Bitcoin's year-end analysis reveals robust growth and resilient investor behavior: CryptoSlate Alpha Snapshot

Welcome to this month’s CyptoRanking Alpha Snapshot, an exclusive overview of the most insightful research, market reports, and analyses released over the past month for our dedicated subscribers. This comprehensive compilation, accessible only to those who have staked the minimum requirement of 20,000 ACS tokens to our Access Protocol pool on Solana, is your gateway to understanding the intricacies of the crypto market.

December has been a pivotal month, marked by our deep dive into Bitcoin’s 2023 year in review, scrutinizing key metrics to unravel the layers behind its year-to-date growth. We’ve also shed light on the complex dynamics between the rise of Central Bank Digital Currencies (CBDCs) and their implications for crypto and Bitcoin.

Our research articles observed a notable end-of-year rally in the stablecoin market cap, mirroring Bitcoin’s price uptick. Our analysis of Bitcoin’s growing economic footprint through its realized cap and the remarkable recovery of Solana in December brought forth nuanced perspectives on these crypto assets.

Furthermore, we delved into the shifting investor behaviors, as evidenced by the withdrawal of Bitcoin from exchanges and the increased reliance on Bitcoin in economies facing financial turmoil. Our exploration extended to understanding Bitcoin’s key cost-basis indicators and its emerging role as a safe-haven asset, challenging gold’s supremacy.

Our insights didn’t stop there. We explored the evolving dynamics of the Bitcoin and Ethereum ecosystems, the implications of Bitcoin inscriptions beyond JPEGs, and the patterns of Bitcoin ownership that signal a strong accumulation trend.

As we look towards the future, our Alpha insights tackled the potential impacts of the spot ETF and the halving on Bitcoin in 2024, along with a detailed analysis of Bitcoin miner revenue and the market activities of short-term holders.

This snapshot is just a glimpse into the wealth of knowledge and insight available to our CyptoRanking Alpha subscribers. Stay ahead of the curve and deepen your understanding of the crypto market with our December Alpha Snapshot.

December α Market Reports

Bitcoin 2023 year in review: Analysis of BTC’s key metrics

This market report dives deep into Bitcoin’s performance over the past year, analyzing a range of metrics to provide a more objective and comprehensive perspective of its YTD growth.

The rise of CBDCs: What lies ahead for crypto and Bitcoin?

This market report explores the evolving role of central bank digital currencies, their potential to redefine global finance and their complex relationship with cryptocurrencies.

December α Research Articles

End-of-year stablecoin cap rally mirrors Bitcoin’s price uptick

The total stablecoin market cap saw a strong recovery in Q4, hinting at an infusion of liquidity into Bitcoin.

Bitcoin’s realized cap shows growing economic footprint

Bitcoin’s true market value gains ground with a 12% realized cap hike.

Solana’s holiday spirits high as it enjoys a booming December

Solana’s rebound resonates with soaring TVL and user engagement in December’s crypto rally.

December sees investors pulling Bitcoin off exchanges

December data suggests growing investor preference for holding Bitcoin off-exchange.

Troubled economies turn to Bitcoin, sparking rally in local trading pairs

From Argentina to Nigeria, Bitcoin trading pairs surged against troubled fiat currencies.

Realized price and true market mean: Understanding Bitcoin’s key cost-basis indicators

Diverging paths of Bitcoin’s realized and true market mean prices offer deep market insights.

Bitcoin challenges gold’s supremacy as safe haven asset

BTC/GOLD ratio hits new highs, mirroring Bitcoin’s ascent against traditional safe havens.

Solana shows renewed strength against Ethereum in SOL/ETH ratio

Despite volatility, SOL/ETH ratio showcases Solana’s resilience in the L1 race.

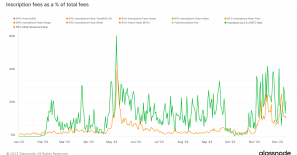

Beyond JPEGs: Exploring the types of Bitcoin inscriptions

Text and BRC-20 inscriptions make up 96% of the 47.36 million Bitcoin inscriptions, with the controversial JPEGs accounting for less than 3%.

Bitcoin outpaces stablecoins in market cap growth

Surging Stablecoin Supply Ratio points to Bitcoin’s growing market dominance.

Bitcoin owners hold tight as new UTXOs outstrip spending

The number of created UTXOs has been outpacing spent UTXOs since late October, pointing to a strong trend of Bitcoin accumulation.

Ethereum sees major shift from centralized exchanges to DeFi

Only 11.81% of Ethereum’s total supply remains on centralized exchanges, marking a significant shift towards DeFi investments.

