Crypto outflows on the rise as investors bet against Bitcoin

Cryptocurrency markets are seeing a resurgence of bearish sentiment, marked by four consecutive weeks of outflows from digital asset investment products, accompanied by a notable increase in investor interest in short Bitcoin positions.

In its weekly report, CoinShares disclosed that cryptocurrency investment products experienced outflows of $59 million over the past week. This adds up to $294 million in outflows over the last four weeks, equating to 0.9% of the sector’s total assets under management (AUM).

On the other hand, investors piled heavily into the short-Bitcoin (BTC) investment products. Per CoinShares, these products saw their single most significant inflow since March, with inflows worth $15 million.

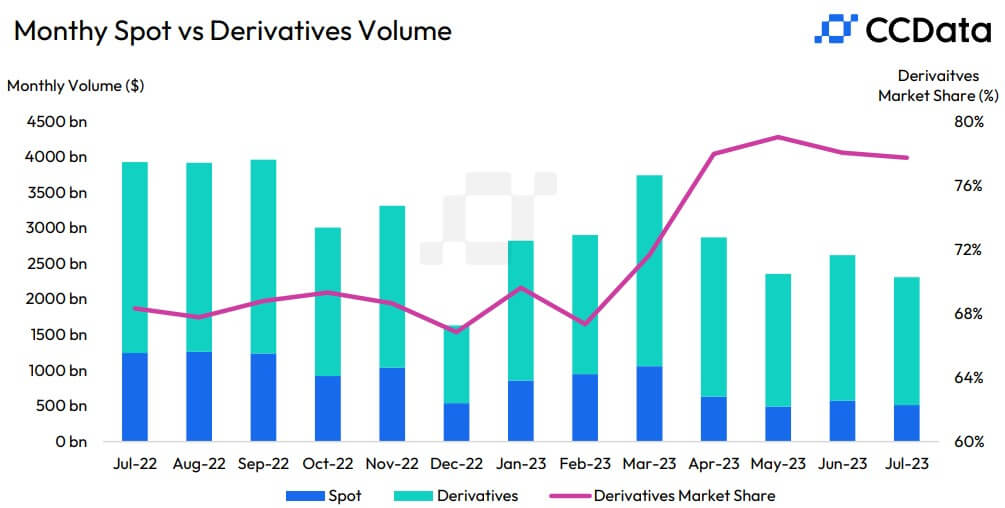

The negative sentiments become more pronounced when considering the trading volume of crypto investment products. According to the data, trading volumes dropped significantly by 73% to just $754 million from the $2.8 billion recorded in the prior week.

Speaking on this trend, CoinShares analyst James Butterfill said:

“Inflows [into] the short investment products suggests that sentiment remains poor for the asset class. We believe continued worries over regulation of the asset class and recent dollar strength are the most likely reasons for this.”

Bitcoin leads outflows

Per the report, Bitcoin took the most hit with outflows worth $69 million last week, bringing its month-to-date flows to $72.4 million.

BTC investment products have been experiencing a bearish streak since the U.S. Securities and Exchange Commission (SEC) delayed its decision on the avalanche of spot BTC exchange-traded fund (ETF) applications before it. While Grayscale scored a pivotal victory that renewed hope of an SEC approval, investors have mainly remained cautious.

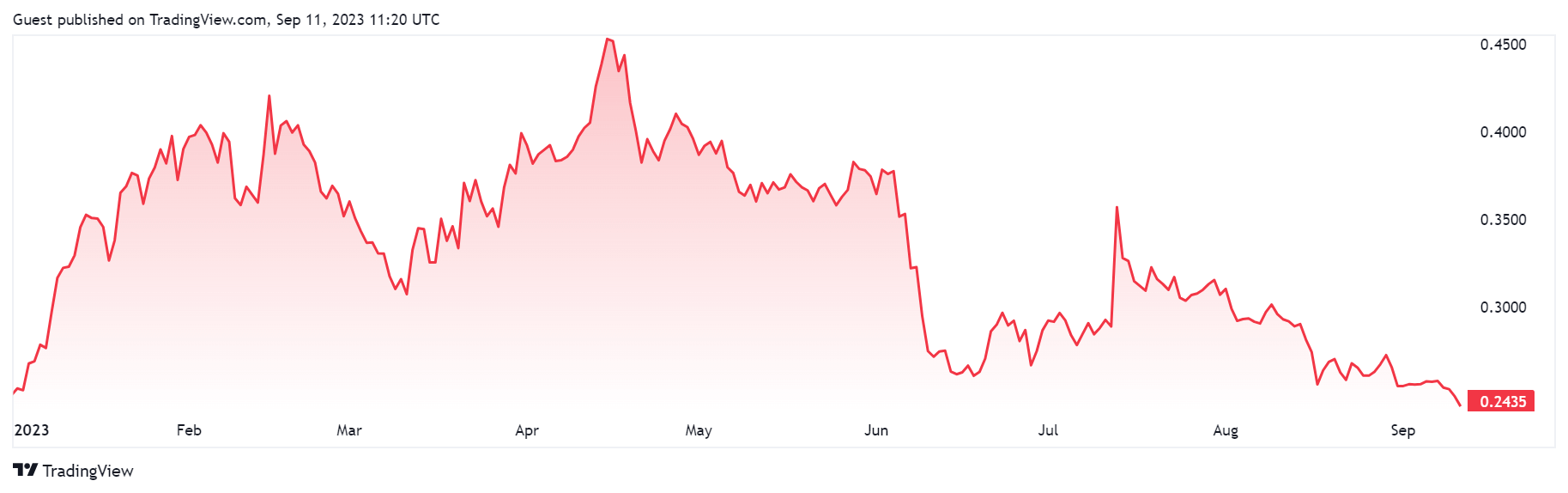

Meanwhile, other assets like Ethereum (ETH) and Solana (SOL) recorded outflows of $4.8 million and $1.1 million, respectively.

This outflow brings ETH’s flows to a negative of $108m, representing 1.6% of Assets Under Management. CoinShares stated that this flow trend shows that ETH is the “least loved digital asset amongst ETP investors this year.”

On the other hand, altcoins like XRP continue to record inflows, with last week’s flow reaching $700,000.

Across countries, Germany took the most hit while Canada and the United States followed closely. Germany recorded $20 million in outflows, while Canada and the United States saw $17.6m and $12.3 million, respectively.