Bitcoin dominates as crypto investments skyrocket by 170% to $2.2 billion in 2023

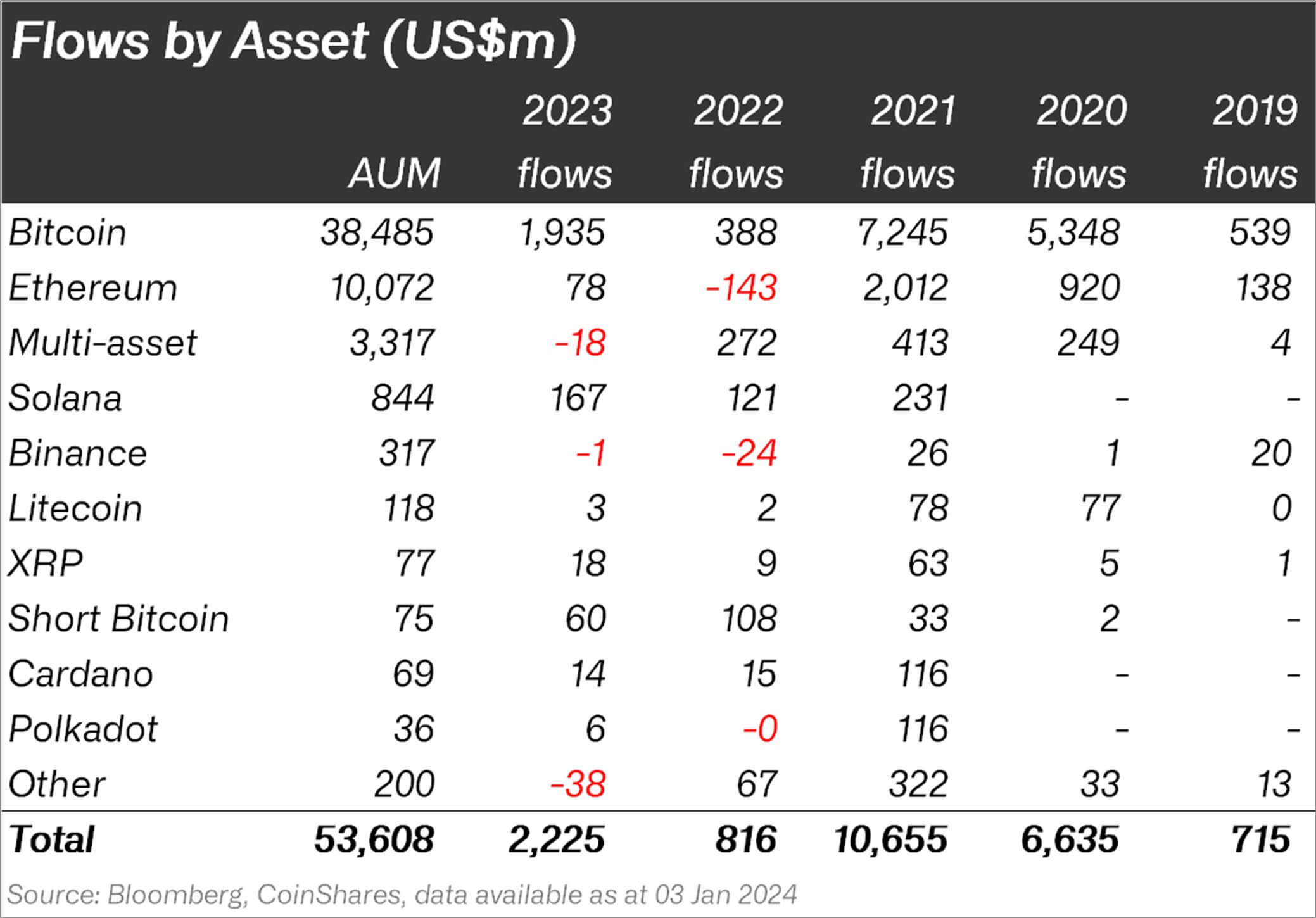

Inflows into crypto-related investment products increased 170% year-on-year to $2.2 billion last year from the $816 million recorded in 2022, according to CoinShares data shared by its head of research James Butterfill, on social media platform X (formerly Twitter).

The increase reflects the resurgence of the burgeoning crypto sector, fueled by remarkable rallies in cryptocurrencies like Solana and Bitcoin. This surge has been largely attributed to the anticipation surrounding the potential approval of an inaugural spot Bitcoin exchange-traded funds (ETFs) in the U.S.

Bitcoin dominates inflow

Last year, Bitcoin-related assets dominated the market, constituting over 86% of the recorded inflows, equating to $1.9 billion. This marks a significant surge of nearly 400% from the $388 million inflows documented in 2022. However, it is worth noting that this figure reflects a decline of 74% from the $7.2 billion peak seen in 2021.

Market observers have attributed this upsurge of inflows to the anticipation of a spot Bitcoin ETF launch in the U.S. CyptoRanking reported that the U.S. Securities and Exchange Commission (SEC) could start approving various pending spot Bitcoin ETFs by the end of the week.

Solana emerged as one of the most favorable assets for investors last year, witnessing total inflows of $167 million. During the period, Solana’s SOL token price rallied by more than 850% to above $100 from under $10 as the asset attracted new users and forged strategic alliances with renowned global financial players like Visa and Shopify.

On the other hand, Ethereum investment products saw inflows of less than $100 million last year and attracted the “least loved altcoin” tag for several weeks. The second-largest cryptocurrency by market capitalization did not see much interest despite the launch of several Ether futures-based exchange-traded funds (ETF) in October.

Meanwhile, the overall bullish sentiment resulted in some investors taking a bearish stand on the market, with $60 million in inflows to Short Bitcoin products last year.

Other digital assets like Litecoin, XRP, Polkadot, and Cardano ended the year with cumulative inflows of $41 million.