Bitcoin's resilience at $37k backed by strong accumulation trend

Bitcoin seems to have established solid support at the $37k level, demonstrated by its swift recovery following a dip to $35,000 upon news about Binance’s SEC fine. While this rebound represents a 122% increase since the beginning of the year, there has been relatively minimal distribution of BTC during this period.

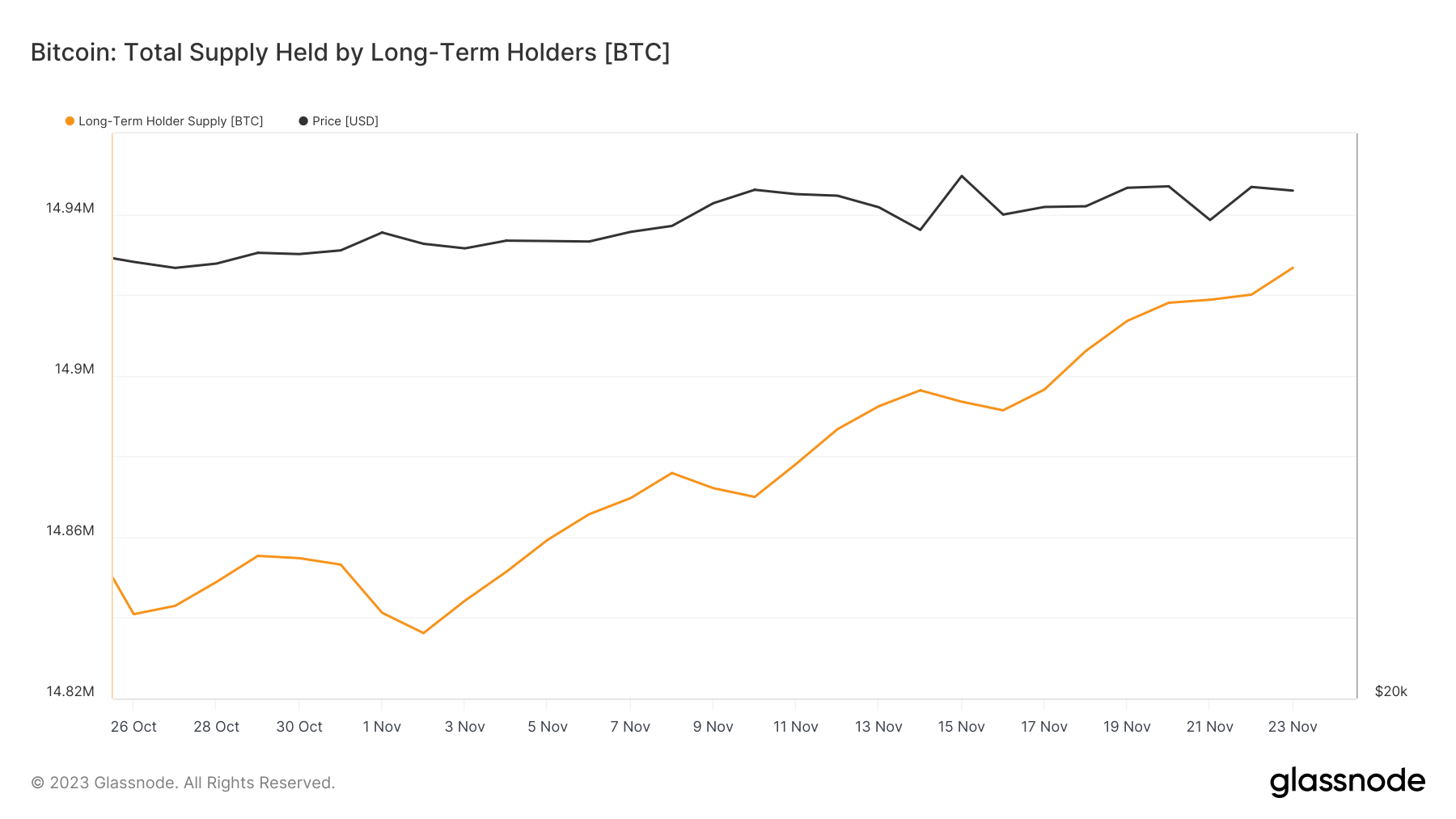

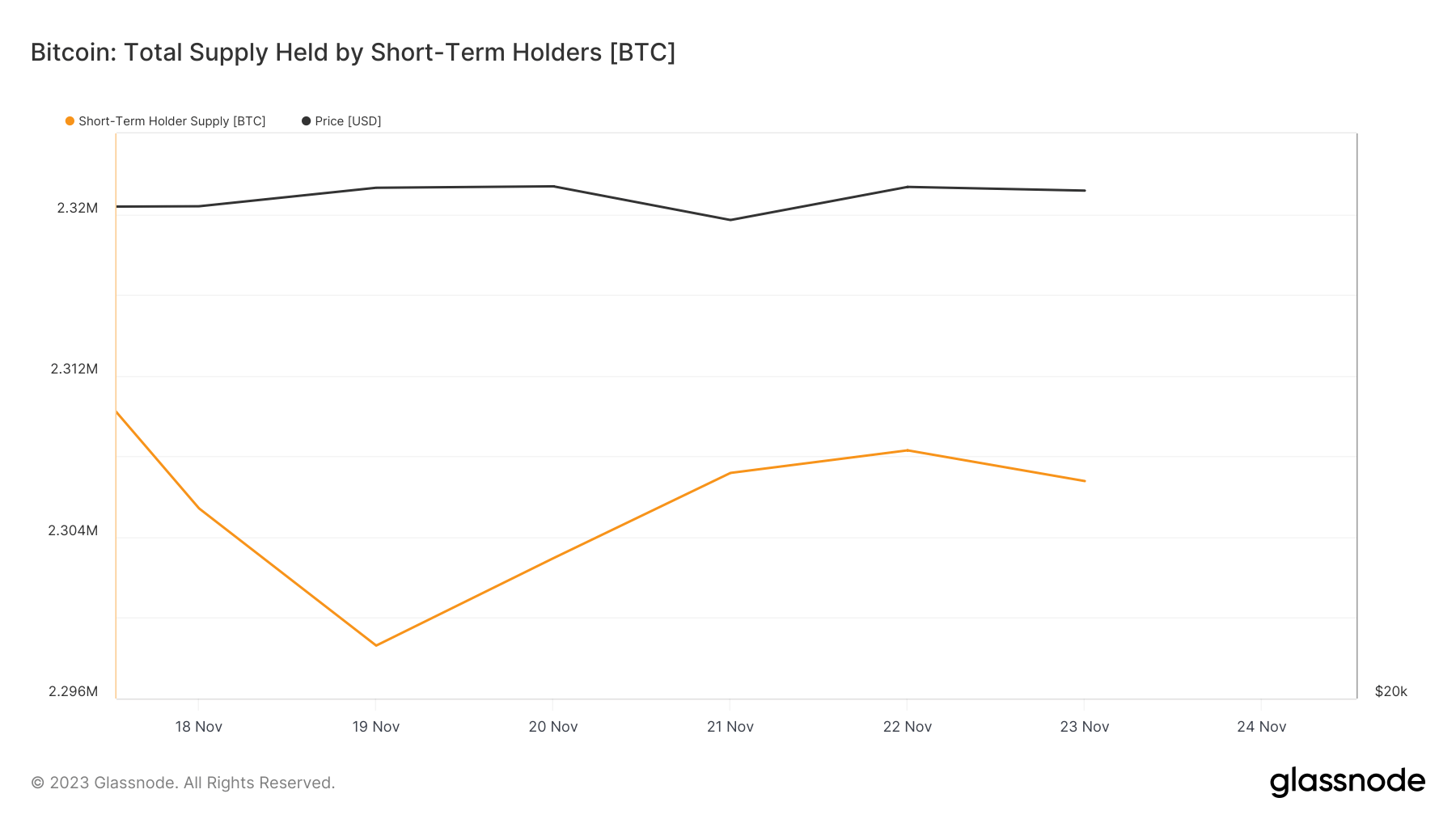

A closer examination of the Bitcoin supply held both by short-term and long-term holders shows a clear accumulation trend across the board. This trend only seems to have increased with Bitcoin’s spike above $37,000, indicating a determination among all holders to buy more BTC.

Glassnode data on long-term holders has been particularly telling over the past year. This cohort, known for their endurance in the market, has seen their holdings grow consistently, especially as Bitcoin’s price surpassed the $37,000 mark. The increase in long-term holder supply shows strong confidence in Bitcoin’s future prospects among these investors.

