Is Dogecoin copying the 2020 fractal that sent DOGE price soaring 15,800%?

Dogecoin's (DOGE) ongoing price action mirrors 2020 fractals that saw its price explode by more than 15,800% to a record high of $0.76 in just six months.

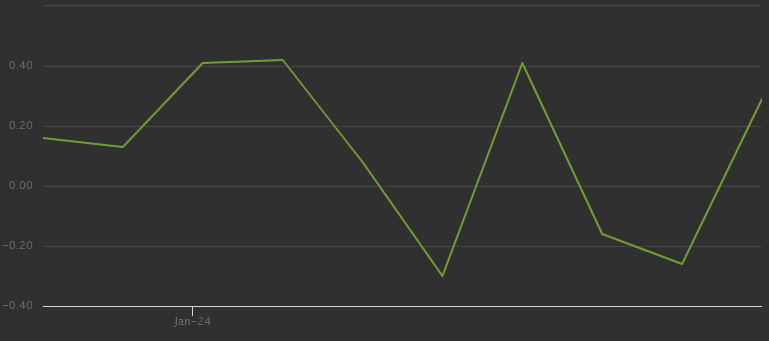

Dogecoin price trend in 2024 vs. 2021

The Dogecoin chart fractal below highlights the similarities between DOGE's ongoing price performance and those recording after the completion of the 2018-2020 bear market.

For instance, in 2018-2020, Dogecoin experienced a prolonged sideways movement within the $0.0012 to $0.0056 range. This phase occurred at the chart’s base levels, between the 0.236 and 0.0 Fibonacci retracement lines, underlining a period of relative market equilibrium with low volatility.

Mirroring the earlier consolidation pattern, Dogecoin has — once again — entered a consolidation phase, but at a higher price range between $0.055 and $0.181. Interestingly, these new bounds also align with the 0.236 and 0.0 Fib retracement levels, respectively.

The current attempt to surpass the 0.236 Fibonacci threshold is akin to the breakout observed in the previous cycle, which may indicate a significant shift in market sentiment if the price sustains above this level, currently at $0.181.

Dogecoin fundamentals 2020 vs. 2024

Fundamentals such as quantitative easing played a key role in sending Dogecoin prices up by more than 15,800% in 2020. Interestingly, the memecoin market is witnessing similar catalysts in 2024 as it attempts to break above its 0.236 Fib line resistance.

Rate cuts potential in 2024

In 2020, Dogecoin's price surged past its 0.236 Fibonacci level, partly fueled by increased cash liquidity resulting from the U.S. Federal Reserve's policy of lowering interest rates.

Likewise, Dogecoin's current efforts to breach the 0.236 Fibonacci threshold coincide with the anticipation of three potential interest rate cuts in 2024.

Altcoin boom after Bitcoin halving

Dogecoin’s 2024 price trends draw further similarities from the 2020 fractal due to the occurrence of Bitcoin halving, events that halve the reward for mining new blocks.

Remarkably, following Bitcoin's third halving on July 11, 2020, Dogecoin's price surged by an astonishing 34,300%.

Similarly, after Bitcoin's second halving, Dogecoin experienced a rally of over 6,350%, showcasing its potential for delivering high returns to investors seeking opportunities in alternative cryptocurrencies after halvings.

Related: Bitcoin halving hype: How retail investors can prepare

Bitcoin’s fourth halving will happen around April 19-20, following which Dogecoin’s price may explode if the history is any indication.

The return of Elon Musk

Elon Musk's active and public support of Dogecoin during 2020 and 2021 played a crucial role in its dramatic price increases while elevating its ranking among the top cryptocurrencies. Now, in 2024, the billionaire entrepreneur is eyeing a move toward integrating DOGE into mainstream platforms.

For instance, on March 14, Musk said his electric vehicle company, Tesla, could add DOGE payments for purchasing cars at some point in the future.

Furthermore, Musk’s “everything app” X (previously known as Twitter) established an XPayments account for its forthcoming payment functionality. There’s a growing expectation that the X app will roll out in-app payment capabilities by mid-2024, which may include cryptocurrencies like Dogecoin.

Dogecoin technical analysis

Technically, Dogecoin’s weekly relative strength index (RSI) has crossed above 70, an overbought zone, which raises its potential to enter a correction or consolidation phase in April.

Nonetheless, a clear breakout above the 0.236 Fib resistance could send DOGE's price toward the 0.382 Fib line at around $0.26 by April's end. That is up approximately 35% from current price levels.

Conversely, a decisive pullback from the 0.236 Fib line risks bringing Dogecoin's price toward its 50-week exponential moving average (50-week EMA; the red wave) at around $0.095, down about 48% from current prices.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.