Ordinal-like transactions surge as gas fees go 'crazy' on Polygon network

The proliferation of Ordinal-like transactions of PRC-20 tokens appears to have pushed gas fees on Polygon (MATIC), an Ethereum (ETH) layer-2 network, to yearly highs.

While the network fees have since receded to previous lows, data from livdir.com shows that the average gas fee peaked at over 5,000 Gwei on Nov. 16.

Data from Polygonscan further corroborates this, showing that the network users spent approximately $131,000, or 155,000 MATIC, on gas fees during the period. This marked the highest amount Polygon users have spent on gas fees since November last year.

Sandeep Nailwal, Polygon’s founder, noted this trend and described the increased gas fees as “crazy.” According to him, the network worked smoothly despite gas fees going amid the 6 million transactions recorded in 24 hours at an average of 170 transactions per second.

PRC-20 POLS token

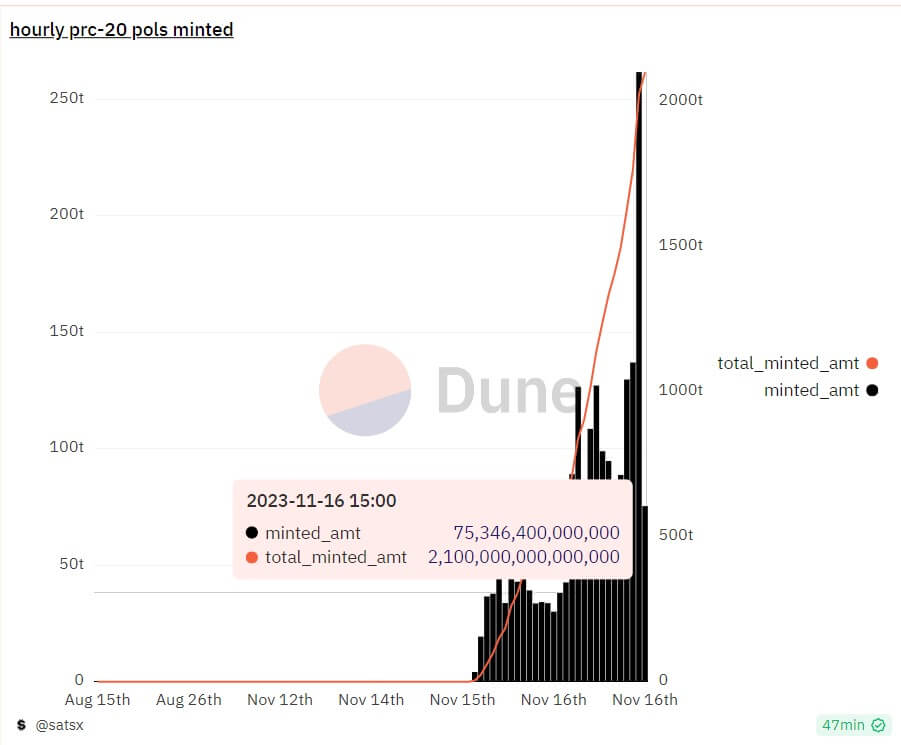

Meanwhile, the rise in Polygon’s fees coincided with increased minting activities of the “PRC-20” token called POLS.

Dune Analytics data, curated by SatsX, shows that the total amount of POLS tokens minted stands at 2.1 quadrillions as of press time. Per the dashboard, these minting activities resulted in spending over 102 million MATIC, valued at approximately $86.7 million, in transaction fees.

The POLS tokens utilize the PRC-20 protocol, leveraging transactional ‘calldata’ on the Polygon blockchain. These tokens resemble Bitcoin Ordinals’ BRC-20 tokens, facilitating the generation of NFT-like assets within the network.

Interestingly, the fee surge on Polygon mirrors similar trends observed on the Bitcoin (BTC) network when Ordinals came to the fore.

CryptoSlate recently reported that a resurgence in the popularity of these Ordinals pushed BTC transaction fees to a six-month high.

Similarly, Ordinals contributed to increased transactions on Litecoin’s (LTC) network, although its transaction fees did not significantly surge like other networks.