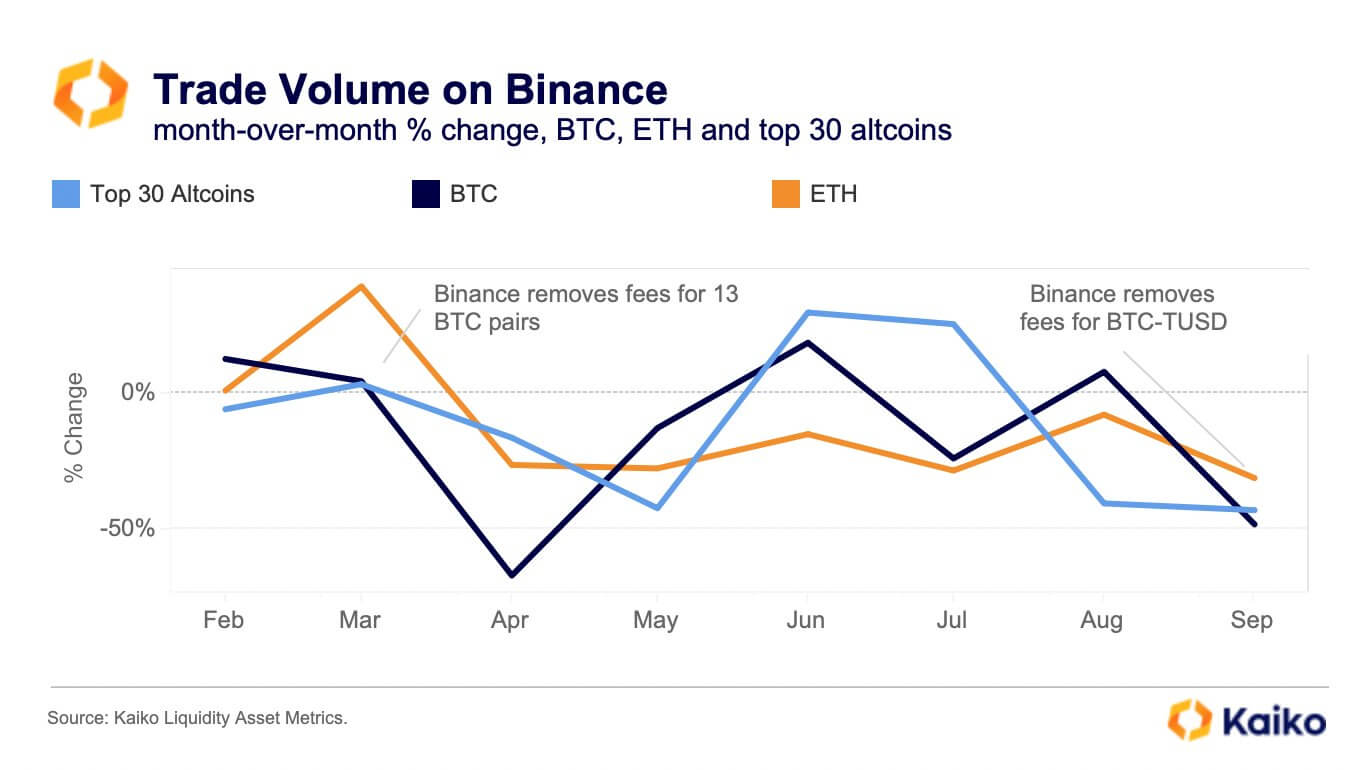

Binance's Bitcoin trading volume falls amid reintroduced fees and swelling regulatory woes

Binance’s Bitcoin trading volume took a significant hit this month, falling 48% after the exchange reintroduced fees for its most liquid BTC trading pairs.

In a Sept. 29 post on X (formerly Twitter), Kaiko research analyst Dessislava Ianeva pointed out that the recorded fall is the second-largest monthly decline since April, adding that “both drops coincided with the removal of zero fees for the largest BTC trading pairs.”

In April, the exchange’s users left the platform after it canceled the trading incentives attached to its Binance USD (BUSD) due to the regulatory challenges facing the stablecoin. At the time, the exchange’s trading volume fell by nearly 70% during the second quarter.

A similar situation occurred this month after the exchange abandoned the zero-trading fee incentives for its TrueUSD (TUSD) and BTC trading pair, resulting in the migration of traders to other platforms.

Binance’s regulatory struggles

While the removal of the free trading incentives has played a part in Binance’s falling volume, the exchange has faced increased regulatory troubles across various jurisdictions, including the U.S. and Europe, which has negatively impacted its overall market share.

In the United States, financial regulators, including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), have brought legal action against it due to its failure to comply with local laws. Additionally, there are reports that the exchange and its CEO, Changpeng Zhao, are under investigation by the U.S. Department of Justice (DOJ).

On the other side of the Atlantic, the platform has had to voluntarily withdraw its license applications from some countries, such as Germany, while it has been outrightly denied in some places.

Amid these issues, the exchange has had to deal with the recent exits of several top executives, including Binance U.S. CEO Brian Shroder, General Counsel Han Ng, Chief Strategy Officer Patrick Hillmann, and SVP for Compliance Steven Christie, among others.

However, Binance co-founder He Yi has tried to downplay all these incidences, saying the exchange faced even more challenging situations in 2019 but emerged out of them stronger. She said the firm “will win this time as well.”