Bitcoin price falls to $65K as $400M crypto market liquidation rocks BTC and altcoins

Bitcoin (BTC) price saw a sudden 5% drawdown on April 12 as traders with leveraged positions in Bitcoin and other cryptocurrencies incurred over $400 million in losses within one hour.

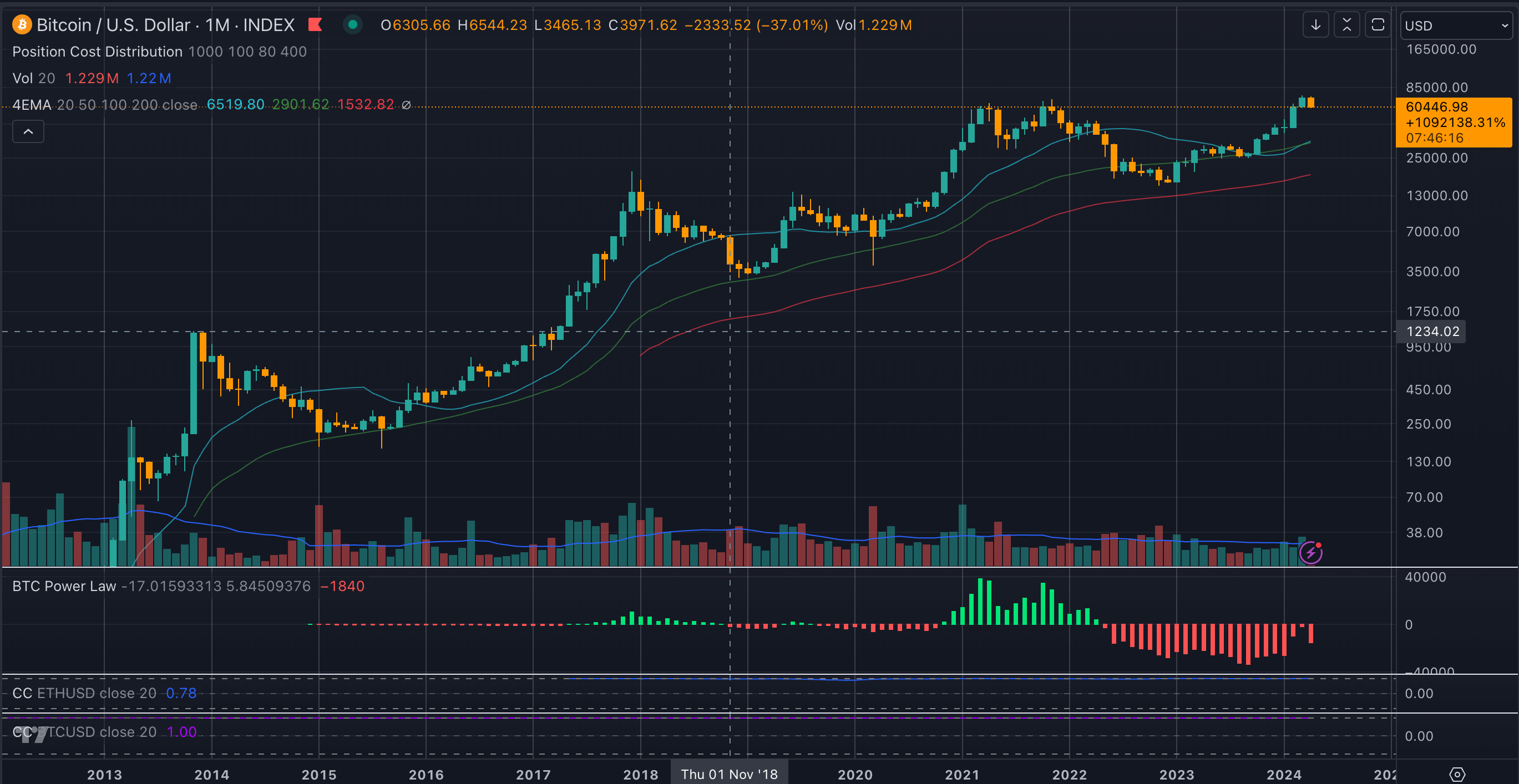

BTC dropped 5% from $68,341 to as low as $65,110 in less than 60 minutes in late New York session trading hours on April 12.

Ether (ETH), the second largest crypto by market capitalization, followed in Bitcoin’s footsteps, falling 8% from an opening of $3,553 to trade at $3,226.

Futures market data from Coinglass show Bitcoin’s flash crash resulted in more than $417 million in leveraged positions wiped out within one hour, with over $77.93 million in Bitcoin longs and more than $63.35 million in Ether longs accounting for the bigger part of that figure.

The most short and long liquidations occurred on Binance, totaling $171 million, while crypto exchange OKX traders saw combined losses of $158 million.

Coinglass also reveals that within the past 24 hours, total liquidations reached $860 million among 270,993 traders.

The crash occurred as U.S. stock markets dipped during the U.S. trading session a few days after new data showed that inflation accelerated for a third consecutive month. The hotter-than-expected CPI print further dashed hopes for Fed rate cuts this year amid fears that progress may be stalling in taming elevated price levels.

JPMorgan Chase CEO Jamie Dimon warned on April 12 that “persistent” inflation, geopolitical tensions and the Fed’s Quantitative tightening efforts threaten an otherwise positive economic outlook.

“We have never truly experienced the full effect of quantitative tightening on this scale,” the head of the largest U.S. bank by assets said in a first-quarter earnings results announcement, adding that the market is likely to be weighed down by“ “persistent inflationary pressures, which may likely continue.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.