Fidelity's Bitcoin ETF joins the $1 billion club in alongside BlackRock

Fidelity’s spot Bitcoin (BTC) exchange-traded fund (ETF) swiftly secured its position as the second ETF provider to surpass $1 billion in assets under management (AUM) within a week of its launch.

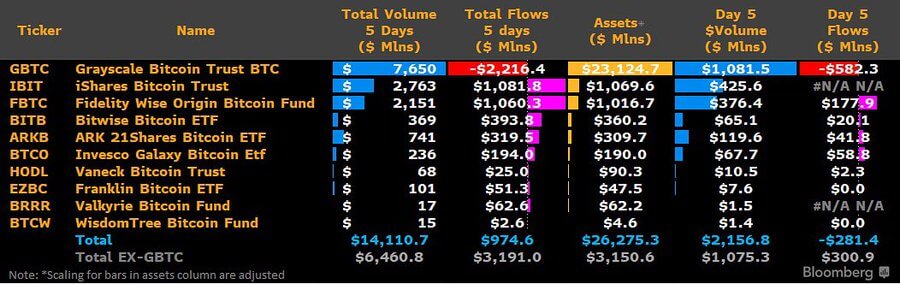

Data from Bloomberg shows that Fidelity’s Wise Origin Bitcoin Trust achieved this milestone on its fifth day of trading, recording flows that reached $1.01 billion in AUM. BlackRock’s iShares Bitcoin Trust (IBIT) had reached the same milestone a day earlier, and its AUM currently stands at $1.06 billion.

This achievement is noteworthy given the brief duration since the ETF’s launch, highlighting a rapid ascent among the recently approved issuers. The expedited growth reflects the substantial investor interest in these products despite the ETF’s previous challenges in securing approval from the U.S. Securities and Exchange Commission (SEC).

Market observers emphasize the significance of achieving $1 billion in AUM within a short timeframe, noting that this accomplishment is notable for any ETF. Moreover, the inflows into these ETFs within just one week signify a robust demand from investors for exposure to Bitcoin through regulated investment vehicles.

Notably, a CyptoRanking Insight noted that the substantial inflows into these ETFs have elevated BTC to the position of the second-largest commodity in the U.S. by AUM, surpassing silver. This shift shows cryptocurrency products’ growing acceptance and integration into traditional investment portfolios.

GBTC outflows cross $2B

Meanwhile, the overall outflow from Grayscale’s GBTC has now reached a substantial $2 billion.

This significant outflow continues a consistent trend since the fund’s launch, with a notable $582 million outflow recorded on its fifth day in the market.

GBTC’s discount has increased to approximately 96 basis points alongside the outflow. Analysts suggest that this discount adjustment may respond to the market’s current selling pressure.

Trading activity remains strong.

Despite their brief one-week existence, Bloomberg ETF analyst Eric Balchunas highlighted the remarkable growth in trading activities for the “Newborn Nine” ETFs.

Notably, the trading volume for these ETFs surged by 34% between the fourth and fifth trading days, defying the typical post-launch decline observed in hyped-up launches.

Author“Normally with a hyped-up launch, you see volume steadily decrease each day post-launch; [it’s] rare to see it reverse back up. All but one saw a jump too, but GBTC [remained] flat, so it wasn’t a volatility thing,” Balchunas added.

Oluwapelumi Adejumo

Journalist at CyptoRankingOluwapelumi values Bitcoin's potential. He imparts insights on a range of topics like DeFi, hacks, mining and culture, underlining transformative power.

@hardeyjumoh LinkedIn Email Oluwapelumi EditorLiam 'Akiba' Wright

Senior Editor at CyptoRankingAlso known as "Akiba," Liam is a reporter, editor and podcast producer at CyptoRanking. He believes that decentralized technology has the potential to make widespread positive change.

@akibablade LinkedIn Email Editor