Bitcoin bull market may return after $1.4T US liquidity spike — Prediction

Bitcoin (BTC) could see a “re-acceleration” of its bull market thanks to new United States economic shifts.

That is the latest macro forecast by Arthur Hayes, former CEO of crypto exchange BitMEX.

Hayes on crypto bull market: "Forget about the Fed"

Bitcoin and altcoins have little hope in the Federal Reserve dropping interest rates soon to attract more liquidity into the economy.

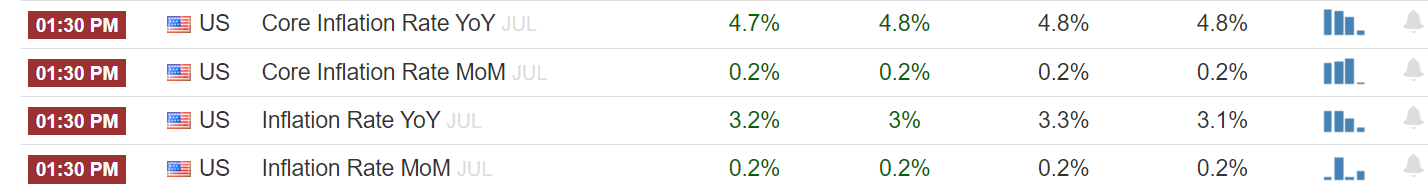

As Cointelegraph reported, the odds of this happening sooner rather than later are becoming slimmer with each macro data print.

For Hayes, however, the Fed is no longer the U.S. yardstick worth watching — instead, it is Treasury Secretary Janet Yellen.

On April 29, the U.S. Treasury will release the quarterly refunding documentation, which sets out how the government will effectively manage liquidity.

On the radar are two key liquidity sources: the Treasury General Account (TGA) and so-called Reverse Purchase Agreements (RRPs).

“As expected tax receipts added roughly $200bn to TGA,” Hayes wrote in a post on X (formerly Twitter) on April 26.

“Forget about the May Fed meeting the 2Q24 refunding annc comes out next week.”

Draining either the TGA or money from the pool of RRPs allows for money to reenter the economy — a key stimulus for risk-asset performance, and specifically crypto upside.

Hayes argues that the focus is thus on Yellen as part of a theory, which calls for U.S. dollar printing to only accelerate toward the upcoming Presidential Election and afterward.

A $1 trillion TGA drain, $400 million in RRPs or a combination of both is on the table, potentially totaling a $1.4 trillion liquidity injection.

“The Fed is irrelevant, Yellen is a bad bitch, you best respect her,” Hayes concluded.

“If any of these three options happen, expect a rally in stonks and most importantly a re-acceleration of the crypto bull market.”

Bitcoin ETFs see "overdue" slowdown

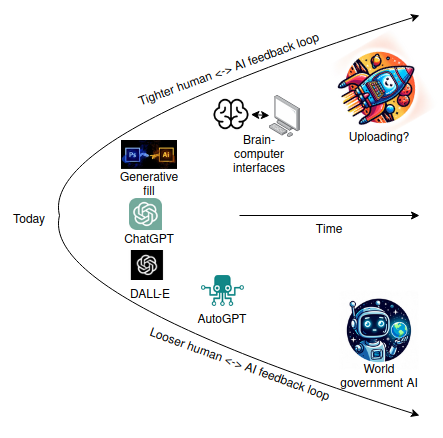

Other players see the knock-on effect of Bitcoin’s mainstream entry becoming a positive feedback loop for price.

Related: BTC halving to fuel ‘raging firesale of crypto assets’ — Arthur Hayes

The U.S. spot Bitcoin exchange-traded funds (ETFs) remain far from their full captive audience — despite marking the most successful ETF debut in history.

Commenting on BlackRock’s iShares Bitcoin Trust (IBIT), the largest product by assets under management excluding the Grayscale Bitcoin Trust (GBTC), Bloomberg ETF analyst Eric Balchunas dismissed a recent cooling of inflows as cause for concern.

“While $IBIT's daily inflow streak is over at 71 days, it is not done setting records. Here's a look at ETFs all time by assets after first 72 days on market,” he wrote alongside Bloomberg data.

“The league of own-ness of IBIT, FBTC et al shows how overheated it all was, a breather was overdue tbh.”

He added that “out of all the 10,698 registered funds in the U.S. (incl ETFs, mutual funds, CEFs) $IBIT currently ranks 2nd in YTD flows.”

While overall allocations remain small thus far, Cathie Wood, CEO of one spot Bitcoin ETF provider, ARK Invest, sees the trend gathering speed.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.