Solana price wavers but increased DApp activity points to SOL recovery

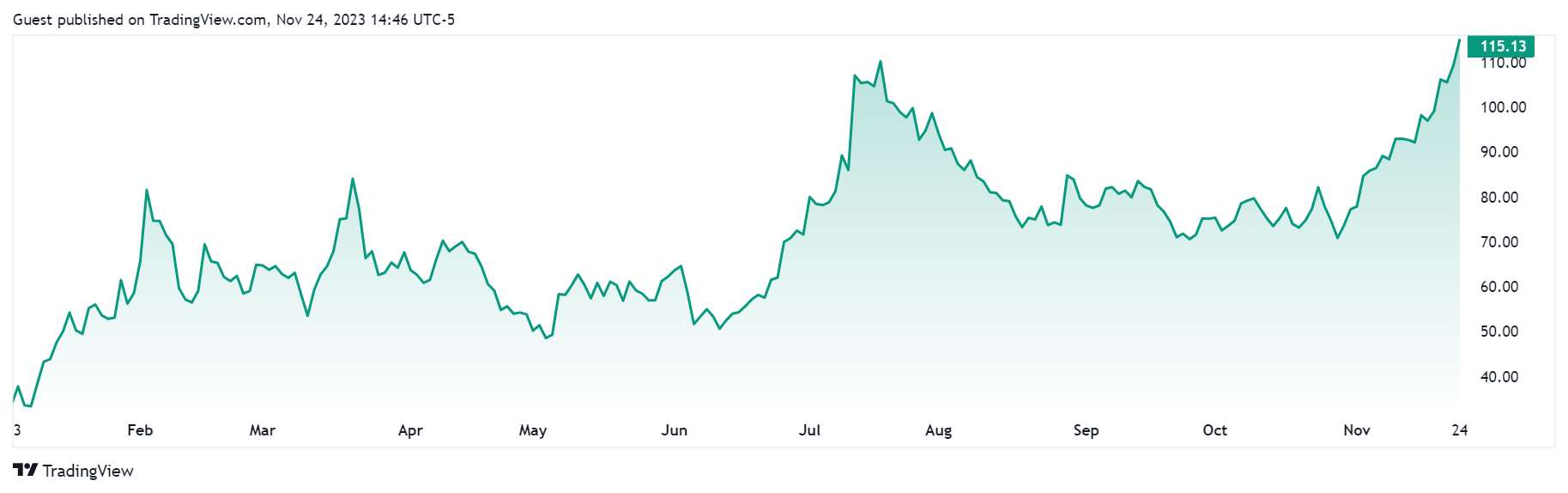

Solana's native token SOL (SOL) experienced a 45% surge over a week, hitting a high of $210 on March 18. Although SOL price hasn't reached its November 2021 all-time high at $260, it has gained 58% over the last 30 days. This performance surpasses that of Ether (ETH) and Avalanche (AVAX), which have increased by 12% and 30% respectively during the same period.

Solana remains firmly in place as the fifth-largest cryptocurrency by market capitalization and the third in terms of total value locked (TVL), making a long-term bearish outlook on SOL’s price difficult to support. Nevertheless, this doesn't assure that SOL's price will stay above $165 in the short term, so investors should examine on-chain metrics to see if the bullish trend is likely to persist.

Solana sees a sudden increase in activity

The view that SOL's 18% drop since March 18 has reversed the bullish trend is challenged by the fact that SOL's price dipped below $165 for less than an hour on March 20, showing significant support. With Bitcoin (BTC) unable to maintain above $70,000, leading to speculation of an altcoin season, both bullish and bearish arguments have their merits.

Critics highlight that the increased demand for Solana led to relatively high fees and more failed transactions. On March 16, data from Cointelegraph indicated that validators experienced delays of up to 40 seconds, causing nearly half of the transactions to fail within a 20-minute span. This rise in activity was spurred by a memecoin frenzy, notably marked by the launch of 'Book of Meme' (BOME), which attracted a remarkable $270 million in trading volume within its first 24 hours.

After Ethereum's DenCun hard fork on March 13, which reduced fees for its layer-2 scalability solutions, competition among memecoin launches intensified. This upgrade led to a surge in Ethereum’s Base activity, with a 77% increase in decentralized applications (DApps) volume in a week, as reported by DappRadar. Consequently, the Ethereum ecosystem has become more competitive for memecoin launches, potentially diminishing the focus and spending power of Solana users.

Solana memecoin decline started after Ethereum Dencun

Although it's challenging to pinpoint the direct cause and effect, Solana SPL memecoins seemed to have hit their peak the day following Ethereum network's upgrade on March 14. Dogwifhat (WIF) and Bonk (BONK) experienced drops of 38% and 40%, respectively. Despite these setbacks, the Solana network has greatly benefited from the heightened activity, with an increase in both volume and active addresses engaging with its DApps.

Notice the Solana network's volume has surged by 55% since March 13, significantly outpacing competitors like BNB Chain and Polygon, which have only seen gains of 2% and 7%, respectively, during the same timeframe. However, the increased activity and volume from memecoins and new token launches do not necessarily guarantee sustained price increases, regardless of the project's merits.

Related: How low can the Bitcoin price go?

This was evident with the liquid staking project Jito (JTO), which saw a 20% drop over two days after reaching a high of $3.85 on March 18. In a similar vein, the decentralized exchange Jupiter (JUP) token has fallen 25.5% from its all-time high of $1.60 on the same day. Despite the level of adoption these projects may have, a downturn in SOL's price impacts the entire Solana ecosystem.

Analysts point out that the significant issuance of tokens to cover Solana's substantial validator costs, effectively inflating the supply of SOL, is a major concern. Additionally, the large volume of tokens held by the bankrupt FTX exchange's estate poses a sell-off risk in the near future. Despite these factors, the Solana's DApps activity growth suggests no apparent weaknesses, indicating that the $165 support level should hold in the near term.

Despite these factors, the Solana's DApps activity growth suggests no apparent weaknesses, indicating that $165 is likely to remain an area of support.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.