Binance’s $1B emergency ‘SAFU’ fund now makes up 3% of UDSC supply

The world’s largest crypto exchange, Binance, is converting its Secure Asset Fund for Users (SAFU) into Circle’s stablecoin USD Coin (USDC), and now represents 3% of the stablecoin’s circulating supply.

The company announced the move on April 18, stating that “we are transferring 100% of SAFU’s assets to USDC” but didn’t elaborate on why, other than it was “making use of a trusted, audited, and transparent stablecoin for SAFU,” which further enhances its reliability and ensures it remains stable at $1 billion.

The exchange’s Secure Asset Fund for Users is an emergency insurance fund established in 2018 to protect Binance users in extreme situations such as exchange hacks, whereby users could be reimbursed for unforeseen losses.

According to Etherscan, the SAFU wallet address made a transaction of 800 million USDC on Ethereum at 02:35 UTC for a transaction fee of just $1.88.

There was also a transfer of 1.36 million BNB worth around $754 million and a 16,277 BTC transfer as part of the conversion process.

The billion-dollar Binance insurance fund now represents around 3% of the entire supply of Circle’s stablecoin, which is $32.6 billion.

It is the second conversion of the fund in just over a year. In March 2023, Binance announced that it had replaced the Binance USD (BUSD) holdings in the SAFU with Tether (USDT) and TrueUSD (TUSD).

The move at the time was in response to a regulatory crackdown on BUSD issuer Paxos which announced that it would stop minting the exchange-backed stablecoin.

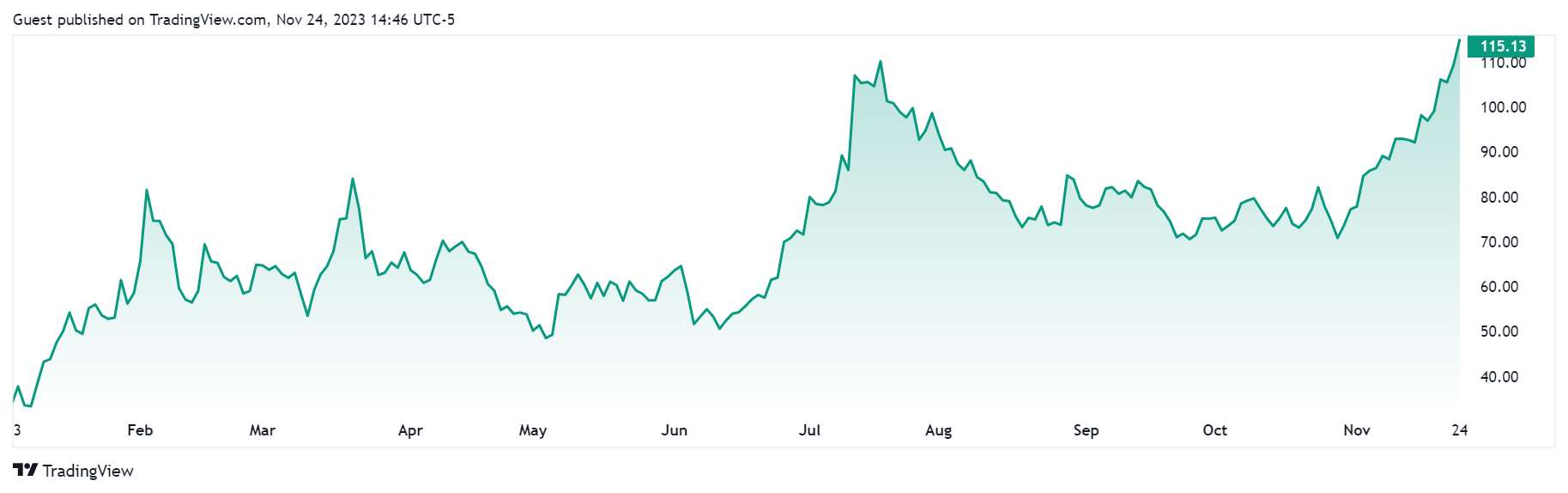

Related: Crypto exchange insurance funds surge more than $1B amid bull market

Tether remains the world’s dominant stablecoin with a circulating supply at record levels of $108 billion giving it a market share of 69%, according to CoinGecko.

Circle’s USDC is the second largest stablecoin, with a market share of around 20%, as its supply has increased by 33% since December.

Related: 'China is about to start bidding' — Will Hong Kong Bitcoin ETFs spark the halving rally?