Price analysis 3/20: BTC, ETH, BNB, SOL, XRP, ADA, DOGE, AVAX, SHIB, TON

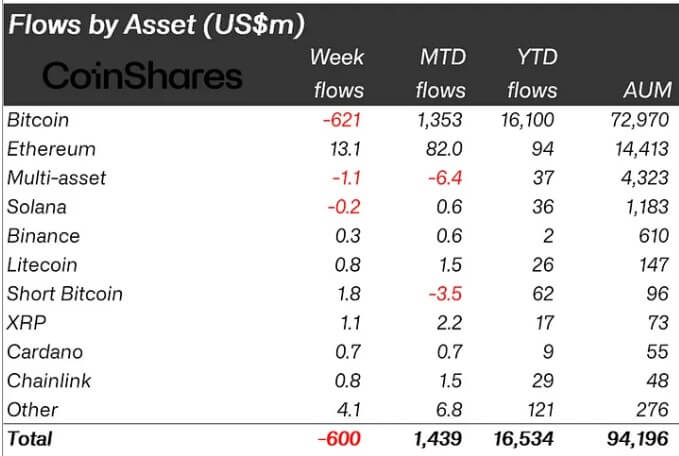

Bitcoin (BTC) nosedived below the $61,000 level on March 19, signaling an urgency by select traders to exit their positions. According to data from investment firm Farside, the recent fall has led to roughly $480 million in outflows from the spot Bitcoin exchange-traded funds (ETFs) in the past two days.

If the Bitcoin ETF investments fail to pick up, another round of selling cannot be ruled out, but a fall does not mean the bull market is over. Capriole Fund founder Charles Edwards said in a X post that it’s “normal” for volatility to pick up one month “either side of the Bitcoin Halving.” However, he added that the 12-month period following the halving historically offers the best risk-reward tradeoff for Bitcoin.

While retail traders speculate on the next move in Bitcoin, MicroStrategy, one of the largest public holders of Bitcoin, continues to buy more. MicroStrategy Executive Chairman Michael Saylor said in a X post that the firm bought 9,245 Bitcoin “using proceeds from convertible notes & excess cash.” The latest purchase boosted the firm’s stockpile to 214,246 Bitcoin, more than 1% of the 21 million Bitcoin that will ever exist.

Will Bitcoin and altcoins continue their correction, or is it time for the recovery to begin? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price analysis

Bitcoin turned down from the support line of the ascending channel on March 18, indicating that the bears are trying to flip the level into resistance. That intensified selling and pulled the price below the 20-day exponential moving average ($65,271) on March 19.

The bulls are trying to arrest the decline at the 38.2% Fibonacci retracement level of $61,736. A bounce off the current level is likely to face selling at the 20-day EMA. If the price turns down sharply from the 20-day EMA, it will suggest strong selling on rallies. The BTC/USDT pair could slide to the 50-day SMA ($56,614), where the bulls are expected to buy aggressively.

The first sign of strength will be a rise above the 20-day EMA. If that happens, it will suggest that the corrective phase may be over. The pair may rise to $69,000. This is the final hurdle before the pair challenges the all-time high at $73,777.

Ether price analysis

The failure to maintain Ether (ETH) above the 20-day EMA ($3,550) on March 18 attracted aggressive selling by the traders. That pulled the price to the 50-day SMA ($3,113) on March 20.

The 20-day EMA has started to turn down, and the RSI is in the negative territory, suggesting that bears have the upper hand. The recovery is likely to face selling at the 20-day EMA. That could keep the ETH/USDT pair stuck between both moving averages for some time.

A break below the 50-day SMA will suggest that the bulls are dumping their positions in a hurry. That could sink the pair to $2,717. Alternatively, a break and close above the 20-day EMA will signal that the bulls are back in the game.

BNB price analysis

BNB’s (BNB) pullback reached the 50% Fibonacci retracement level of $500 on March 19, just below the 20-day EMA ($511).

The bulls are trying to stop the fall at the 20-day EMA, which is a positive sign. The BNB/USDT pair could rally to $590, where the bulls and the bears are likely to witness a tough battle.

If the price turns down from $590, it will suggest that the bears are active at higher levels. That increases the risk of a slide to the breakout level of $460.

On the contrary, if buyers kick the price above $590, it will suggest that the pullback may be over. The pair may then climb to $645.

