Binance's FDUSD market cap hits record high, dethrones USDC in Bitcoin trading volume

The First Digital USD (FDUSD) stablecoin has overtaken Circle-issued USD Coin (USDC) as the second-most popular pair for Bitcoin during the last five months, thanks to the zero-trading fee program on Binance.

CCData’s latest stablecoin report revealed a significant uptick in FDUSD’s trading volume on centralized exchanges — primarily Binance — which has taken its market capitalization to record highs.

The stablecoin’s volume climbed 51.1% to $122 billion in January, making it the second most popular trading pair after Tether’s USDT.

Overall stablecoin trading volume on centralized exchanges rose 4.54% to $1.05 trillion in January, the highest level since December 2021.

Rise of FDUSD

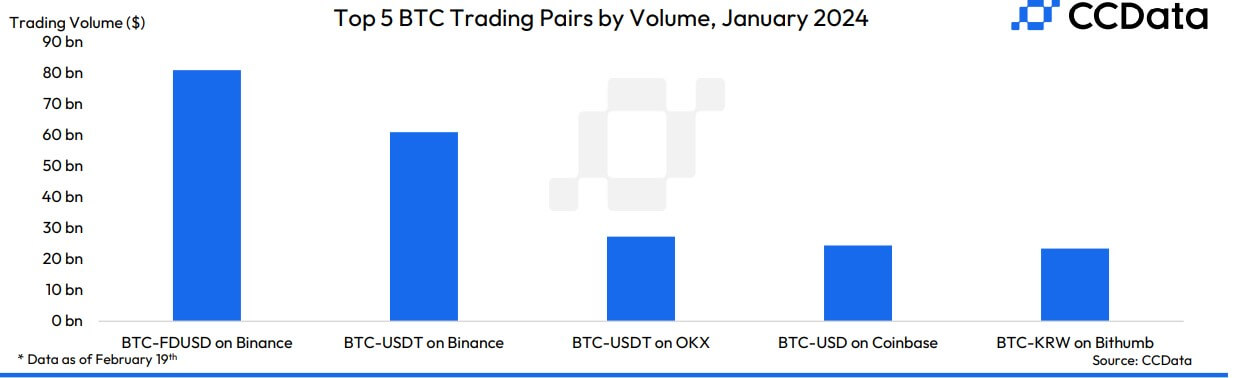

According to the report, the BTC/FDUSD pair on Binance made up most of the trading volume as the most traded Bitcoin pair on the exchange after the approval of spot Bitcoin ETFs in the US.

The pair recorded a monthly volume of $80.8 billion in January, followed by the BTC/USDT pair on Binance, which saw roughly $60 billion in volume for the same period.

FDUSD’s market capitalization increased by approximately 13% to a new all-time high of $2.44 billion, bringing its stablecoin market share to 15.6%.

FDUSD has emerged as one of the most popular stablecoins in recent months thanks to Binance’s heavy promotion of the digital asset.

Following Binance USD’s (BUSD) regulatory struggles, the crypto exchange urged its users to pivot to FDUSD and introduced several new products designed to incentivize the stablecoin use on its platform.

USDT remains king

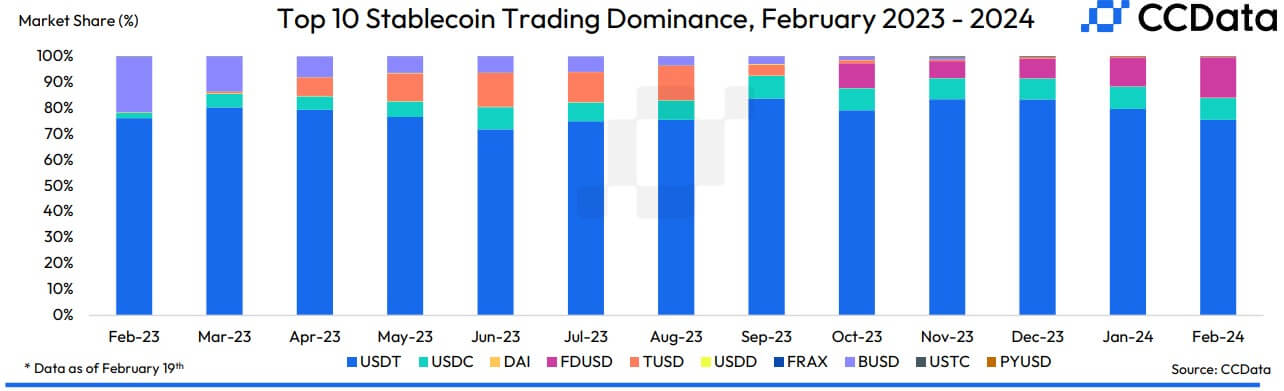

Tether’s USDT remains the dominant stablecoin in the sector by a large margin despite FDUSD’s ascent, controlling roughly three-quarters of the market share among the top 10 stablecoins.

Top 10 Stablecoins Dominance (Source: CCData)It remains the most dominant trading pair on centralized exchanges, with a cumulative monthly volume of $241 billion.

USDT’s market cap is up 1.23% in February and currently stands at $97.3 billion, marking a record high for the stablecoin’s circulating supply. Meanwhile, the stablecoin’s market dominance was 70.6% as of Feb. 20.

JPMorgan analysts recently warned that USDT’s dominance in the crypto sector could prove detrimental to the industry — a claim that was vehemently rejected by the Tether CEO Paolo Ardoino.