Bitwise CEO confirms $370 million inflows for its Bitcoin ETF in blazing four-day debut

Bitwise Bitcoin ETF Trust (BITB) has swiftly surged to an impressive $370 million in assets under management (AUM) within its inaugural four days of trading.

Hunter Horsley, the CEO of Bitwise, shared this milestone on Jan. 18 via social media platform X (formerly Twitter), noting a remarkable influx of $68 million designated explicitly for Bitcoin acquisition during the past day. This helped to push BITB’s total AUM to a notable mark of $370 million in just four days.

Bloomberg ETF analyst James Seyffart suggested that some Bitwise inflows came from investors divesting their Grayscale’s Bitcoin Trust ETF (GBTC) shares for rival ETFs.

Meanwhile, Nate Geraci, the president of the ETF Store, noted that Bitwise’s AUM places it within the top 25 out of the 540 ETFs launched in 2023 by AUM.

Apollo’s ETF tracker shows that BITB’s AUM is at $290 million as of press time, which may reflect a decrease in holdings but, more likely, a delay in reporting figures. Regardless, Bitwise’s ETF maintains a healthy top-three position among the recently launched spot Bitcoin ETFs. It trails behind BlackRock’s iShares Bitcoin Trust (IBIT), which boasts an AUM of $707 million, and Fidelity’s Wise Origin Bitcoin Trust (FBTC) with $523 million in AUM.

‘Ridiculously impressive number’

Bitwise’s impressive numbers reflect the significant interest the newly launched spot Bitcoin ETFs have attracted within a week of their introduction.

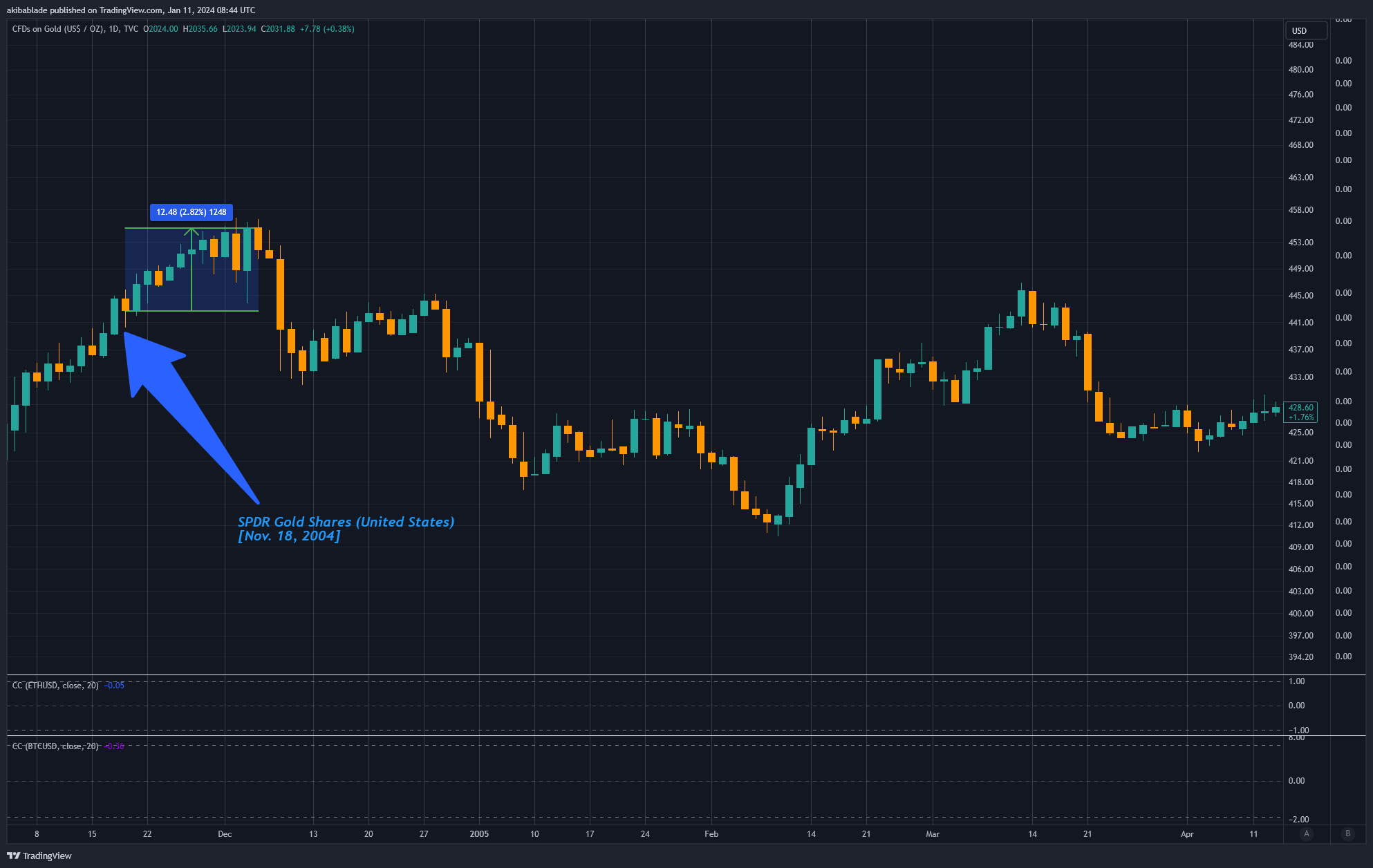

CyptoRanking Insight reported that the trading volume across the new spot Bitcoin ETF products reached $10 billion in the last three days. Another report also noted that Bitcoin is now the second-largest commodity in the U.S. by AUM, ahead of the ‘Broad Diversified’ asset class and precious metal, silver.

Speaking on these milestones, Ophelia Snyder, the co-founder of the crypto-focused investment firm 21 Shares, said:

“A ridiculously impressive number given that most institution **still** do not have access to these products and most advisors can’t actively advise their clients on the space. The ETFs are in early days.”

Notably, Bitwise had foreseen a groundbreaking trajectory for BTC ETFs, anticipating they would achieve unprecedented success at their launch. The firm based its prediction on the substantial capital influx expected from retail and institutional investors.