD, a memecoin built on the Base platform, which astonishingly saw its market capitalization surge to over $80 million within a mere 24-hour period. Unfortunately, this meteoric rise was abruptly halted when the developer executed a rug pull, causing the project’s momentum to evaporate.

Similar narratives have unfolded with projects like PEPE, MiLady, and several others, where they enjoyed brief spells of success but ultimately failed to establish the long-term sustainability necessary for survival in the crypto space.