Coinbase-backed Base TVL decline 30% from September peak

Coinbase-backed Base has seen a substantial drop in decentralized finance activities on the network, with the total value of assets locked (TVL) dropping by around 30% in the last two months.

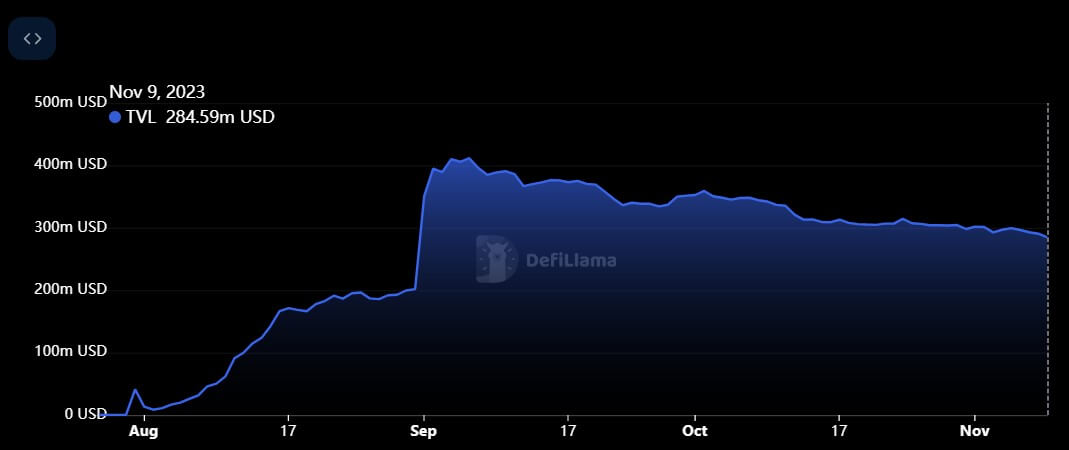

Data from DeFillama shows that the Ethereum (ETH) layer2 network’s TVL has dropped by more than 30% to $284.59 million from its September peak of $411.5 million.

This means that investors have removed more than $100 million worth of their assets from protocols operating on the network despite the improved market conditions recorded during the period.

The recent downturn marks a notable reversal of fortune for this blockchain network, which gained considerable prominence within the industry upon its public debut in August.

During that period, CryptoSlate reported that Base ranked among the top 10 networks regarding trading volume. The rise of memecoins, such as Bald, and the growth of the decentralized social protocol Friend.Tech drove its widespread adoption.

However, the network has recently witnessed a decline in its TVL and trading activity.

To provide context, data from DeFillama reveals that just three of the top 10 protocols on the network experienced growth in their TVL over the past week. The majority of these protocols reported double-digit losses.

Furthermore, examining decentralized exchanges (DEX) trading volume highlights that the layer-2 network has slipped from its position among the top 10 chains by trading volume.

Base’s network activity appears to have also suffered compared to Ethereum and rival layer-2 networks. Its daily average transactions per second (TPS) of 3.11 lags behind Ethereum and other layer-2s, including Arbitrum and Optimism, which is above 7 TPS, L2beat data shows.

However, these declines do not mask Base popularity among other layer-2 networks.

Besides that, Lido DAO, the largest Ethereum liquid staking service provider, officially launched its Wrapped Staked Ether (wstETH) on the network as part of its expansion plans across layer-2 solutions.