Ethereum futures ETFs launch to tepid demand; Bitcoin and Solana remain favored investment products

Ethereum (ETH) investment products struggled to record notable inflow despite the recent launch of several Ether futures-based exchange-traded funds (ETF) last week.

According to CoinShares’ latest weekly report, these ETFs’ attraction of a meager sum of $10 million underscores the “tepid appetite” for Ethereum among investors. It continued that when a similar futures ETF launched for Bitcoin last year, the product saw up to $1 billion in investments during the first week of its operations.

However, CoinShares’ senior analyst James Butterfill noted that the performance of the Ether-based ETFs could also be tied to the overall “poor investor appetite for digital assets at present.”

Last week, several futures-based Ethereum ETFs from different asset managers like Valkyrie, VanEck, ProShares, Bitwise, Kelly, and VolShares launched in the U.S. CryptoSlate reported that these ETFs saw around $2 million in trading volume during the first day of their launch.

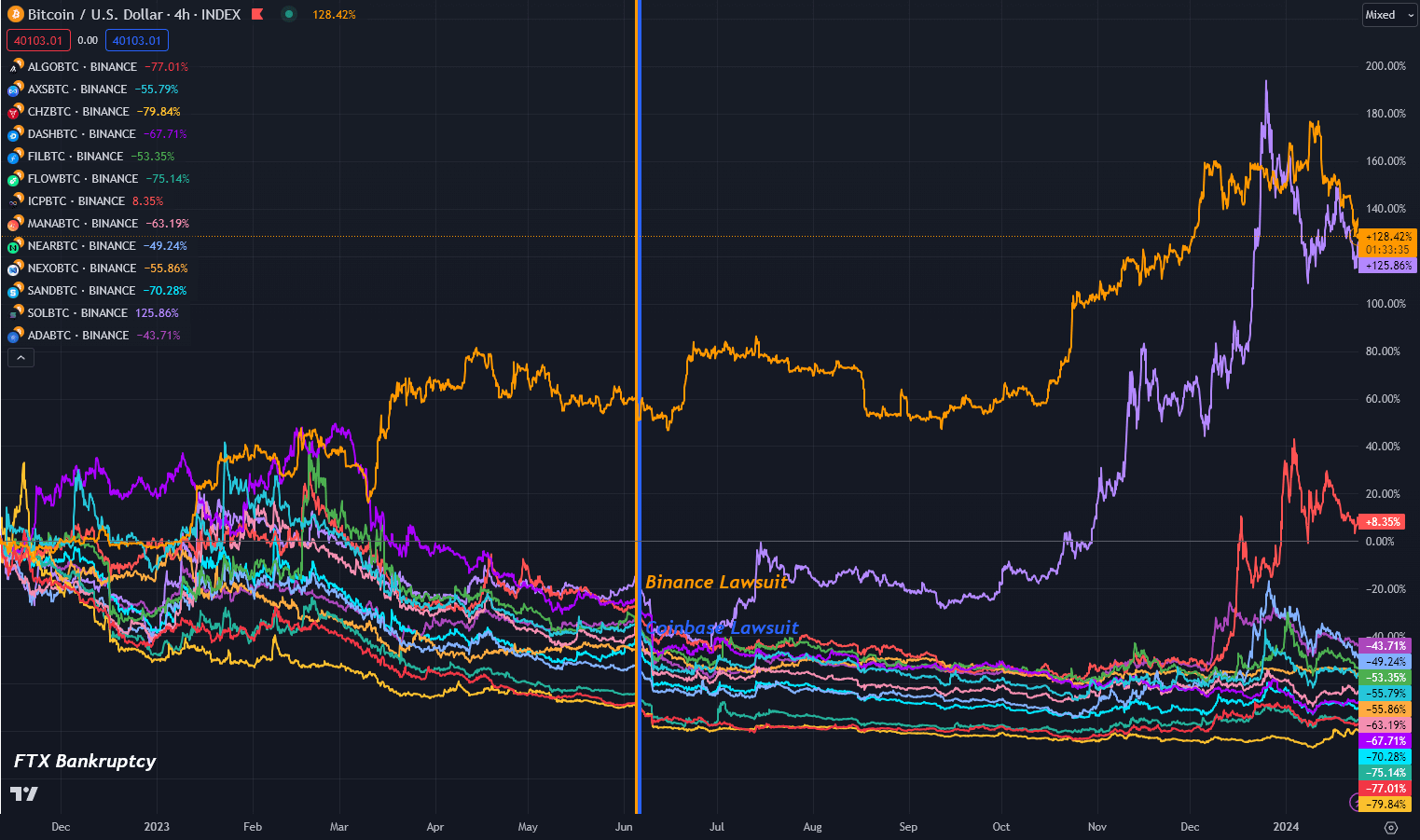

Bitcoin, Solana continues dominance

Meanwhile, Bitcoin (BTC) and Solana (SOL) investment products continued their dominant trend as digital assets investment products recorded inflows of $78 million last week. During this period, ETPs’ trading volumes rose by 37% to $1.13 billion.

According to Coinshares, BTC products saw inflows totaling $43 million, with the asset’s current positive price performance enticing some investors to add $1.2 million to their short-bitcoin positions. Additionally, the top cryptocurrency trading volume on trusted exchanges jumped by 16%.

Over the past week, BTC’s price peaked at $28,410 and has continued to trade near the $28,000 benchmark.

On the other hand, Solana recorded its largest weekly inflow of $24 million since last year’s March and has continued to “assert itself as [investors’] altcoin of choice” despite the recent launch of Ethereum ETFs.

Across regions, CoinShares highlighted that investors from Europe continue to dominate as they contributed to 90% of inflows. Meanwhile, investors in Canada and the U.S. remain largely cautious, though they contributed $9 million to the inflows recorded during the previous week.