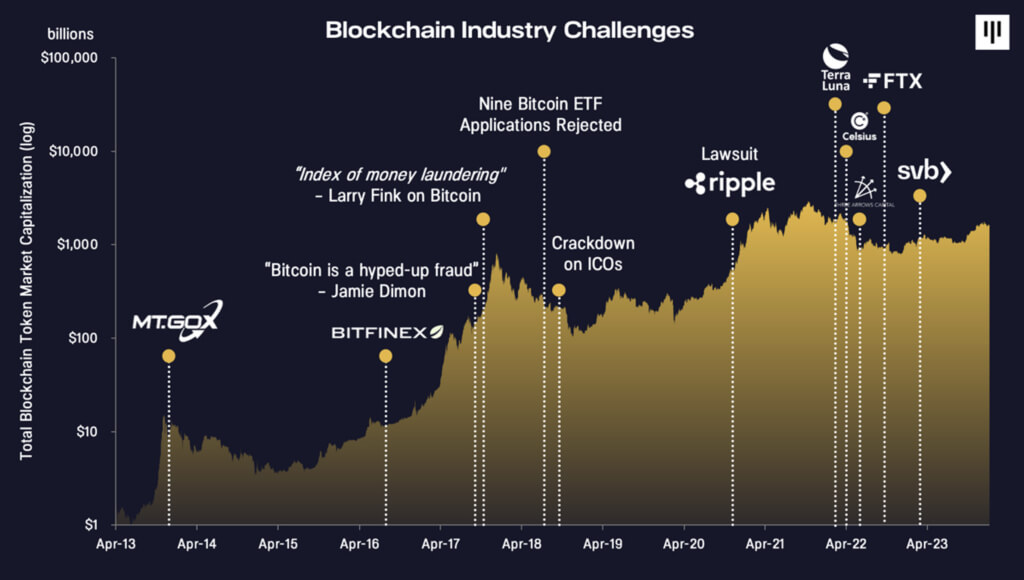

Inflows into digital assets rise 340% week-on-week in anticipation of US spot Bitcoin ETF - report

Digital asset investment products saw their fourth consecutive week of inflows, totaling $66 million, according to CoinShares’s latest weekly report.

In contrast, last week saw inflows of $15 million, indicating a 340% increase week-on-week.

Continued interest in digital assets amid the anticipation of a spot Bitcoin ETF launch in the U.S. However, CoinShares James Butterfill suggests the excitement appears to be tempered with caution compared to earlier periods of high inflows.

According to the report, the recent inflows into digital assets, although significant, are relatively low compared to the flurry of activity following Blackrock’s announcement in June. That period saw four consecutive weeks of inflows totaling $807 million, demonstrating a more robust investor response. Butterfill argues that investors’ cautious approach, despite the upbeat news from the Grayscale vs. SEC court ruling, suggests the market’s maturation and increasing investor sophistication.

The report further detailed that Bitcoin investment products attracted 84% of the inflows, pushing the year-to-date total to $315 million. Interestingly, an initial surge in short-Bitcoin inflows, which peaked at $23 million following an increase in Bitcoin’s price, was primarily reversed by the end of the week, with net inflows totaling only $1.7 million.

In contrast to the overall positive trend, Ethereum saw further outflows of $7.4 million, making it the only altcoin to record outflows during the last week. This is juxtaposed with the performance of Solana, which continued to attract investors. Solana recorded further inflows of $15.5 million last week, taking its year-to-date inflows to $74 million, accounting for 47% of its total AuM.

Investors, while demonstrating enthusiasm for a spot Bitcoin ETF, show an increased level of caution compared to previous periods of inflows.

This balance between optimism for new investment mechanisms and a careful approach to market movements bodes well for the overall stability of the digital asset market moving forward.

CoinShares releases a weekly report on digital asset investment products available on its website.