Bitcoin surge triggers miner sell-off

A decline in miner BTC balances signals strategic moves in response to December price rally.

Bitcoin’s supply in profit shows bullish sentiment despite volatility

Bitcoin’s supply in profit reflects sustained market optimism, staying robust above the 50-day moving average despite recent corrections.

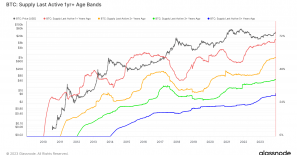

Bitcoin’s supply last active over a year ago reached ATH

Long-term Bitcoin holders prevail, pushing dormant supply to unprecedented levels.

Understanding investor sentiment through the Bitcoin leverage ratio

Bitcoin traders embrace risk management with lowered leverage ratio throughout 2023.

Bitcoin’s illiquid supply hits 10-year high, signaling strong investor conviction

The increase in Bitcoin’s illiquid supply correlates with an upward trend in market valuation.

Bitcoin Lightning Network experiences capacity and channel surge

Lightning Network’s capacity spike indicates a growing trust in Bitcoin transaction efficiency.

December Top α Insights

What will have a bigger impact on Bitcoin in 2024: the spot ETF or the halving?

Analyzing the impact these two pivotal developments could have on Bitcoin.

Nearly $1.5B in Bitcoin profits pocketed by short-term holders; long-time holders stay patient

Bitcoin’s rollercoaster ride in November leads to massive profits for short-term holders as Bitcoin rides a recent wave of optimism.

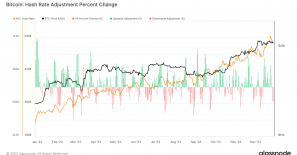

Bitcoin miner revenue per exahash spikes, nearing yearly high

Miner revenue hits $50 million, outpacing long-term average.

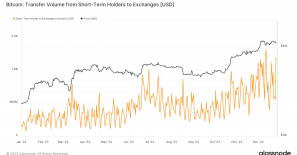

Bitcoin dip sees short-term holders send $2 billion to exchanges

Short-term holders’ activity spikes as $2 billion worth of Bitcoin hits exchanges amidst market dip.

Short-term holders trigger Bitcoin’s largest sell-off in 18 months with $2B transferred to exchanges

Bitcoin’s dramatic value plunge to $40,000 followed by record transfer from short-term holders.

Record 31% of Bitcoin supply dormant for over five years

Steadfast Bitcoin investors signal indifference to price swings, demonstrating their confidence in long positions.

The end-of-year decline in hash rate sparks debate over miner sell-offs

As Bitcoin’s next halving looms, miner bitcoin reserves shrink amid uncertain market signals.

Bitcoin miner revenue reshaped by Inscriptions, transaction fees hit $500M in 2023

Emerging trends in Bitcoin transaction fees highlight miners’ growing dependence on new technologies like Inscriptions amid declining block rewards.

Bitcoin matches 21 years of S&P 500 trading in just over a decade of 24/7 markets

Bitcoin illustrates the impact of crypto on financial markets by offering a trading calendar that outstrips 21 years of S&P 500 operations.

Bitcoin on the cusp of historic 9th consecutive week of gains

With eight weeks of gains behind it, Bitcoin inches ever closer to breaking previous records.

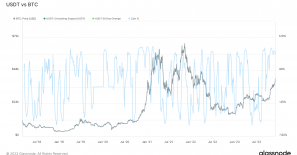

USDT Tether supply edges toward 90 billion with potential influence on Bitcoin prices

USDT Tether experiences a 4 billion surge in circulating supply, echoing trends in Bitcoin’s valuation.

Halving history: How Bitcoin fees support miner as reward decline

Analysis shows fluctuating Bitcoin fees per block play key role in miner profitability.

Small investors increase Bitcoin holdings amid ETF anticipation

‘Plankton’ and ‘Shrimp’ Bitcoin addresses swell, reflecting confidence in cryptocurrency’s future.

Bitcoin continues its winning streak, marking a potentially historic fourth month

Outshining past performances, Bitcoin’s steady ascent hints at breaking its six-month profit record.

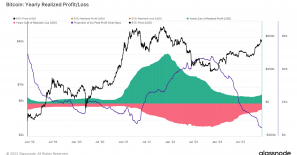

Realized gains and losses reflect a volatile year for Bitcoin

The digital asset market remained volatile with $83 billion in realized profits against $55 billion in losses last year.

Digital assets defy traditional market trends amid signs of economic slowdown

Economic indicators hint at recession while digital currencies and equities stay their course.