Regulatory-compliant US Treasury tokens on the rise as DUST launches on Singapore DEX DigiFT

Decentralized exchange (DEX) DigiFT has launched a regulatory-compliant tokenized version of the U.S. Treasury known as DUST, according to an Aug. 10 press statement.

The Singapore-licensed crypto platform stated that the token was backed by a single U.S. Treasury note with a maturity date of Dec. 31. This offers accredited and institutional investors a chance to invest in U.S. treasuries via an on-chain channel.

DigiFT CEO Henry Zhang said the product would bring investors the best of decentralized finance and traditional yield. He added:

“DUST will enable us to broaden pathways for investors to explore tokenised real-world assets (“RWAs”) on-chain with full transparency, backed by institutional grade risk management mechanisms.”

Investors can access U.S. Treasuries via DUST using either fiat currency or stablecoins. With a modest minimum investment of 1 USDC/USD, the product extends investment opportunities to people in different financial classes.

Meanwhile, DigiFT said DUST provides same-day settlement for investments below $50,000, subject to liquidity.

The tokenized treasuries and bonds market has grown substantially, with the total value of assets locked in the sector at more than $650 million, according to rwa data. Some popular protocols in the space include Backed, Maple, Ondo, etc.

Maple Finance introduces on-chain Treasury pools

Meanwhile, another on-chain marketplace for institutional investors, Maple Finance (MAP), recently obtained exemption from the Securities and Exchange Commission (SEC) to offer its one-month U.S. Treasury yields in the country.

Maple wrote:

“The structure provides Lenders with the most direct access to U.S. Treasury Bill rates on-chain, recourse to Treasury Bill collateral without ETF liquidity or depeg risks.”

With the exemption, U.S.-based investors can access Maple Finance Treasury pools previously only available to foreign investors.

SEC was able to grant the exemption under its Regulation D Rule 506(c) Exemption. The regulator’s website state that the exemptions allow a company to broadly solicit and advertise an offering to accredited investors.

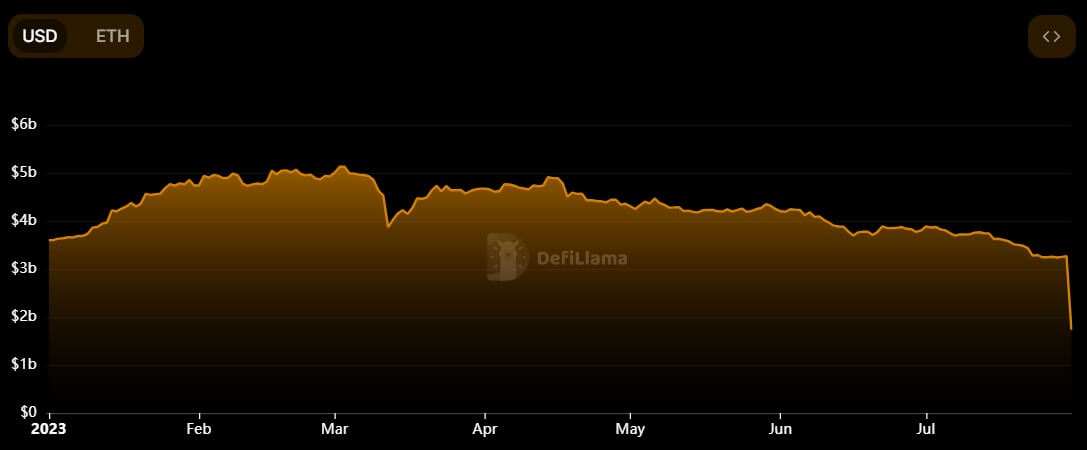

Data from Maple Finance showed that the 30-day annual percentage yield (APY) for the pool is 4.77%. The outstanding loan value is 21.7 million USDC, while over 193 million USDC in loans have been originated.