Fidelity inflows smash Grayscale outflows as $255 million Bitcoin enters US market

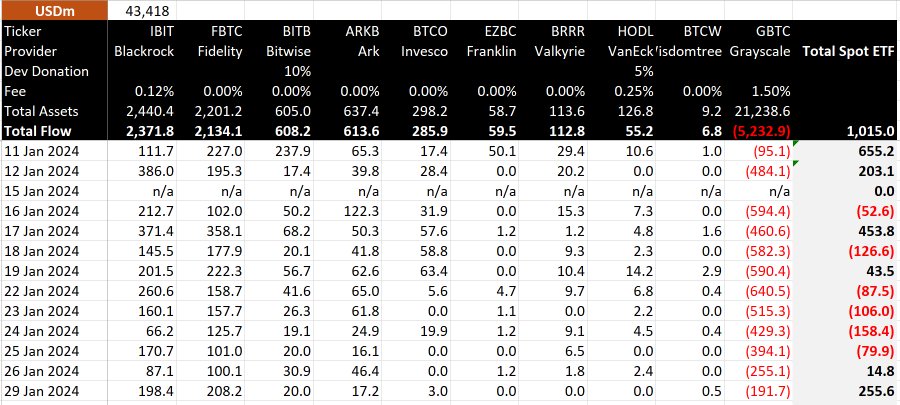

Grayscale’s Bitcoin Trust (GBTC) is experiencing a slowdown in outflows, with just under $200 million withdrawn from the fund on Jan. 29.

Data from BitMEX Research indicates a total outflow of around $192 million during this reporting period. Notably, this marks the lowest outflows since the fund’s inception, surpassing only the initial day of trading when withdrawals amounted to $95 million.

Meanwhile, a look at the newborn nine shows that the inflows into the funds keep offsetting that of Grayscale.

The Fidelity Wise Origin Bitcoin Fund (FBTC) emerged as a standout, concluding the twelfth trading day with the highest inflow at $208 million. In comparison, other funds, including BlackRock’s IBIT, experienced a $198 million inflow. ETFs such as BITB, ARKB, and BTCO recorded inflows of $20 million, $17 million, and $3 million, respectively, while others reported zero inflows.

The robust trading activities contributed a net inflow of $255.6 million during the twelfth trading day.

GBTC maintains ‘liquidity crown’

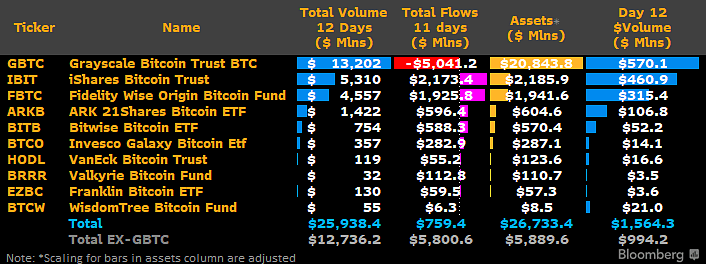

However, Grayscale’s GBTC remains the top cryptocurrency ETF in liquidity, as Bloomberg Intelligence analyst James Seyffart observed.

Despite recent outflows, GBTC’s trading volume reached $570 million on Jan. 29, surpassing BlackRock’s IBIT by $110 million and reaffirming its market dominance.

Following its recent conversion, Grayscale’s ETF has experienced substantial outflows totaling more than $5 billion. Analysts attribute the outflows to profit-taking maneuvers by investors exposed to its previous net asset value discount.

Furthermore, the fund’s relatively high 1.5% management fee is cited as a factor that has led some investors to shift towards competing ETF providers such as BlackRock and Fidelity, who charge a lower fee of 0.25%.

As of Jan. 29, the outflows have resulted in Grayscale’s ETF’s Assets Under Management (AUM) dropping to approximately $21.431 billion (equivalent to 496,573 BTC) from its year-to-date peak of nearly $29 billion (623,390 BTC), as reported by the fund’s official website. This data indicates that fund users have divested over 100,000 units of the leading cryptocurrency since the approval of the ETF conversion.

AuthorOluwapelumi Adejumo

Journalist at CyptoRankingOluwapelumi values Bitcoin's potential. He imparts insights on a range of topics like DeFi, hacks, mining and culture, underlining transformative power.

@hardeyjumoh LinkedIn Email Oluwapelumi EditorLiam 'Akiba' Wright

Senior Editor at CyptoRankingAlso known as "Akiba," Liam is a reporter, editor and podcast producer at CyptoRanking. He believes that decentralized technology has the potential to make widespread positive change.

@akibablade LinkedIn Email Editor Latest ReportThe invisible engine: How OTC trading powers Bitcoin ETFs

Exploring the intricacies of OTC trading, providing a comprehensive understanding of this often overlooked but vital component of the market.

Andjela Radmilac · 2 days ago