Crypto product inflows in 2023 surpass last year's total by over $30 million

Crypto product inflows for this year have eclipsed the total for the previous year despite having a few weeks left in the calendar, according to CoinShares’ latest weekly report.

Per the report, the weekly inflows into cryptocurrency products have reached a robust $767 million, exceeding the $736 million recorded in 2022.

Sixth weekly inflow

This record-breaking yearly performance comes on the heels of last week’s $261 million inflow, marking the sixth consecutive week driven by the positive sentiment surrounding the possibility of approval of spot-based Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC).

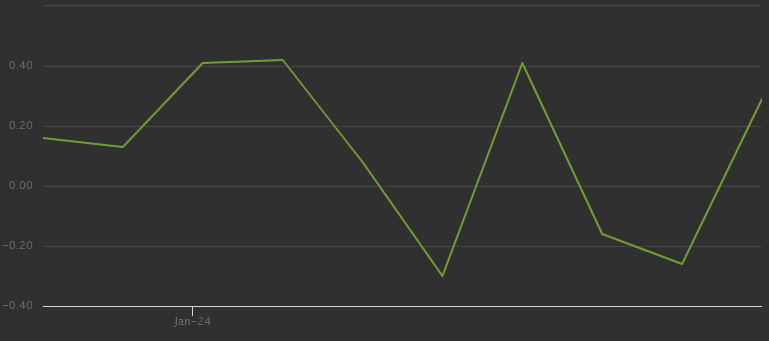

CoinShares notes that this recent surge in inflows is reminiscent of the run observed in July 2023 and marks the largest since December 2021.

Notably, Bitcoin (BTC) continues to dominate this surge, attracting $229 million in inflows last week and pushing its year-to-date inflow to an impressive $842 million. Even in the face of this bullish sentiment, Short-Bitcoin products also saw substantial inflows, totaling $4.5 million.

Source: Bloomberg, CoinShares, data available as at 03 Nov 2023

Ethereum, after experiencing consistent outflows since the start of October, had its first positive week, accumulating $17.5 million. Despite losing around $107 million to outflows this year, this week marks its most substantial inflow since August 2022.

Solana, a prominent competitor to Ethereum, also saw notable inflows amounting to $10.8 million. Additionally, several other altcoins, including Chainlink (LINK), Polygon (MATIC), and Cardano (ADA), registered inflows of $2 million, $0.8 million, and $0.5 million, respectively.

US investors drive inflow

Surprisingly, U.S. investors, who have mostly been cautious in their approach, are now actively participating in the digital asset product market.

According to CoinShares, U.S. investors contributed the most significant share of inflows recorded last week, totaling approximately $157 million.

Source: Bloomberg, CoinShares, data available as at 03 Nov 2023

This increased interest from U.S. investors may be attributed to recent developments in spot Bitcoin ETF applications, which have garnered significant attention and investment from the broader crypto community.

Germany follows closely, recording inflows of $63 million, while Switzerland and Canada also made noteworthy contributions, amounting to $36 million and $9 million, respectively.