Solana price analysis

The bulls pushed Solana (SOL) above the $205 resistance on March 18 but could not sustain the breakout. That may have tempted short-term traders to book profits.

The SOL/USDT pair dipped to the 20-day EMA ($158) on March 20, a crucial support to watch out for. If the price rebounds off the 20-day EMA with strength, it will suggest that the sentiment remains positive. The bulls will again try to drive the price above the overhead resistance at $205.

On the other hand, a shallow bounce will suggest a lack of aggressive buying at the current levels. If the price slips below the 20-day EMA, the selling could accelerate, and the pair may drop to the 50-day SMA ($126).

XRP price analysis

XRP (XRP) has been trading inside a large range between $0.46 and $0.74 for several months. Trading inside a range can be volatile and random.

The XRP/USDT pair is trying to take support at the uptrend line, but the relief rally is likely to face selling at the 20-day EMA. If the price turns down from the 20-day EMA and breaks below the uptrend line, the pair could slump to the support of the range at $0.46.

On the contrary, if buyers drive the price above the 20-day EMA, it will suggest that the bulls are trying to make a comeback. The bullish momentum could pick up if the pair rises above $0.67. The pair may subsequently climb to the formidable resistance at $0.74.

Cardano price analysis

Cardano (ADA) turned lower from the 20-day EMA ($0.68) on March 18 and plunged below the 50-day SMA ($0.62) on March 19.

The ADA/USDT pair is attempting to take support at $0.57, but the recovery attempt is likely to face selling at the moving averages. If the price turns down from the moving averages, it will increase the possibility of a break below $0.57. The pair may then skid to $0.53.

If buyers shove the price above the 50-day SMA, the pair may reach the 20-day EMA. This remains the critical overhead resistance to watch out for. A break above this level will suggest that the selling pressure is reducing.

Dogecoin price analysis

The bears sold Dogecoin’s (DOGE) recovery attempts on March 17 and pulled the price back below the 20-day EMA ($0.15) on March 18.

The selling continued on March 19, and the DOGE/USDT pair plunged to the strong support at $0.12 on March 20. Buyers are expected to guard the 50-day SMA ($0.11), but they may find it difficult to propel the price above $0.16.

The 20-day EMA has started to turn down, and the RSI is just below the midpoint, suggesting that bears have a slight edge. The bulls will be back in command on a break above $0.16. That could clear the path for a rally to $0.19.

Related: How low can the Bitcoin price go?

Avalanche price analysis

The long wick on Avalanche’s (AVAX) March 18 candlestick shows profit booking at higher levels. The selling picked up, and the price reached the breakout level of $50 on March 20.

Buyers will try to flip the $50 level into support. If they succeed, the AVAX/USDT pair could again rise toward $65. If the price turns down from the overhead resistance, the pair may consolidate between $50 and $65 for a while.

A break and close below $50 suggests that the bulls are rushing to the exit. That may sink the pair to the next solid support at the 50-day SMA ($42). The bulls will have to catapult the price above $65 to signal the resumption of the uptrend.

Shiba Inu price analysis

Shiba Inu (SHIB) slipped below the $0.000029 support on March 16, and the bears successfully defended the retest on March 17. This suggests that the bears are trying to flip $0.000029 into resistance.

The SHIB/USDT pair fell to the 61.8% Fibonacci retracement level of $0.000023 on March 20, which is the last bastion of support. If this level cracks, the pair may nosedive to the 50-day SMA ($0.000017). The deeper the fall, the greater the time it will take for the new up-move to begin.

The bulls will have to drive and sustain the price above the resistance line to indicate that the correction may be over. The pair could then travel to the overhead resistance of $0.000035 and eventually $0.000039.

Toncoin price analysis

Toncoin (TON) pulled back to the 20-day EMA ($3.39), but the bulls aggressively purchased the dip, as seen from the strong bounce on March 17.

The bears sold the rallies and tried to sink the price below the 20-day EMA on March 18 and 19, but the bulls held their ground. Buyers are trying to sustain the price above $4.15. If they manage to do that, the TON/USDT pair could rise to $4.60. A break and close above this level will suggest the start of the next leg of the uptrend to $5.64.

The crucial support to watch on the downside is the 20-day EMA. The bears will have to sink the price below the 20-day EMA to indicate that a local top may be in place.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.