Binance's BUSD loses top five stablecoin spot as supply dips under 1B

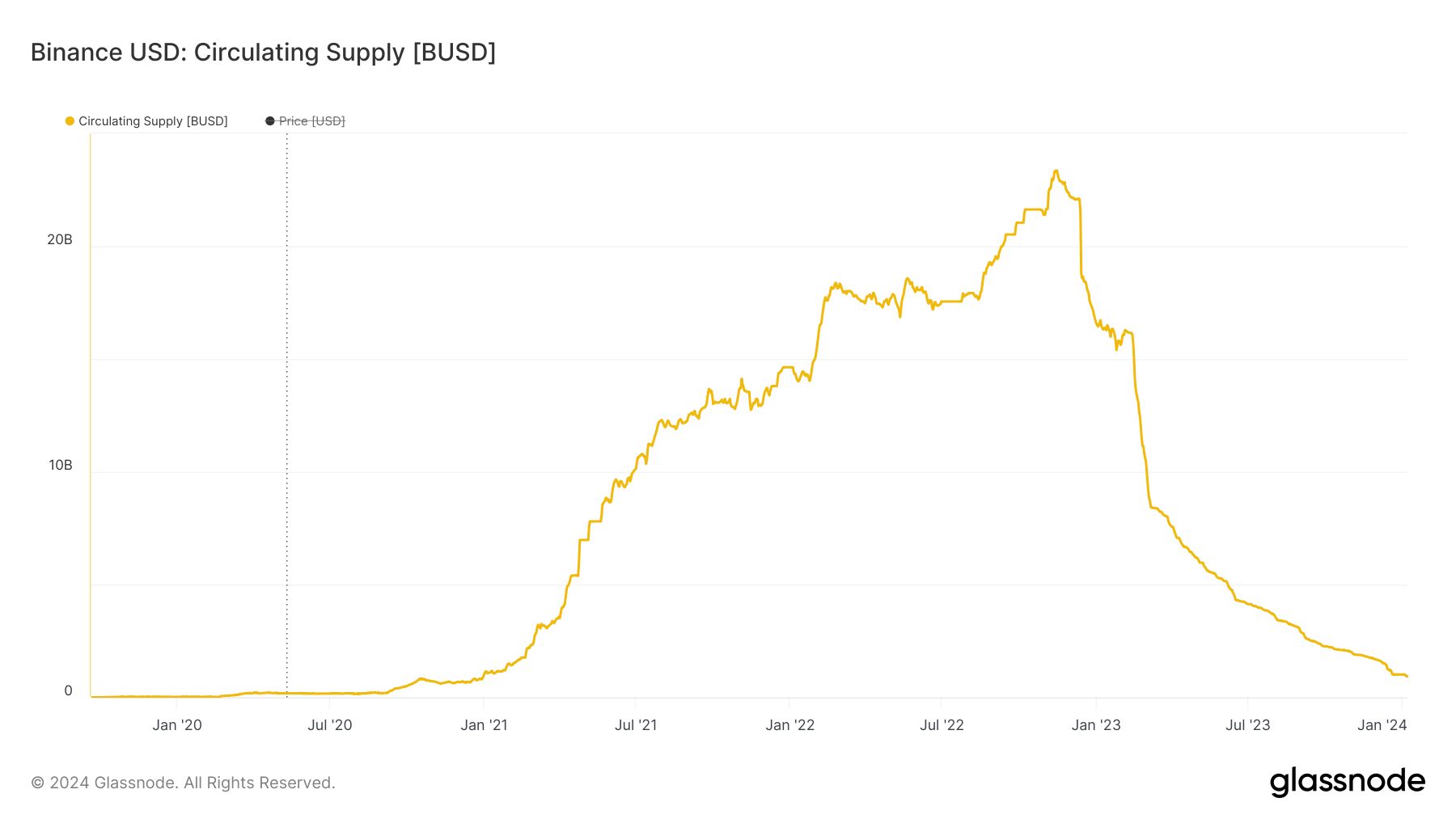

Binance USD (BUSD) slipped out of the top five stablecoins by market capitalization over the weekend after its circulating supply dipped under 1 billion, its lowest point since Dec. 2020.

Data from CyptoRanking shows that BUSD’s circulating supply sits at 927 million tokens, marking a staggering 96% decrease from its peak supply of 23.45 billion. This decline has also significantly impacted its trading volume of less than $50 million during the past 24 hours.

The Binance-backed stablecoin troubles began last year after the U.S. Securities and Exchange Commission (SEC) labeled it a security in its legal actions against the cryptocurrency exchange. Besides that, BUSD issuer Paxos was forced to stop other mints of the asset by the New York Department of Financial Services. Binance and Paxos vehemently rejected this SEC classification.

These developments prompted a swift exodus from the troubled stablecoin within the crypto community as Binance immediately began to push several stablecoin alternatives, including TrueUSD (TUSD) and First Digital USD (FDUSD), to its users.

On Jan. 5, Binance revealed that it completed the automatic conversion of eligible users’ balances in the BUSD token to FDUSD. It further explained that it no longer supports the withdrawals of BUSD and urged its users to manually swap these BUSD tokens for FDUSD tokens at a 1:1 conversion rate on Binance Convert.

Despite this, Binance and Paxos have committed to supporting BUSD until its complete phase-out this year.

USDT, USDC maintain stablecoin dominance

With BUSD’s decline, the top five stablecoins market by market capitalization now includes new entrants like TUSD and FDUSD—two stablecoins that were heavily promoted by Binance.

However, Tether’s USDT remains the dominant player in the space, controlling around 70% of the market with a market capitalization of more than $90 billion. It is followed closely by Circle’s USDC, whose market cap sits at $24.56 billion.

21Shares researcher Tom Wan emphasized that for a stablecoin to contend effectively against these behemoths, it would require integration into centralized exchanges, incorporation into DeFi platforms, and application in payment and remittance functions.