FTX transfers $316 million in crypto, with Solana leading the outflows

FTX recently transferred approximately $316 million in digital assets to various crypto exchanges, according to on-chain data.

Over the past several weeks, the beleaguered crypto exchange has been rapidly divesting portions of its crypto holdings, including assets like Solana (SOL) and Ethereum (ETH), as part of its bankruptcy proceedings.

For context, FTX executed crypto transfers worth over $60 million between Nov. 7 and Nov. 8, according to insights from Lookonchain.

These transactions have added to the selling pressure in a market influenced by optimism over the potential approval of a Bitcoin spot exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC).

Solana dominates FTX Transfers

An analysis of FTX transfers by Lookonchain revealed that Solana (SOL) accounts for more than half of the transfers made by the exchange.

As of Nov. 8, the distressed exchange has moved 4.8 million SOL tokens, equivalent to $187 million.

These transactions may likely exert additional selling pressure on the token that has seen a recent resurgence. However, SOL’s price has remained resilient, trading above $40.

In the last 24 hours, it has even seen a 5.22% increase, reaching $43.75, data from CryptoSlate showed. This positive trend has been a consistent theme throughout the year, with SOL gaining over 330% since the beginning of the year, recently hitting a yearly high of $46.

SOL is the most significant asset on FTX’s balance sheet, valued at over $1 billion.

Other assets transferred

In addition to its Solana transactions, FTX has executed substantial transfers of other digital assets. These transfers encompassed approximately $32 million in ETH, $14.3 million in Polygon’s MATIC, and $4.46 million in Lido’s LDO.

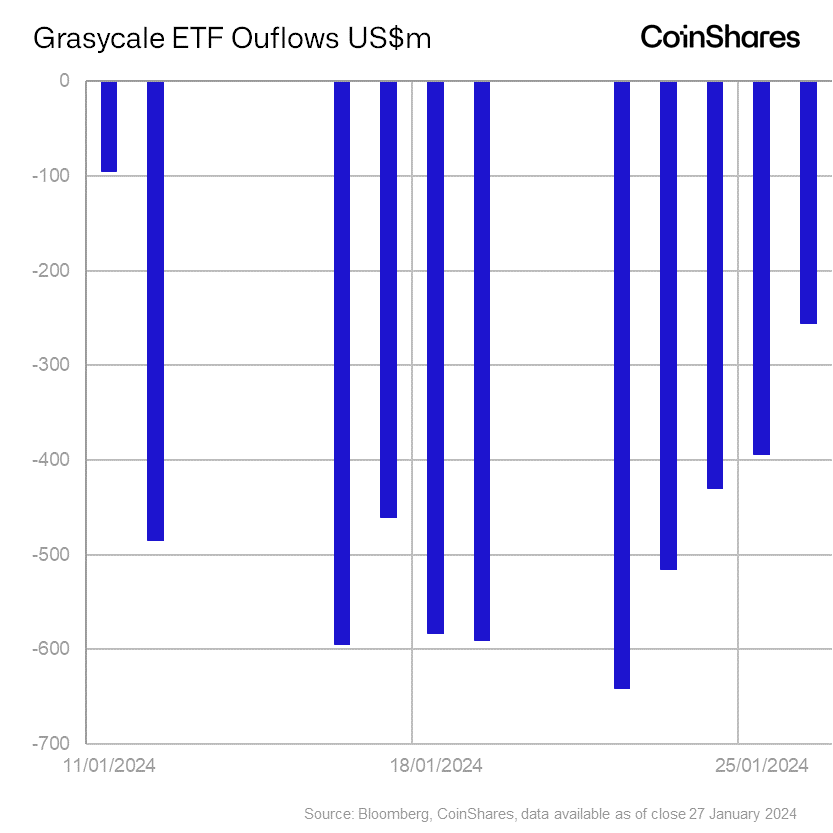

FTX also moved $4 million in Maker, $3.1 million in Sushi, and $1.6 million in Aave tokens, among others. These transactions are geared towards compensating FTX customers and investors who suffered losses from last year’s crash. The exchange recently moved to sell $744 million worth of its Trust assets held at Grayscale and Bitwise.