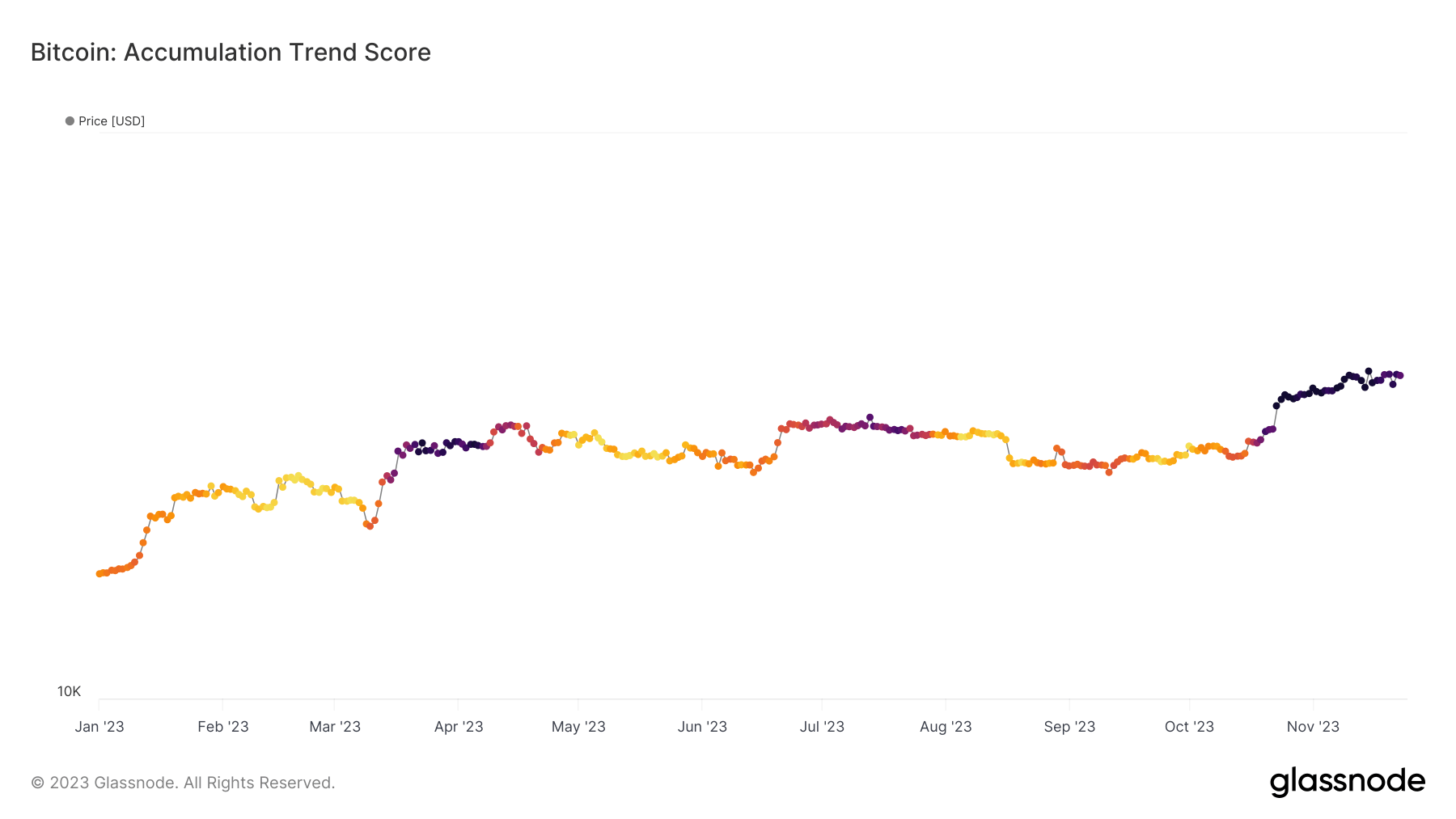

The Bitcoin accumulation trend score further supports this thesis. This metric, which gauges the degree of accumulation activity within the market, has shown positive signs. An increase in this score generally indicates heightened investor interest in acquiring more Bitcoin, often a bullish signal in the market. In this case, the trend score’s rise alongside climbing prices confirms that long-term holders are not just holding onto their assets but actively increasing their positions.

Over the past year, there has been a significant decline in short-term holder supply. Apart from distribution, this could indicate that a significant part of short-term holder supply has transitioned into the hands of long-term holders, as investors hold their coins beyond the 155-day threshold that typically differentiates short-term from long-term supply.

However, the last five days have seen an uptick in short-term holder supply. This recent increase suggests that Bitcoin’s escalating price has attracted new investors, keen on capitalizing on its growth. Monitoring short-term holder supply is crucial as it often reflects the market’s immediate reaction to price movements and can be an early indicator of changing market sentiments.

