Vitalik Buterin stirs market uncertainty with $1M Ethereum transfer to Coinbase

According to on-chain data, a wallet associated with Ethereum (ETH) co-founder Vitalik Buterin sent 600 Ether worth roughly $1 million to Coinbase earlier today.

The motive behind the transaction remains speculative as of press time. Usually, transfers to exchange are translated to mean an intention to sell. With Ethereum’s price recently struggling, Buterin’s transaction could further exert more selling pressure on the digital asset.

Meanwhile, on-chain sleuth Lookonchain reported that Vitalik.eth wallet repaid 251,000 RAI on DeFi platform Maker and withdrew 1,000 ETH (around $1.67 million) on Aug. 20.

The wallet known as “vitalik.eth” was created seven years ago and contained 3,993 ETH, worth $6.5 million as of press time. CryptoSlate, using the Arkham Intelligence dashboard, confirmed that the wallet belonged to the Ethereum co-founder. Other digital assets in the wallet include $84,000 worth of USD Coin (USDC) and $58,000 worth of Wrapped Ethereum (WETH).

This is not the first time Buterin would transfer assets to a crypto exchange. Earlier in the year, the Ethereum co-founder sent 200 ETH to Kraken in March. Around the same period, Buterin dumped several unsolicited altcoins (sh*tcoins) for 439.25 ETH.

ETH price struggling

Buterin’s transaction is coming on the heels of last Thursday’s crypto market flash crash. Last week, ETH’s price fell below $1700 for the first time since June and continued to trade under the mark as of press time.

According to CryptoSlate’s data, ETH traded at $1667 at the time of writing after a slight decline of 0.18% in the last 24 hours.

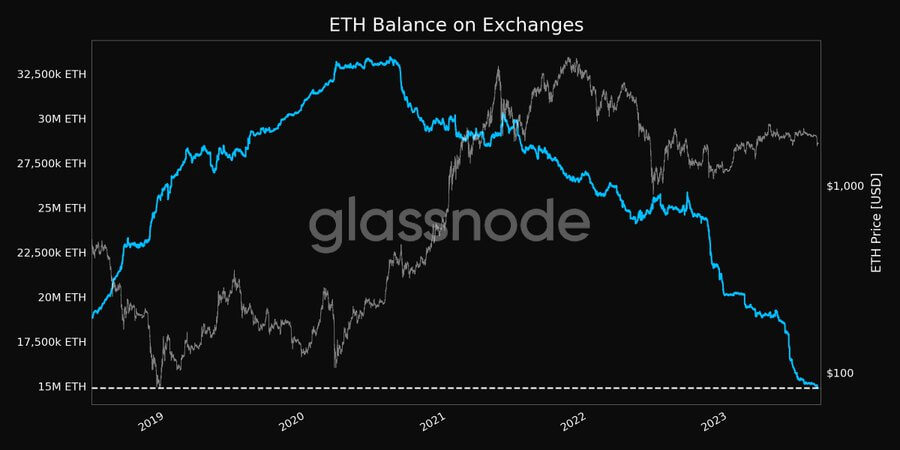

However, data from blockchain analytical firm Glassnode shows that Ethereum holders are jealously guarding their holdings as they rapidly send their assets off crypto exchanges. According to the data aggregator, the amount of ETH held on exchanges is 14.88 million, a level not recorded since 2018.

Exchange outflows usually suggest a bullish sign that the asset is being held for its long-term benefit. Going by this, it means ETH holders are less concerned about its recent poor price performance.