AI-powered DeFi platform introduces token mints by placing orders

Brightpool Finance focuses on reducing entry barriers and enhancing price stability in the DeFi space through AI-calculated trading rewards and price-freezing features.

While the volatility of Bitcoin (BTC) has enjoyed some chill time, it is still not at the level desired by investors who seek to avoid unpredictable prices. Moreover, low liquidity in the decentralized finance (DeFi) sector, which has a market capitalization under $100 billion compared to Bitcoin’s $1.2 trillion, further increases price volatility.

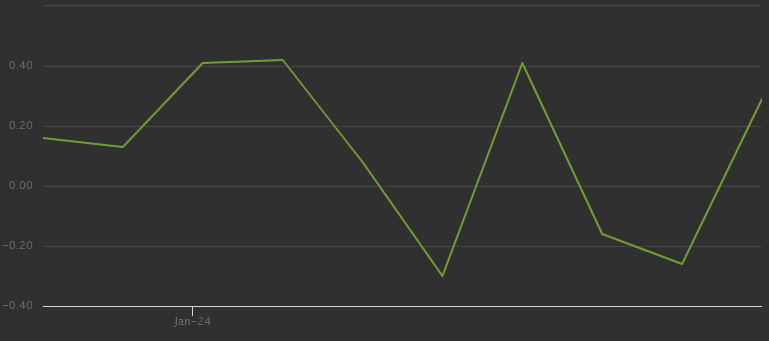

Bitcoin has become less volatile over the years. Source: CoinGlass

Another important obstacle to crypto adoption is accessibility, which arises especially in mining — the process of adding transactions to the blockchain and creating new tokens. Mining requires technical knowledge and access to substantial computational resources.

As a result, the crypto industry must innovate to develop more accessible and stable alternatives that facilitate easier adoption.

Mitigating volatility with AI

Brightpool Finance, an artificial intelligence-powered DeFi platform, operates as a decentralized exchange (DEX) that allows users to trade digital assets and turn market volatility into an opportunity. Unlike traditional exchanges that charge fees for transactions, Brightpool rewards its users for every trading order.

Brightpool has integrated the Nobel-prized Black-Scholes-Merton model, BS.AI, which is AI-enhanced for seeking opportunities in crypto volatility, streamlining reward and token generation. The AI dynamically adapts to market shifts, ensuring targeted token distribution and accurate limit order execution.

Brightpool eliminates the need for user-provided liquidities. Source: Brightpool Finance

The platform launched its native token, BRIX, to ensure price stability with an approach similar to the VIX — a volatility forecasting index in stock markets. BRIX directly benefits from increased market volatility, transforming it from a mere indicator into a valuable asset. As volatility peaks, the value of BRIX also increases, protecting tokenholders against market uncertainties.

Minting before halving

BRIX offers users mining opportunities with its zero initial supply and novel proof-of-bid mechanics. In this model, miners can mint BRIX only by placing bids on the platform. The platform also employs a halving mechanism that gradually reduces mining rewards as more tokens are minted.

BRIX mining offers early incentives. Like Bitcoin’s halving event, BRIX incorporates a halving mechanism where mining rewards gradually decrease as more tokens are minted. Therefore, participating in the early stages of mining can provide users with a distinct advantage. To join the early mining process, users need only place a buy or sell order on the Brightpool platform.

Due to the halving mechanism, it is really advantageous to users to mint as soon as possible. Source: Brightpool Finance

The halving mechanism encourages early participation with higher starting rewards that decrease over 45 stages. Initially, the platform invites only select groups who can access it via a specially provided link to join early. The sooner users start minting, the bigger the rewards, as the benefits decrease with each halving phase.

In the beta phase, Brightpool Finance’s mining mechanism is accessible to a limited number of users. Before the full launch, the platform conducted a two-month testnet phase on Arbitrum Sepolia — a safe space for developers to test their decentralized applications (DApps).

Brightpool envisions a future where innovation meets practicality, making interaction with digital assets easier. By inviting external projects to pool with the BS.AI model and utilize traded pairs, Brightpool aims to increase liquidity and create a vibrant ecosystem.

As new approaches to stability and accessibility emerge in the crypto world, they will further alter the paradigms of crypto trading and liquidity management in the DeFi space, reducing the bias of traditional investors.

Learn more about Brightpool FinanceDisclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.