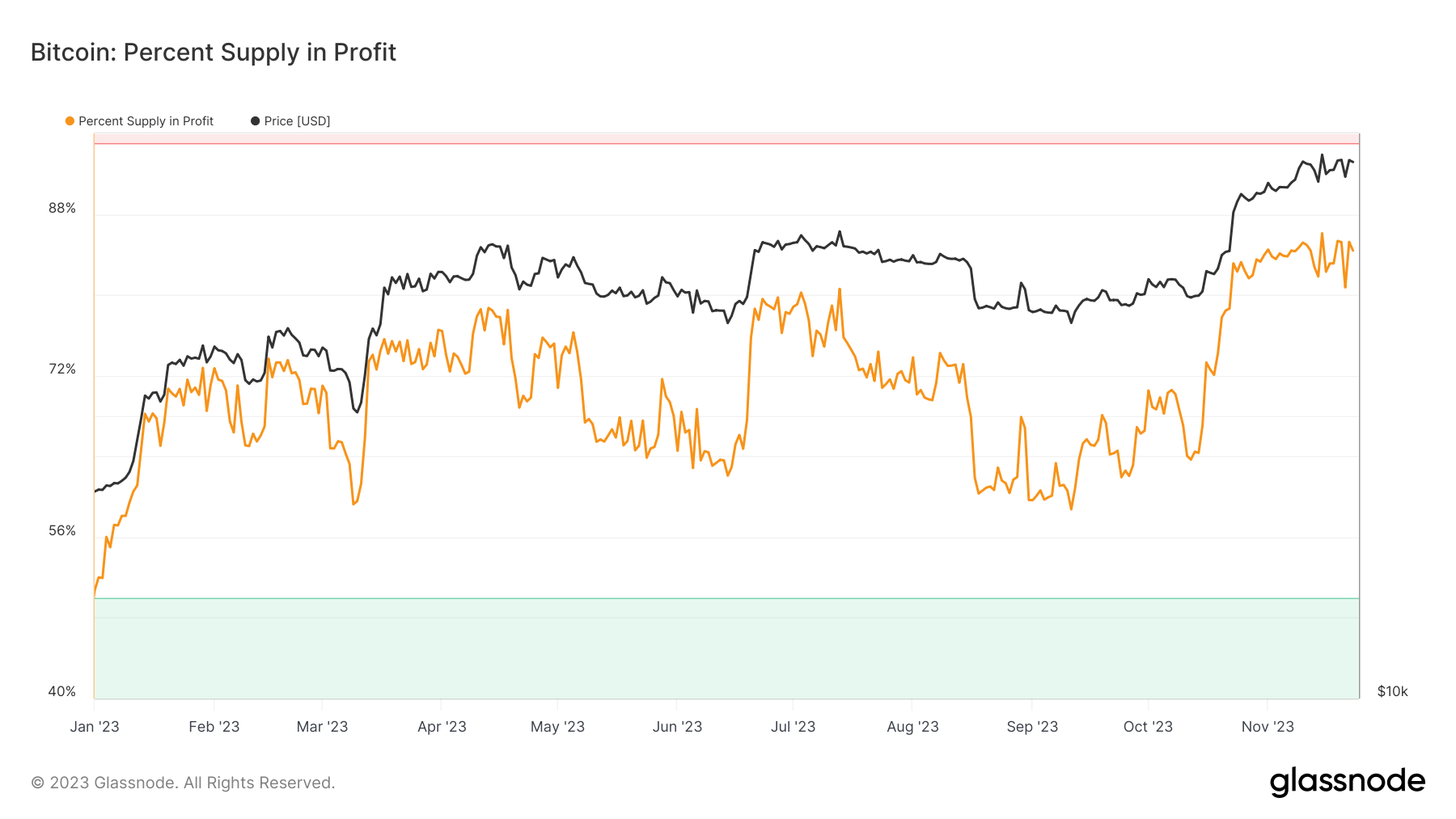

This accumulation has led to a significant spike in unrealized profits for Bitcoin holders. As of Nov. 23, 84.38% of Bitcoin’s supply is in a state of profit. This metric is pivotal as it represents the potential selling pressure or holding power within the market. Historically, high levels of unrealized profits have been precursors to bull rallies, as they indicate strong market confidence and a tendency for holders to await further price appreciation before distributing their coins to realize profits.