Bitcoin's safe-haven status strengthened despite recent price crisis: Kaiko

Bitcoin has offered significantly higher returns than traditional safe-haven assets like gold, U.S. bonds, or the dollar.

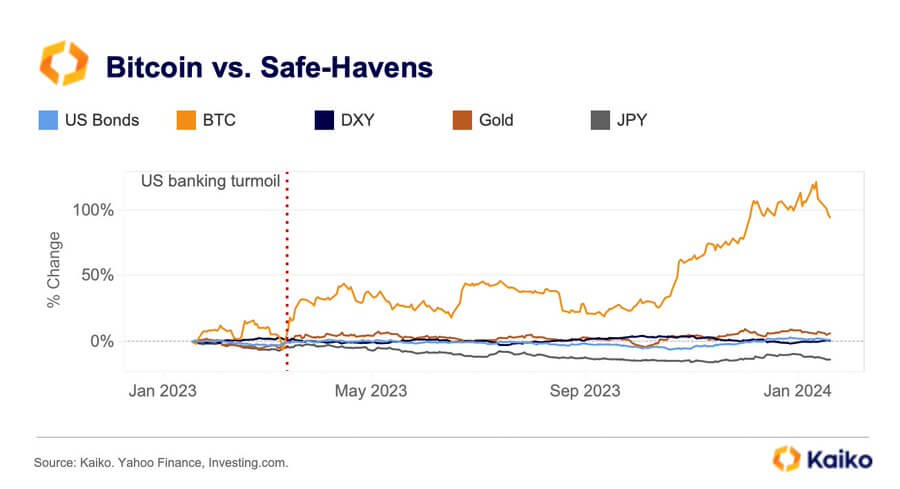

Data from Paris-based crypto analytical platform Kaiko showed that an investment in the top cryptocurrency in January last year would have yielded more than 100% returns, while similar investments in gold and other assets would have generated considerably lower returns during the same period.

“Overall, BTC offers significantly higher returns than other traditional safe-havens such as gold, U.S. bonds or the dollar. It has notably outperformed, attracting safe-haven flows during the U.S. banking crisis last year,” Kaiko wrote in its recent research report.

The firm described a safe haven asset as uncorrelated with equities during market turmoil.

BTC’s 60-day correlation with the Nasdaq 100 has significantly declined in the past year, further bolstering the top asset image as a safe haven asset.

“[BTC correlation with Nasdaq 100] has been close to zero on average since June of 2023 as BTC price movements have been driven by the hype around spot U.S. ETFs,” Kaiko stated.

The growing investors’ interest in Bitcoin as a reliable safe-haven asset has been further propelled by influential institutional entities like BlackRock, who increasingly recognize the digital asset’s safe-haven characteristics.

Notably, a CyptoRanking report also confirmed this market dynamics. The report observed a BTC/GOLD ratio growth, showing that investors increasingly preferred BTC over gold because of its perceived attributes as a digital store of value and a hedge against inflation.

Meanwhile, Kaiko’s analysis follows BTC’s recent price struggles below $40,000 despite introducing several spot exchange-traded funds (ETF) in the U.S. However, according to CyptoRanking, the top cryptocurrency’s value has risen by more than 3% during the past day to around $41,150 as of press time.

AuthorOluwapelumi Adejumo

Journalist at CyptoRankingOluwapelumi values Bitcoin's potential. He imparts insights on a range of topics like DeFi, hacks, mining and culture, underlining transformative power.

@hardeyjumoh LinkedIn Email Oluwapelumi EditorLiam 'Akiba' Wright

Senior Editor at CyptoRankingAlso known as "Akiba," Liam is a reporter, editor and podcast producer at CyptoRanking. He believes that decentralized technology has the potential to make widespread positive change.

@akibablade LinkedIn Email Editor