Blockchain private credit and tokenized treasuries value hits combined $1.34B continuing RWA resurgence

In a turnaround from last year’s downturn, real-world assets (RWAs) such as private credit leveraging blockchain technology have witnessed a significant rebound.

On-chain Private Credit.

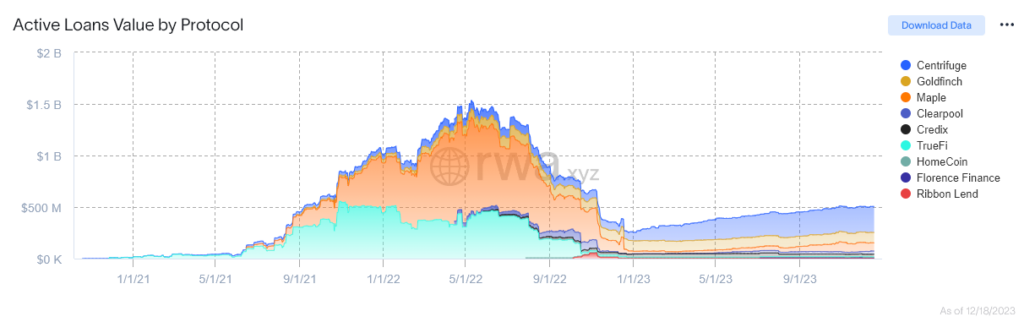

According to rwa.xyz, there has been a 127% surge in active private loans via digital ledgers since the beginning of 2023, currently at around $581 million. This recovery, though still not at its peak of nearly $1.5 billion in June of the previous year, marks a notable shift in the landscape of blockchain-based financing, particularly in a world grappling with elevated interest rates.

According to Bloomberg, this resurgence in the blockchain sector contrasts the traditional private credit market, a mammoth $1.6 trillion industry. A key differentiator lies in the borrowing costs. Blockchain protocols, on average, offer rates below 10%, while their traditional counterparts hover in the double-digit range. This cost efficiency is mainly attributable to digital ledgers’ inherent transparency and efficiency. Blockchain transactions are openly accessible for public scrutiny, and integrating smart contracts – software that automatically monitors loans and manages collateral – further streamlines the process.

The table below showcases the average loan cost, current active loans, total loans, and the value of defaulted loans. Most protocols run on Ethereum, with just Credix and Clearpool utilizing Solana and Polygon, respectively. Only $69 million has fallen into default, representing 1.5% of the $4.5 billion total loan value.

Legendary (Asia) Capital’s co-founder Agost Makszin told Bloomberg that the decreased risk in blockchain lending may be attributed to increased transparency and faster liquidation processes than traditional methods. The blockchain-based private credit sector appears to be finding solid footing again after the FTX crisis hit it hard. As shown in the above chart, the peak loan value of $1.5 billion does not align with the top of the 2021 bull market. Instead, it peaked just before the collapse of Terra Luna in May 2022. The decline continued through the FTX debacle before bottoming at around $250 million.

Tokenized Treasuries.

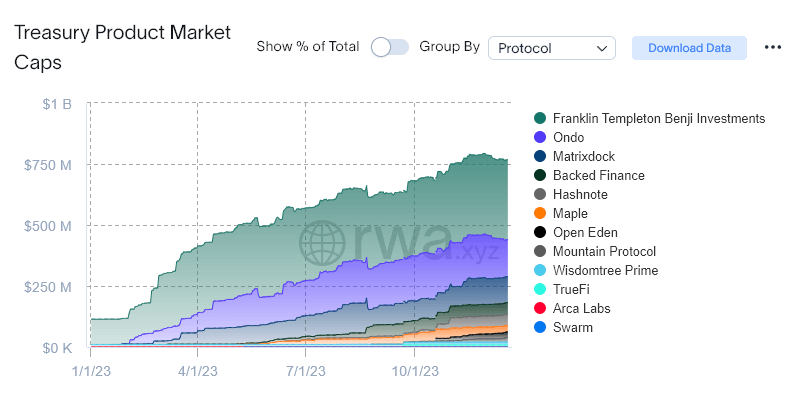

However, private credit is not the only blockchain-based RWA seeing a revival. On Nov. 26, tokenized treasuries hit an all-time high of around $790 million. The sector has exploded up 572% since the start of the year, climbing from $114 to $767 million currently.

Tokenized treasuries are dominated by Ethereum and Stellar, splitting most of the total value, with nominal value on Polygona and Solana. The largest protocol is Stellar-based Franklin Templeton Benji, with a market cap of $325 million, while the subsequent seven leading protocols are all deployed on Ethereum.

Bloomberg recently noted that the road to recovery and growth has its challenges. The absence of a standardized credit rating system in the crypto lending market hampers a complete understanding of risks, a concern raised by Tom Wan, a researcher at digital-asset fund provider 21co. The industry’s reputation, tarnished by last year’s crash, continues to be a hurdle, alongside issues like uneven access to banking facilities and complexities inherent in blockchain technology.

Regardless, while potentially underestimating the growth of the RWA sector by indicating only a 55% increase across the lending sector, Bloomberg’s report showcases the mainstream interest in tokenized on-chain products. With institutions such as BlackRock flipping its stance on Bitcoin to overwhelming positive and JP Morgan’s continued exploration into tokenization, 2024 could be a significant year for institutional adoption of digital ledger technologies.

Further, while the tokenized treasuries market, as tracked by rwa.xyz, stands below $1 billion, this does not consider the proxy tokenized treasuries held by stablecoin providers such as Tether and Circle. These issuers have tens of billions of dollars with U.S. Treasuries, representing the USDT and USDC stablecoins issued on the chain. When considering these assets, the value of treasuries tokenized in some form on the chain is surpassing $100 billion.